Ethereum treasury SharpLink Gaming holds 740,760 ETH worth over $3 billion

Key Takeaways

- SharpLink Gaming’s Ethereum reserves have reached 740,760 ETH.

- The company increased its ETH holdings through large purchases and maintains over $84 million in cash reserves for future acquisitions.

Share this article

SharpLink Gaming, the second-largest corporate holder of Ethereum, said its treasury now totals 740,760 ETH, an increase of 11,956 units in four days. The company acquired 143,593 ETH last week at an average price of $4,648.

With ETH currently trading above $4,300, SharpLink’s ETH stash is valued at over $3 billion.

The expanded holdings secure SharpLink’s place as one of the biggest corporate Ethereum treasuries, second only to BitMine Immersion, which has been accumulating aggressively and now controls over 1.5 million ETH.

SharpLink recently raised $146.5 million through its At-the-Market facility and secured an additional $390 million via a registered direct offering that closed on August 11. The firm maintains over $84 million in cash reserves for future ETH acquisitions.

The company’s ETH Concentration metric, which measures ETH holdings per 1,000 assumed diluted shares, rose to 3.87, marking a 94% increase since the launch of its treasury strategy in June. Total staking rewards have reached 1,388 ETH since the strategy’s inception.

SharpLink’s weekly ETH purchases have steadily increased from 77,200 ETH in late July to the current week’s acquisition of 143,593 ETH. The company’s average purchase price has risen from $3,756 to $4,648 during this period.

Share this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

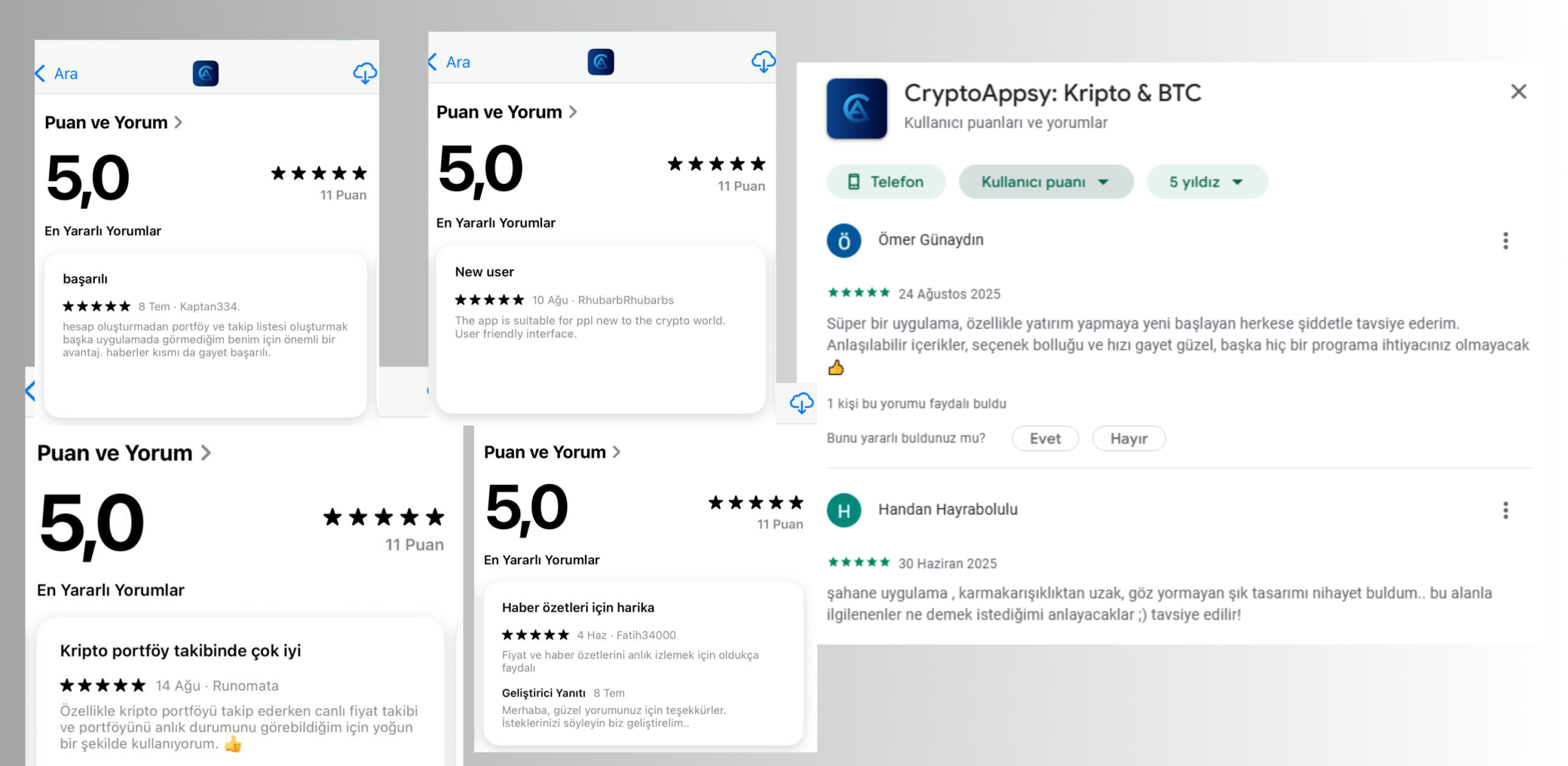

CryptoAppsy Empowers Crypto Enthusiasts with Instant Market Insights

Shardeum Surpasses 700 Million SHM Tokens Staked as Staking Delegators Program Expands

Crypto Industry Must Make Progress Before Trump Leaves Office: Etherealize Co-Founder

One of the Most Anticipated Altcoins May Be Approaching Launch – Tokens Are Moving, Here Are the Latest Data