Interpreting Galaxy Q2 Financial Report: Hundred Billion Revenue but Unprofitable, Transforming into AI "Gold Mining"

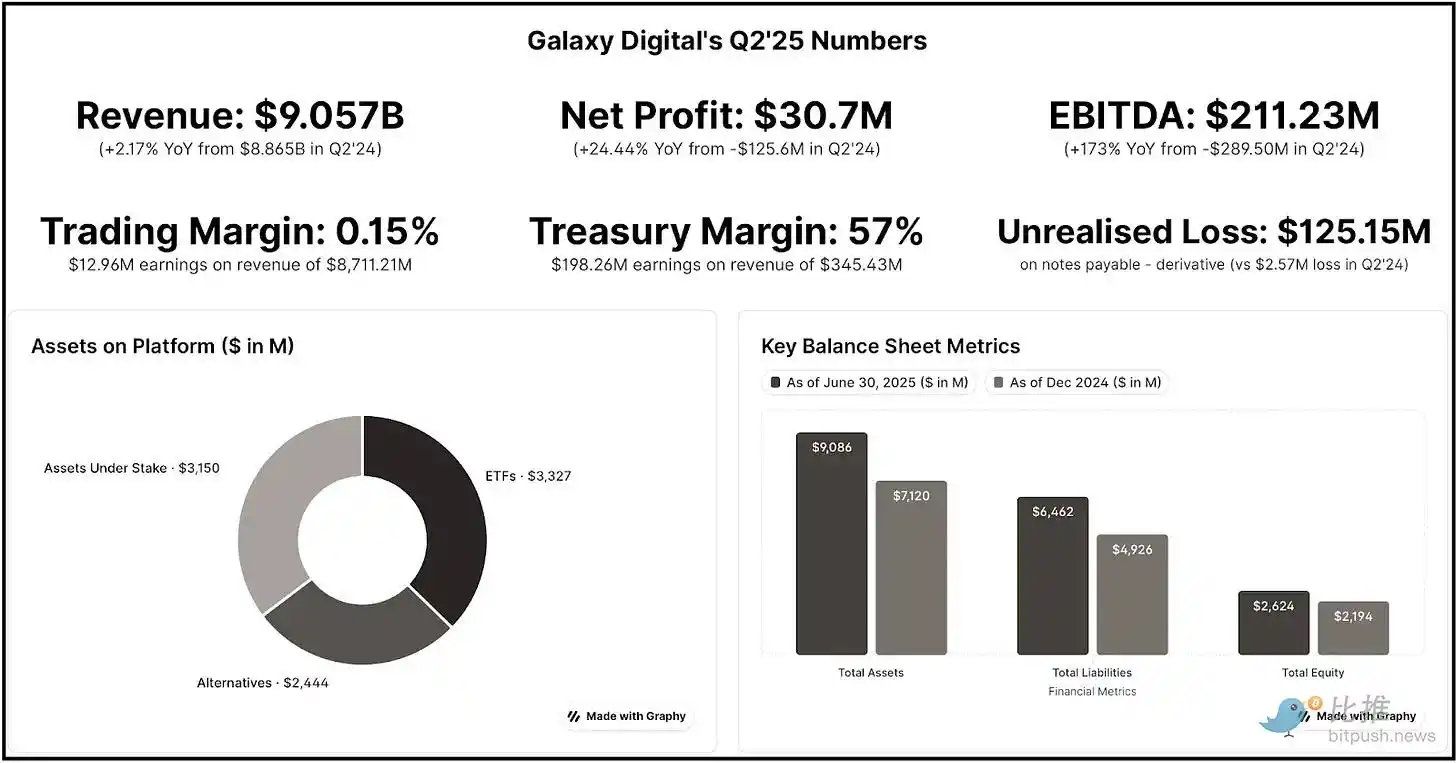

Galaxy's cryptocurrency trading business generated $8.7 billion in revenue, but only brought in $13 million in profit (a profit margin of only 0.15%).

