Toyota Unveils Blockchain Framework to Turn Vehicles Into Tradeable Digital Assets

Toyota Blockchain Lab has released a white paper detailing the Mobility Orchestration Network (MON), a blockchain system that would transform vehicles into real-world assets tradeable across financial markets. Built on Avalanche’s multi-chain architecture, MON aims to create digital identities for vehicles through NFTs, enabling investors to treat vehicle fleets as structured portfolios that can be … <a href="https://beincrypto.com/toyota-blockchain-lab-mon-mobility-trust-networks/">Continued<

Toyota Blockchain Lab has released a white paper detailing the Mobility Orchestration Network (MON), a blockchain system that would transform vehicles into real-world assets tradeable across financial markets.

Built on Avalanche’s multi-chain architecture, MON aims to create digital identities for vehicles through NFTs, enabling investors to treat vehicle fleets as structured portfolios that can be securitized into tokens.

Toyota Redefines Vehicles as Trust Networks

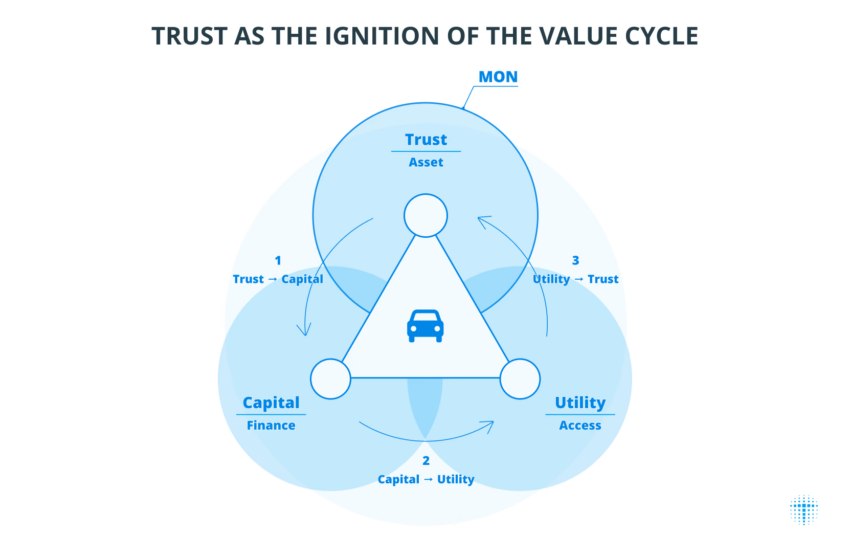

The proposal positions vehicles not as isolated assets but as nodes within a network of manufacturers, owners, insurers, operators, and regulators. MON aims to consolidate legal, technical, and economic proofs into verifiable digital identities linked to each vehicle through non-fungible tokens (NFTs).

Toyota said the system could enable investors to treat vehicle fleets as structured portfolios, later securitized into tokens. MON seeks to provide a transparent foundation for financing electric fleets, autonomous taxis, and logistics operations by linking vehicle ownership, usage, and maintenance records.

