MANTRA Proposes Key Changes to OM Token: What You Need to Know

MANTRA proposes migrating OM token to its native blockchain, enhancing liquidity, security, and decentralization, while setting a hard supply cap of 2.5 billion tokens.

MANTRA has released a significant governance proposal to migrate its OM token entirely from the Ethereum ERC-20 standard to a native token on its own blockchain.

The main goal is to improve liquidity, security, and scalability, as well as accelerate the growth of MANTRA’s Real World Asset (RWA) tokenization ecosystem. This proposal aims to ensure long-term growth, regulatory compliance, and the ecosystem’s evolution.

MANTRA Proposes Major Token Overhaul for Growth

The team explained that over 250 million OM tokens, 28% of the total ERC20 supply, have already migrated to the MANTRA Chain. The network now plans to complete this transition.

According to the proposal, the full migration from Ethereum-based OM tokens to the native version on MANTRA Chain will be finalized by next year. By January 15, 2026, the team will deprecate the ERC20 OM tokens through a managed sunset process. Thus, the network will recognize only the MANTRA Chain-native OM token.

The team has emphasized that the process will be transparent. They added that detailed instructions will be provided to ensure a smooth transition for all stakeholders.

“It will culminate in bridge closure and the remaining non-bridged ERC 20 OM reclaimed by the MANTRA Chain Association for ecosystem initiatives. Post-deprecation, MANTRA Chain-native OM = the canonical version,” the post read.

One of the key aspects of the proposal is the adjustment to OM’s inflation rate. The inflation rate will return to 8%, with the goal of achieving an approximate 18% staking APR.

Additionally, the team has proposed enforcing a hard supply cap of 2.5 billion OM tokens. This will ensure that the total supply remains finite and prevents inflationary pressures from undermining the token’s value.

“This will require a Bank Module update, capping the supply of OM at 2.5B. This will occur subsequently should this proposal pass,” the proposal added.

As part of the proposal, liquidity from multiple blockchains, including Base, Polygon, BNB Chain, and Ethereum, will be consolidated onto MANTRA Chain. The first phase of this liquidity migration will begin immediately after the proposal is approved. Moreover, Ethereum liquidity will move over in Q4 2025.

This consolidation aims to deepen liquidity pools within the MANTRA Chain ecosystem, resulting in more efficient trades and better access for DeFi users. Furthermore, to improve decentralization, the MANTRA Chain Association will reduce the number of validators from five to two by Q3 2025.

“MCA validators reduced 5 to 2 (Q3 2025) – their redistributed stake will enhance decentralization across all existing network validators,” the team noted.

Moreover, MANTRA will activate commissions on MCA validators by the end of 2025. This move will provide an additional incentive for broader community participation in network governance.

Lastly, the team also suggested redirecting funds from Sybil-slaying measures and staking rewards to support long-term growth. MANTRA will allocate the OM tokens to three key areas:

- MultiVM application development to enhance technical capabilities.

- RWA issuer onboarding programs to attract more real-world asset issuers.

- User incentives to promote the adoption of tokenized assets.

The governance proposal is now open for community voting, with voting set to conclude on August 22.

The proposal comes as the OM token’s price struggles continue. BeInCrypto Markets data showed that the altcoin’s value has dipped 22.5% over the past month. At press time, it was trading at $0.23.

MANTRA (OM) Price Performance. Source:

MANTRA (OM) Price Performance. Source:

After suffering a 90% crash, the altcoin has yet to bounce back completely. While the team has made numerous efforts, like token burns to boost its recovery efforts, the price is yet to reclaim old highs.

Whether this proposal will pass or not, and its potential impact on the token’s future remains uncertain. However, it marks a crucial step in MANTRA’s strategy to solidify its position in the crypto space and foster long-term growth for its ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Musk and Ryanair CEO clash over cost of Starlink Wi-Fi on planes

Dollar Weakens While Yen Strengthens Following Verbal Warnings

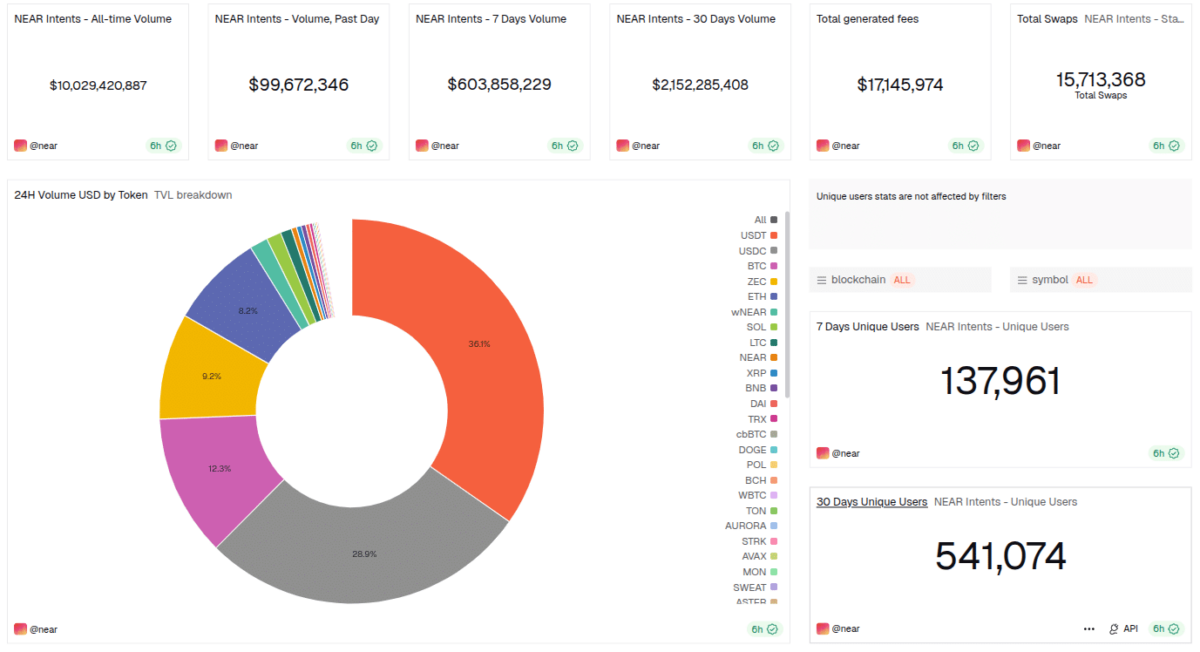

NEAR Intents Achieves $10B in Swap Volume as Industry Support, Adoption Grow

PNC Bank CEO says stablecoins must choose: be a payment tool or a money market fund