Original Article Title: From Mining Coins to Mining Intelligence

Original Article Author: Prathik Desai, Token Dispatch

This article will delve into Galaxy Digital's second-quarter 2025 financial report, as the digital asset and data center solutions provider prepares for a major transformation. They are shifting from their core business (contributing 95% of revenue but with a profit margin of less than 1%) to a new business model promising a high revenue-to-cost ratio.

TL;DR

· Galaxy's crypto trading business generated $8.7 billion in revenue but only brought in $13 million in profit (with a profit margin of just 0.15%), while quarterly compensation expenses amounted to $18.8 million—resulting in negative cash flow from the core business.

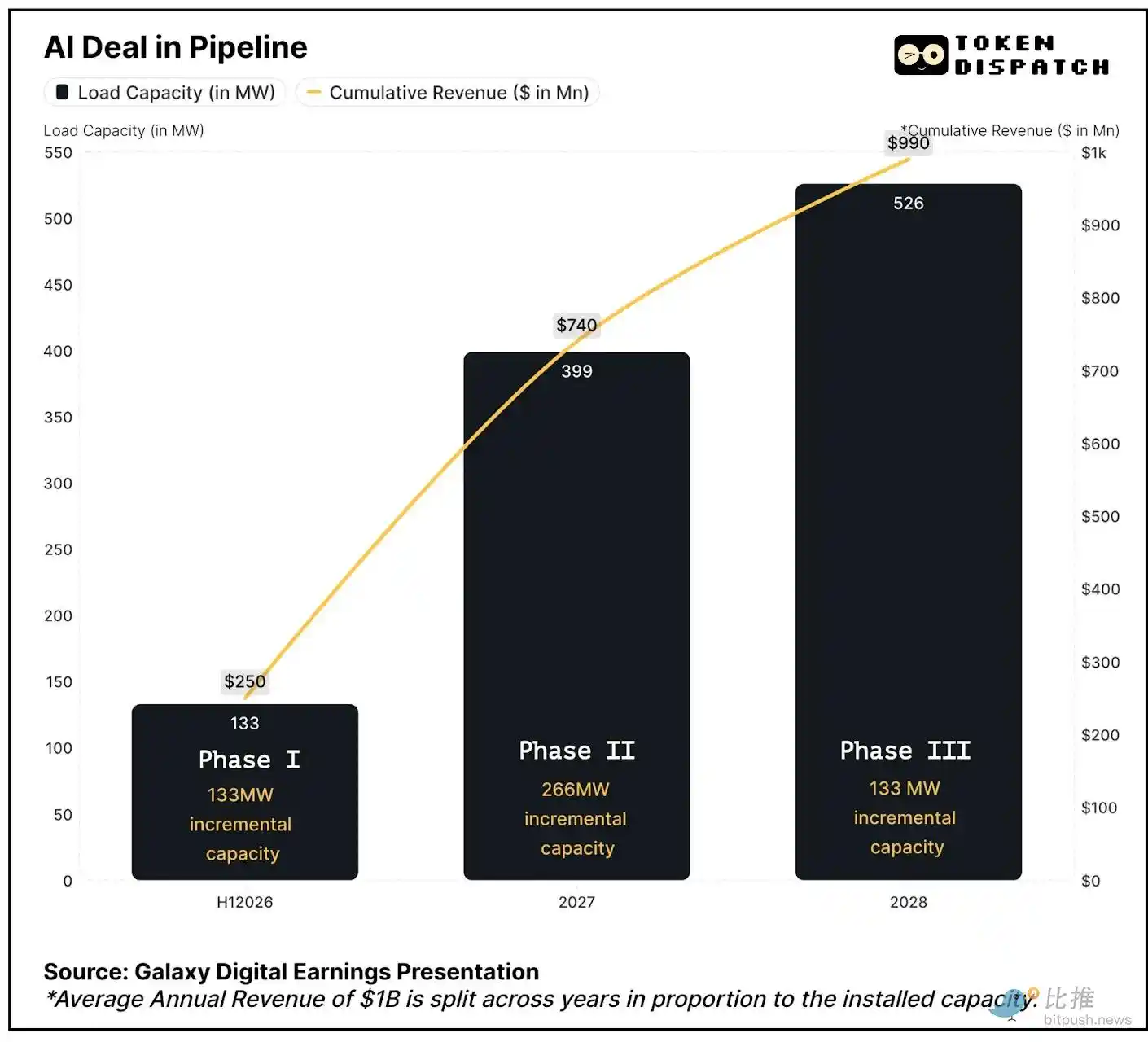

· AI Transformation: Signed a 15-year, 526MW capacity agreement with CoreWeave, committing to achieve over $1 billion in revenue annually starting from the first half of 2026 in three phases, with a profit margin as high as 90%.

