KAITO price rebounds from 3-month low, holds $1 support despite $23M unlock

KAITO price is showing early signs of a potential reversal, forming a bullish engulfing pattern on the day of a $23M token unlock, with strong support emerging around $1.00.

- KAITO price bounced sharply from a 3-month low near $1.00 on strong volume during the major token unlock, forming a bullish reversal candlestick.

- Medium- to long-term trend remains bearish, but the bullish engulfing suggests buyers are defending the $1.00 level.

- Local resistance is at $1.30–$1.40, and a confirmed break above this zone could signal a larger trend reversal and potential continuation toward higher levels.

Kaito ( KAITO ) price rebounded sharply from its 3-month low near $1.00 yesterday, posting an intraday gain of more than 11% and reaching a high of $1.20. This move brought KAITO price close to the first major resistance zone around $1.30–$1.40. The rebound was accompanied by a notable surge in trading volume and the RSI climbing from sub-40 levels to around 45.

Even though the medium-to-long-term trend remains bearish, with KAITO price trading below the 20-day EMA, while both the 50-day and 100-day SMAs are sloping downward, yesterday’s bounce is noteworthy because it marked the formation of a bullish engulfing candlestick. This pattern, combined with the spike in participation, suggests that buyers are attempting to establish a short-term floor around the $1.00 area.

Source: TradingView

Source: TradingView

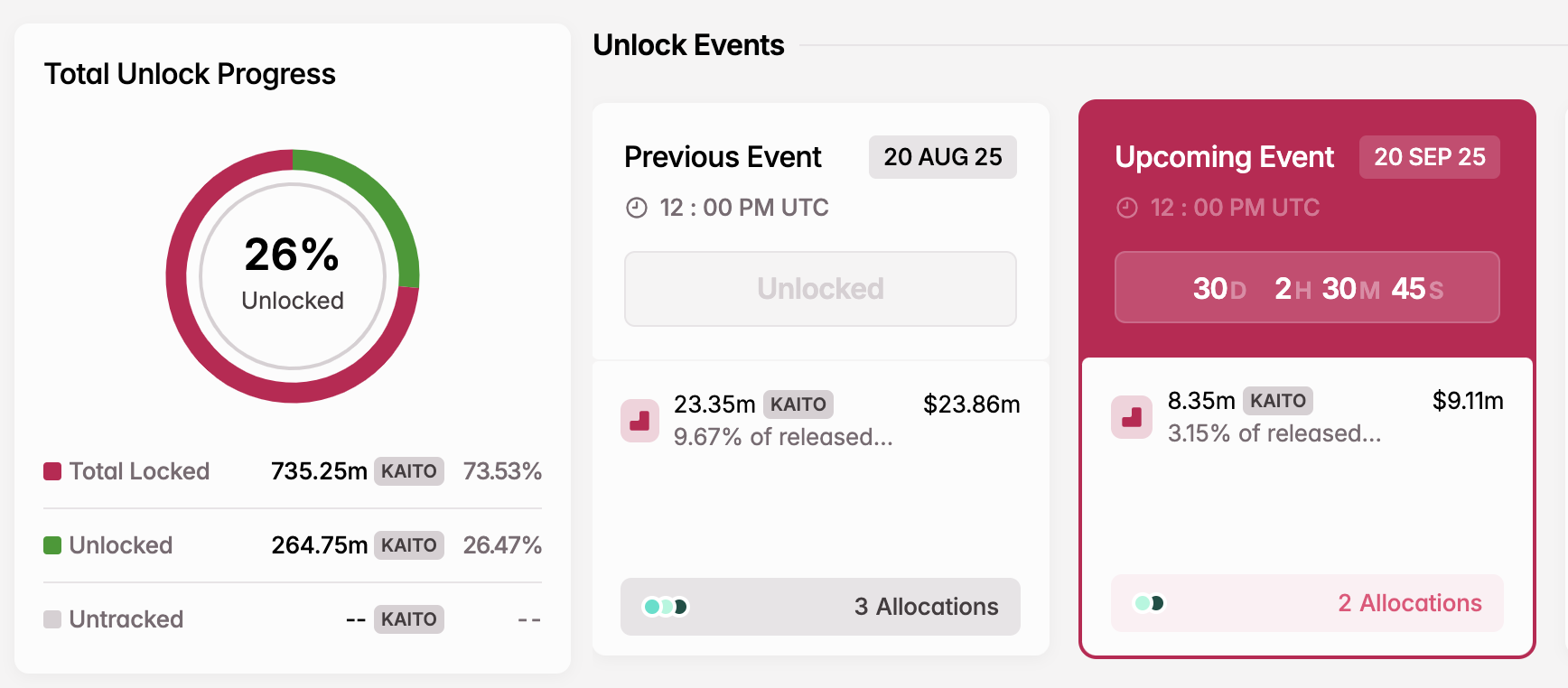

KAITO price unfazed by $23M token unlock

Adding to the significance of the bullish engulfing pattern is the fact that it formed on the same day as a major token unlock , when over $23M worth of KAITO entered circulation.

Unlock events are typically bearish catalysts , as they increase supply and often trigger profit-taking. However, instead of a breakdown, KAITO absorbed the new supply and rallied on strong volume, suggesting that much of the selling pressure had already been priced in, or that fresh demand was strong enough to offset it. This resilience adds weight to the $1.00 zone as an emerging psychological support level.

Looking ahead, traders should watch for confirmation above $1.30–$1.40 local resistance to hint at a larger trend reversal and reclamation of the higher levels.

Source: Tokenomist

Source: Tokenomist

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interop roadmap "accelerates": After the Fusaka upgrade, Ethereum interoperability may reach a key milestone

a16z "Big Ideas for 2026: Part Two"

Software has eaten the world. Now, it will drive the world forward.

When the Federal Reserve "cuts interest rates alone" while other central banks even start raising rates, the depreciation of the US dollar will become the focus in 2026.

The Federal Reserve has cut interest rates by 25 basis points as expected. The market generally anticipates that the Fed will maintain an accommodative policy next year. Meanwhile, central banks in Europe, Canada, Japan, Australia, and New Zealand mostly continue to maintain a tightening stance.

From MEV-Boost to BuilderNet: Can True MEV Fair Distribution Be Achieved?

In MEV-Boost auctions, the key to winning the competition lies not in having the most powerful algorithms, but in controlling the most valuable order flow. BuilderNet enables different participants to share order flow, reshaping the MEV ecosystem.