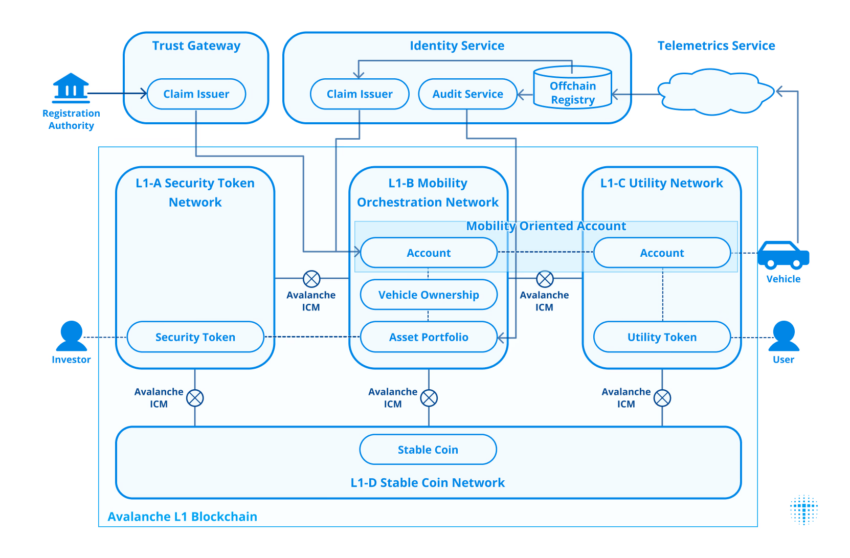

Avalanche’s architecture forms the backbone of MON’s prototype, chosen for its ability to deploy multiple interoperable L1 chains. Unlike most EVM-compatible platforms, Avalanche supports “infinite L1s,” allowing enterprises to segment networks for trust, utilities, securities, and payments. As Avalanche highlighted on X, this multi-chain design aligns with industries that demand scalability and compliance.

Naohiko Ueno, a Toyota Blockchain Lab contributor, emphasized the collaboration in his post:

Avalanche × TOYOTA Blockchain Lab出ましたね。くわしくは後ほど書きますが、今回Ava側はじめ多くの方のサポートで形になっています。個人的にはAvaのアンバサダーでもあるので、一歩踏み出した感があります。#Avalanche #ToyotaBlockchainLab https://t.co/3PRDVCGzy7

— 上野直彦naox1102.eth@TOYOTA Blockchain Lab (@Nao_Ueno) August 19, 2025

“Avalanche × TOYOTA Blockchain Lab. With strong support from many, this step became reality. As an Ava ambassador, it feels like we’ve truly advanced.”

How MON Works in Practice

Toyota Blockchain Lab

Toyota Blockchain Lab

The white paper describes three “bridges” to overcome fragmentation:

- Trust Bridge – Bundles institutional proofs like registration, insurance, and compliance with technical attestations from OEMs and operational metrics. These form the foundation of each Mobility Oriented Account (MOA).

- Capital Bridge – Connects verified vehicle portfolios to finance networks, enabling tokenization into securities and unlocking capital inflows.

- Utility Bridge – Integrates real-world usage, from ride-hailing to charging logs, ensuring that operational results reinforce financial trust.

Toyota’s prototype runs on four Avalanche L1s:

- L1-A Security Token Network – Issues securities backed by vehicle portfolios.

- L1-B MON Core – Manages ownership rights and MOAs.

- L1-C Utility Network – Handles real-time vehicle operations.

- L1-D Stablecoin Network – Supports payments and settlements.

Key services include an Identity Service to link real-world data with blockchain proofs and a Trust Gateway to bridge off-chain institutional records, such as registrations or insurance certificates.

Source:

Toyota Blockchain Lab

Source:

Toyota Blockchain Lab

Broader Implications for Mobility and Finance

Toyota said MON is not intended as a single global chain but a protocol enabling regional ecosystems to interoperate. Local MON instances would respect national regulations using a common trust language for cross-border asset flows.

The lab highlighted the potential for MON to expand beyond financing, impacting secondary markets like used cars, leasing, and insurance by streamlining data verification. Toyota previously highlighted blockchain use cases through its affiliate KINTO, which began testing NFT-based safe driving certificates in May 2024.

While MON remains at the proof-of-concept stage, analysts note that Toyota’s move marks one of the most detailed attempts to merge automotive assets with blockchain finance. MON could accelerate investment in electrification and autonomous mobility by anchoring trust across legal, technical, and economic domains.

As the Toyota Blockchain Lab stated:

“Mobility is not a static asset but a network of shared responsibilities. MON provides the foundation to extend this trust globally.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bankless | Hyperliquid's Battle for Supremacy in 2025: Can It Hold On in 2026?

How does x402 V2 make autonomous payments by AI agents possible?

![[Bitpush Daily News Selection] JPMorgan issues Galaxy short-term bonds on the Solana network; New York court sentences Terraform Labs founder Do Kwon to 15 years in prison; US Financial Stability Oversight Council (FSOC) annual report removes digital asset risk warning; OpenAI launches a more advanced model, GPT-5.2, to compete with Google](https://img.bgstatic.com/multiLang/image/social/35029d7d430a8303837232285bb190721765555021864.jpg)