· In a supply-constrained market, Galaxy controls 3.5GW of Texas power capacity, and data center demand is expected to double by 2030.

· Secured $1.4 billion in project financing, validating business feasibility and mitigating execution risk.

· The current model relies on crypto treasury revenue ($198 million in the second quarter) to fund operations, as returns from capital-intensive trading are minimal.

· Stock price initially rose 17% then fell back as investors must wait until the first half of 2026 to see incremental revenue.

When you look at Galaxy Digital's second-quarter financial report, one thing is easy to overlook: what comes next. A closer look reveals that this company, led by Michael Novogratz, is at a turning point from cyclical crypto trading to more stable AI infrastructure revenue.

The Goldmine of AI Infrastructure

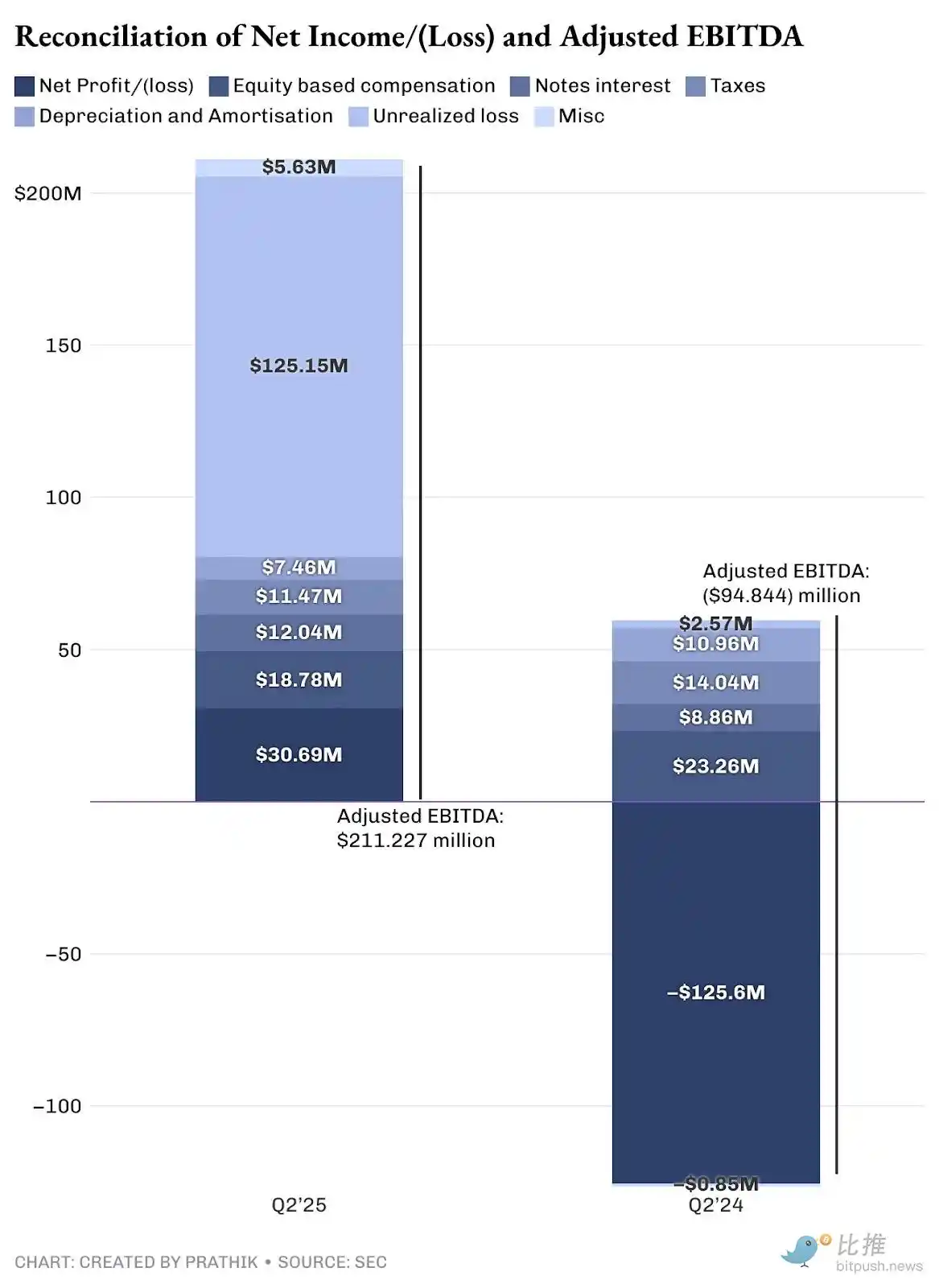

Galaxy Digital is undergoing one of the largest business transformations in the crypto space—from a low-margin trading business to a high-margin AI data center. In the current quarter, Galaxy recorded $31 million in net revenue, with an EBITDA (earnings before interest, taxes, depreciation, and amortization) of $211 million after adjusting for non-cash and unrealized expenses.

In its total revenue, its trading business earned only $13 million from a $8.7 billion sales figure, with a minuscule profit margin of just 0.15%. This means that 95% of its revenue hardly brought any profit.

In contrast, their new AI data center contracts promise over $1 billion in annual revenue with a 90% profit margin on average. Although I am very bullish on AI and high-performance computing infrastructure, I believe the promised profit margin is overly optimistic. This is not just my speculation. You can compare it with the 46-47% profit margin reported by top AI data center operators Equinix and Digital Realty this quarter.

However, I still believe this direction is the right one, purely from a revenue-generation standpoint. Currently, most of Galaxy's revenue comes from its trading business, which is high-cost and low margin. Most of its earnings (revenue minus expenses) come from its treasury and ventures division.

