ETH Open Interest Reaches ATH, Signaling Potential for Further Gains

Despite a market correction, crypto investors are showing an unusual preference for high-risk assets, with Ethereum's perpetual futures trading volume share hitting a historic 67%.

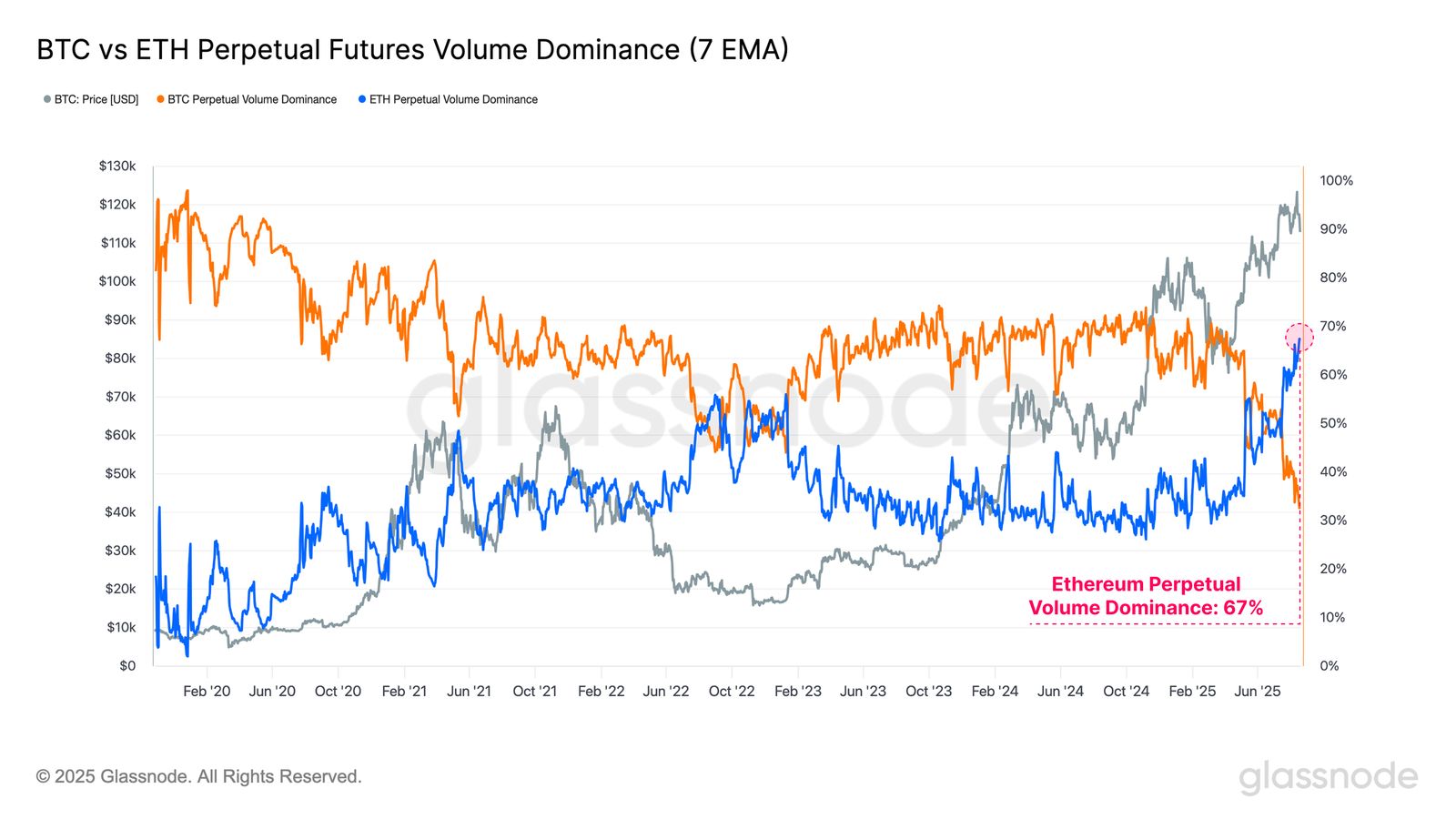

Ethereum’s perpetual futures trading volume share hit a historic high of 67% over the past week. In other words, two-thirds of all crypto perpetual futures trading involved Ethereum.

This indicates that crypto investors are unusually favoring high-risk investments, even amid a market downtrend caused mainly by concerns over rising US inflation.

BTC-ETH Open Interest is Very Close

Glassnode released its weekly report, “A Derivatives-Led Market,” on Wednesday. It explained that while Bitcoin’s price recently hit a new all-time high before correcting, the crypto derivatives market primarily drove the market’s direction.

Despite the correction, Glassnode pointed out that market participants still consider this a bull market, which is reflected in the rising open interest dominance of ETH, a key “bellweather asset“

As of Thursday morning UTC, the spot dominance gap between Bitcoin (59.42%) and Ethereum (13.62%) is about fourfold. However, the open interest dominance is much closer, with Bitcoin at 56.7% and Ethereum at 43.3%. This suggests that leveraged investors are showing significantly greater interest in ETH.

This trend is even more pronounced in trading volume. Ethereum’s perpetual futures trading volume share has reached an all-time high of 67%.

BTC vs ETH Perpetual Futures Volume Dominance(7 EMA). Source: Glassnode

BTC vs ETH Perpetual Futures Volume Dominance(7 EMA). Source: Glassnode

Glassnode explained that these figures highlight the high level of investor interest in the altcoin sector and indicate that investors are now willing to take on greater investment risk.

So, could the price of ETH rise further and serve as a stepping stone to an “altcoin season”? Ultimately, the key appears to lie in the attitudes and interest rate decisions of the US Federal Reserve (Fed) officials.

One of the main reasons for the recent crypto price correction is the uncertainty surrounding the Fed’s interest rate cuts due to renewed US inflation. If Fed Chair Jerome Powell’s speech at the Jackson Hole meeting on Friday signals a move toward interest rate cuts, ETH is expected to rise much faster than BTC.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.