Harvard economist Kenneth Rogoff, who once claimed Bitcoin would fall to $100 before reaching $100, has acknowledged he miscalculated three key points.

His remarks come as Bitcoin trades above $100,000, far from the crash he anticipated in 2018.

Rogoff Reflects on Missed Predictions

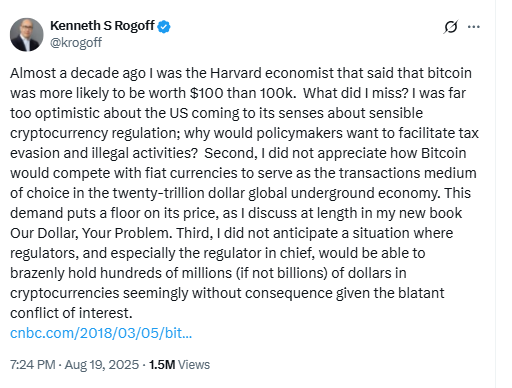

In a post on X, Rogoff recalled his 2018 CNBC interview, where he predicted strict regulation would collapse Bitcoin.

Instead, the cryptocurrency surged more than 1,000% over seven years. Rogoff, a former IMF chief economist and author of Our Dollar, Your Problem, admitted,

“Almost a decade ago, I said Bitcoin was more likely to hit $100 than $100K. What did I miss?”

He noted he had expected U.S. regulators to clamp down. Instead, Bitcoin gained legitimacy, breaking $100,000 in December 2024, shortly after Donald Trump’s election win.

Kenneth S Rogoff. Source: X (@krogoff)

Kenneth S Rogoff. Source: X (@krogoff)

Bitcoin’s Role in Currency Competition

Rogoff also underestimated Bitcoin’s use in the global underground economy. He wrote that he failed to see how the digital asset would compete with fiat currencies in illicit transactions worth trillions.

However, Bitcoin has also served as an inflation hedge in nations with collapsing local currencies.

While illicit activity linked to crypto reached $50 billion in 2024, Chainalysis data shows this represents less than 1% of global money laundering, most of which still happens in cash.

As his third miscalculation, Rogoff pointed to regulators themselves. He said he did not expect officials, including “the regulator in chief,” to hold large amounts of cryptocurrency despite conflicts of interest.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Crypto Industry Responds

Industry leaders reacted quickly. Bitwise CIO Matt Hougan wrote that Rogoff failed to see how decentralized systems could succeed outside traditional institutions.

FalconX researcher David Lawant credited Rogoff’s book The Curse of Cash for motivating his move into Bitcoin.

VanEck’s head of digital assets research, Matthew Sigel, ranked Rogoff ninth among Bitcoin’s biggest critics, saying he wrote its obituary too early.

He added, “Fundamentals matter: fiat debasement, demographic wealth shifts, and global demand for a neutral reserve asset.”

Ironically, Harvard’s own endowment fund disclosed a $116 million investment in BlackRock’s spot Bitcoin ETF earlier this month.

Editor at Kriptoworld

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: August 4, 2025 • 🔄 Last updated: August 4, 2025