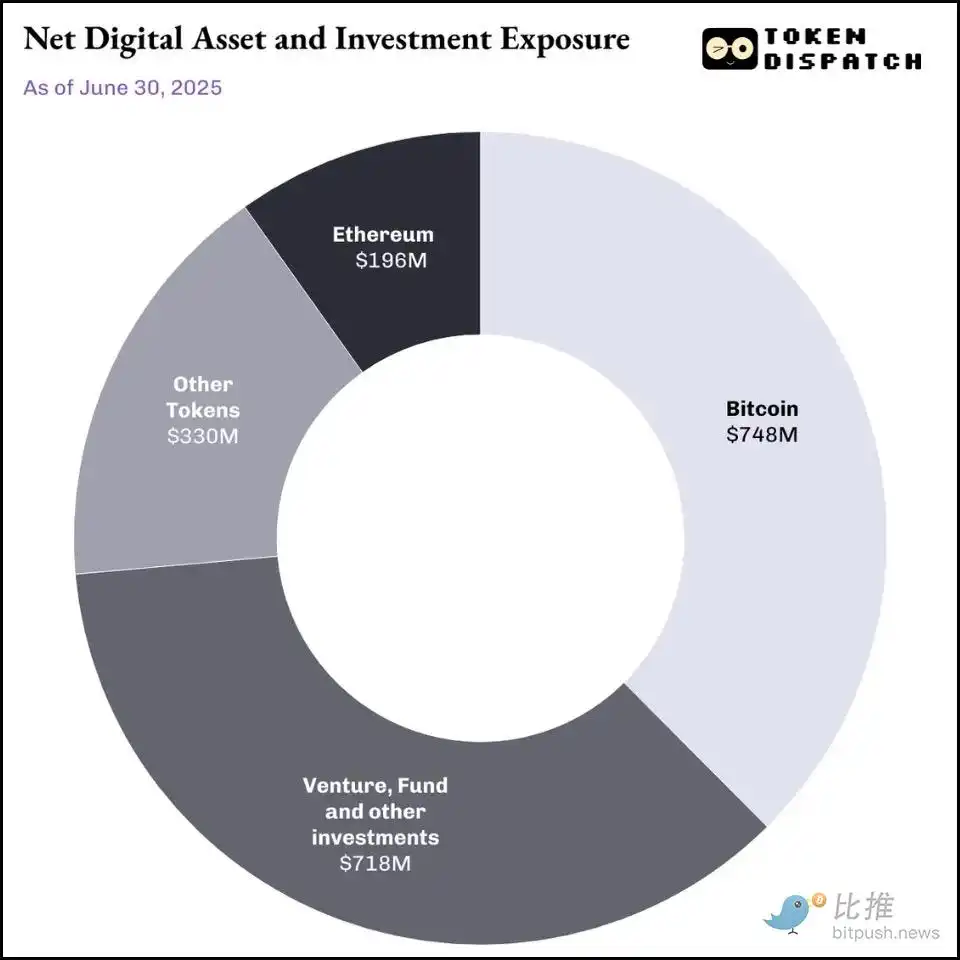

The treasury division includes investments in digital assets and mining activities, equity investments, as well as the realized and unrealized gains and losses on these digital assets and equity investments.

Its $2 billion treasury serves both as an investment vehicle and a strategic financing source in favorable market conditions.

This division generated $198 million in revenue (excluding non-cash unrealized gains). Unlike pure-play crypto companies, Galaxy's treasury business enables it to raise funds by strategically selling treasury assets at opportune times.

This is where I find Galaxy's crypto treasury strategy starkly different from Michael Saylor's Bitcoin treasury. Strategy's "buy and hold forever" approach realized $14 billion in unrealized gains this quarter. However, all of this is merely on paper. Strategy's shareholders cannot benefit from this $14 billion in unrealized gains.

Galaxy's case is different. It not only acquires and holds crypto assets in its treasury but also engages in strategic sales, resulting in realized profits that shareholders can directly benefit from. This is tangible value that can be shared.

Nevertheless, I still consider Galaxy's treasury division to be an unreliable revenue source. As long as the crypto market is in optimal conditions, this division will continue to generate returns. Yet, whether in traditional or crypto markets, that's not how things work. Markets are inherently cyclical at best, making these returns heavily reliant on the state of the crypto market.

This is why Galaxy needs its AI transformation to be successful, as its current model is not sustainable.

Market Opportunity

Galaxy positions itself at the intersection of two massive trends: explosive AI compute demand and a longstanding U.S. power infrastructure shortage. A McKinsey report projects that global data center demand is expected to double from 55GW in 2023 to 219GW by 2030.

Major cloud service providers (Hyperscalers) are expected to invest $800 billion in data center capital expenditures (CapEx) by 2028, a 70% increase from 2025, but are constrained by power supply.

Galaxy's advantage lies in its 3.5GW potential capacity in the Helios campus in Texas, enough to power over 700,000 homes in the state. Helios has received approval for 800MW, with an additional 2.7GW under review by the Electric Reliability Council of Texas (ERCOT), positioning Galaxy with some of the largest available power capacity in the constrained AI infrastructure market.

Galaxy's Helios AI and HPC data center campus digital rendering in Texas.

The foundation of Galaxy's transformation journey is a 15-year agreement signed with CoreWeave, one of the largest AI infrastructure deals in the industry. CoreWeave has committed to using 526MW of critical IT capacity in three phases.

90% of the expected margin is attributed to the lightweight operational nature of data center infrastructure once built.

In the CoreWeave deal, I see a significant risk: execution. Just as I was contemplating how Galaxy would need to raise funds, plan, and execute, the company has cleared the first hurdle.

On August 16, Galaxy successfully closed a $1.4 billion project financing for the Helios data center, securing the funds needed to complete the first phase of construction. This gives me more confidence in how it can help eliminate key financing risks and validate the commercial viability of the Helios project.

