The USD1 stablecoin is World Liberty Financial’s dollar-pegged token that recently saw a $205 million mint, pushing supply to about $2.4 billion and lifting WLFI’s treasury to a record $548 million. The mint signals increased treasury allocation to USD1 within the Trump family-backed DeFi project.

-

USD1 mint: $205 million

-

Supply jumped to $2.4 billion; treasury now $548 million (Nansen).

-

USD1 is now the largest holding in WLFI’s portfolio at $212 million (39%).

USD1 stablecoin: latest $205M mint raised supply to $2.4B and treasury to $548M — read key impacts and next steps for investors.

The Trump family DeFi project has minted $205 million USD1, pushing treasury holdings and stablecoin supply to record highs.

The Trump family–backed project World Liberty Financial (WLFI) executed a large mint of its USD1 stablecoin, adding $205 million to the token’s supply. That action increased the stablecoin supply to roughly $2.4 billion and raised WLFI’s on-chain treasury to a new high of $548 million, according to Nansen.

What is the USD1 stablecoin?

USD1 stablecoin is World Liberty Financial’s dollar-pegged token launched in early April. The token aims to function as a payment and treasury instrument for the project, and the recent $205 million mint makes USD1 one of the fastest-growing entrants by supply since launch.

How large is USD1 compared to major stablecoins?

By market capitalization, USD1 has become one of the top stablecoins globally, ranking sixth since launch. Leading the market are Tether (USDT) at about $167 billion and Circle’s USDC at roughly $67.4 billion. USD1’s rapid supply increase reflects active issuance rather than existing circulating market liquidity.

Why did WLFI mint $205 million of USD1?

WLFI stated the mint was for treasury allocation, increasing the project’s holdings in stablecoin to improve liquidity and operational flexibility. The mint followed public comments by Federal Reserve Governor Christopher Waller praising stablecoins and the GENIUS Act as supportive regulatory steps for payment stablecoins.

How did regulators and officials react?

Federal Reserve Governor Christopher Waller said, “I believe that stablecoins have the potential to maintain and extend the role of the dollar internationally.” SEC Chair Paul Atkins called the GENIUS Act “a seminal step for the US Congress and government.” Those statements preceded WLFI’s minting event and add context to recent policy developments.

What is in WLFI’s treasury after the mint?

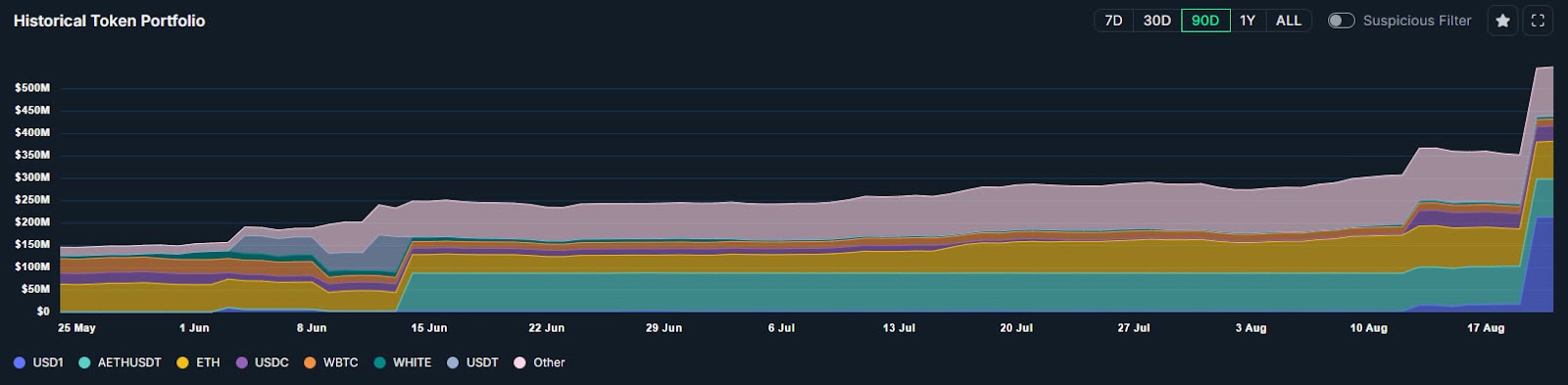

Per on-chain analytics firm Nansen, WLFI’s treasury now totals $548 million. USD1 is the largest single holding at $212 million (39% of the portfolio). Other notable allocations include Aave Ethereum USDT (AETHUSDT) at $85 million and a position of approximately 19,650 ETH.

World Liberty’s treasury holdings are at their largest-ever levels. Source: Nansen

World Liberty’s treasury holdings are at their largest-ever levels. Source: Nansen

When did USD1 launch and what’s next?

USD1 launched in early April. The $205 million mint is the token’s most significant supply increase since late April, and it precedes reports that World Liberty Financial is exploring a publicly traded vehicle to hold WLFI tokens with a fundraising target around $1.5 billion. Market participants will monitor circulating supply, exchange listings, and on-chain flows.

How should investors interpret the mint?

Investors should view large on-chain mints as treasury management decisions that affect supply and institutional backing, not direct market demand. The mint increases the protocol’s liquidity buffer but may not immediately translate to circulating market liquidity.

Frequently Asked Questions

Did WLFI link USD1 minting to any new partnerships?

No public partnership was announced tied to this mint. WLFI described the mint as a treasury allocation; sources cited include Nansen and public remarks by federal officials.

Is USD1 redeemable for dollars?

World Liberty Financial has positioned USD1 as dollar-pegged; redemption mechanics and custodial details are determined by the project’s on-chain and off-chain infrastructure and disclosures.

Key Takeaways

- Major mint: WLFI minted $205 million USD1, raising supply to ~$2.4B.

- Treasury peak: WLFI’s treasury is now $548M, with USD1 at $212M (39%).

- Regulatory context: Statements by Christopher Waller and Paul Atkins and the GENIUS Act framed the timing.

Conclusion

The USD1 stablecoin mint marks a material liquidity move for World Liberty Financial and pushes WLFI’s treasury to record levels. Investors should monitor on-chain flows, project disclosures, and regulatory developments. For ongoing coverage and updates, check COINOTAG’s analysis and data-driven reporting.