Cash Flow Equation

The current cash flow of Galaxy exposes the unreliability of its trading business, while highlighting why AI infrastructure can provide true financial stability. The company had $1.18 billion in cash and stablecoins at the end of the second quarter, which may sound like a lot, but there is more detail behind it. Galaxy's trading business operates on a capital-intensive model, where margin lending requires a large cash reserve. Most of this $1.18 billion is not freely available.

Galaxy actually generates very little free cash flow. After paying a $14.2 million interest expense and meeting ongoing operational needs, the core business is almost breakeven on a cash basis.

This forces Galaxy to rely on the appreciation of the crypto market, specifically its treasury and mining businesses, to generate funds for operations within the inherent cyclicality and unpredictability. In contrast, CoreWeave's three-stage contract structure and the high-profit nature of its business are likely to immediately create positive cash flow.

Even if the profit margin is not as high as 90%, a more reasonable 40-50% profit margin is still more reliable and stable than a cyclical treasury division.

Unlike the trading business that requires continuous capital investment in working capital and technological infrastructure, data center operations will generate cash that can be reinvested in expansion or returned to shareholders.

Galaxy's recent Helios project financing has helped address the cash flow issue. By obtaining dedicated construction funds, Galaxy has separated infrastructure development from its operating cash flow requirements. This is not possible in the trading business, as it requires capital on the balance sheet that competes directly with other corporate demands.

Expense Breakdown

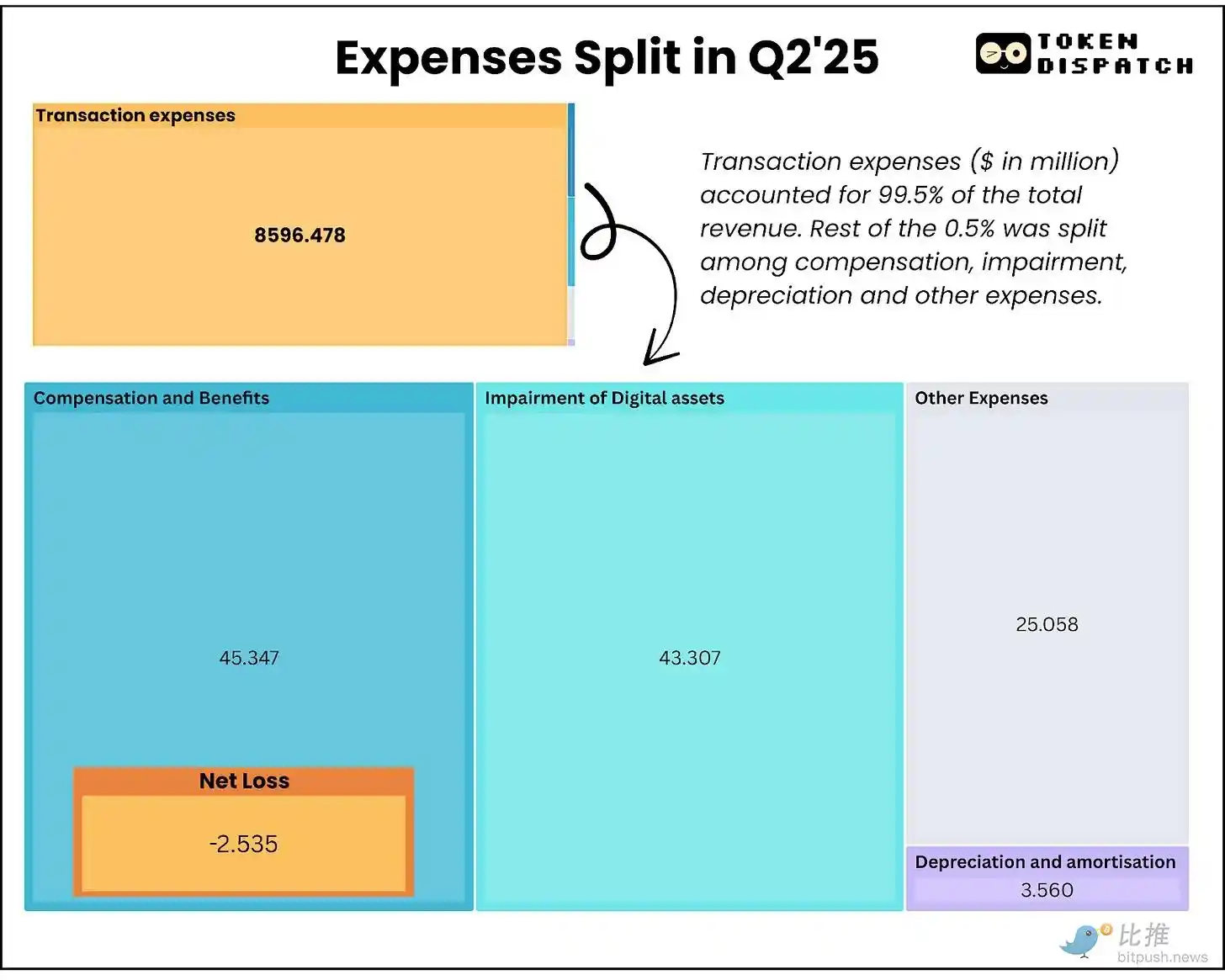

The total expenses of the digital asset division amount to $8.714 billion, with trading expenses accounting for the vast majority ($8.596 billion). These are pure pass-through costs with minimal markup opportunities. As they are inevitable in a commoditized trading business and spreads continue to compress, Galaxy can hardly optimize these costs.

More concerning is that quarterly compensation expenses include $18.8 million in stock incentives that must be paid in cash. This means that Galaxy's talent retention expenditure exceeds the earnings from its core business ($13 million).

The transformation to AI infrastructure will help change this situation. Once the facility is operational, the incremental costs required for data center operations are minimal. For example, the entire digital asset business of Galaxy had an adjusted gross profit of $71.4 million in the second quarter. In a fully utilized scenario, just the first and second phases of Helios (approximately 400MW) could generate $180 million in quarterly revenue, with operational complexity and costs being only a small part of it.

Market Reaction

The Galaxy stock price saw a modest 5% uptick in the 24 hours following the announcement of its second-quarter earnings, followed by a subsequent 17% surge over the next week, only to have investors pull out.

This is likely due to investors realizing that out of the $2.11 billion in revenue, $1.8 billion came from non-cash adjustments and treasury gains rather than operational improvements. Investors may not have yet factored in Galaxy's complex AI infrastructure transformation, as meaningful data center revenue is not expected until the first half of 2026.

Given everything that is yet to unfold, I remain optimistic about the long-term sentiment. The additional 2.7GW capacity under ERCOT study suggests that Galaxy is looking to solidify its position as a long-term infrastructure provider, not just a single-tenant facility operator.

Once fully developed, Galaxy's operations in Texas could rival some of the largest hyperscale data center campuses operated by Amazon, Microsoft, and Google. This scale could provide leverage in negotiations with more AI companies while creating operational efficiencies to boost profit margins. The company's crypto-native expertise positions it uniquely in the emerging intersection of AI and blockchain technologies.

Path Forward

Galaxy is embarking on a massive, all-or-nothing gamble.

If the AI infrastructure transformation succeeds, they will evolve from a profit-squeezed trading company into a cash-generating machine. If it fails, they will have spent billions constructing expensive real estate in Texas while their core business slowly dwindles.

The $1.4 billion in project financing validates external confidence, but I am keeping an eye on two key metrics: whether they can actually deliver the 133MW AI facility by the first half of 2026 and if the 90% profit margin can be sustained when they start incurring actual operating costs. Current operations provide enough cash flow to sustain operations, but meaningful growth investment requires a stronger crypto market. The AI infrastructure opportunity promises a stable revenue generation potential, contingent entirely on the execution over the next 18-24 months.

The recent completion of project financing eliminates a significant execution risk, but Galaxy must now prove they can successfully transition their crypto mining infrastructure into an enterprise-grade AI computing facility to make long-term investors bet. Until then... stay curious.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zuckerberg’s Threads starts 2026 ahead of Musk’s X in user count

Bitcoin Sees $1.65B Exodus From Exchanges as Holders Move to Cold Storage

Google Plans to Challenge US Court Decision Declaring Its Search Practices as an Illegal Monopoly