Investigating Kanye West’s YZY Chaos: Insider Bragging, TRUMP–LIBRA Connection and More

Kanye West’s YZY token soared to $3B then crashed, as insider gains, Mikey Shelton’s bragging, and TRUMP–LIBRA links came to light.

Kanye West’s (Ye) new YZY meme coin launch on Solana was billed as another cultural moment from one of music’s most influential figures. Instead, it has turned into a case study in how celebrity tokens can spiral into controversy.

On-chain data reveals a strange connection between YZY insiders and early LIBRA and TRUMP meme coin traders. Investigations also show a figure named ‘Mikey Shelton’ behind the insider pump-and-dump setup.

Some Traders Lost Millions on Kanye’s YZY

The YZY token went live on August 21, 2025. Within 40 minutes, it surged to a $3 billion market cap, before falling back to nearly a third of that.

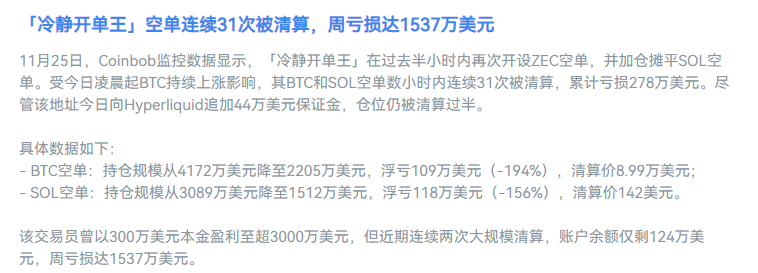

Nansen’s analysis shows 62,465 wallets traded YZY on launch day, generating extreme outcomes:

- Profits: +$50.4 million realized across the top 500 wallets.

- Losses: −$21.4 million realized.

- Largest profit: $3 million.

- Largest loss: $1.3 million.

- Liquidity pool: earned $10 million in fees.

In short, a handful of wallets captured millions in upside while thousands of retail traders ended up in the red.

YZY Token Profit and Loss Leaderboard. Source:

YZY Token Profit and Loss Leaderboard. Source:

The Shady Role of Mikey Shelton

One of the most striking post-launch developments came from Mikey Shelton, a name that had already appeared in Ye’s circle earlier this year.

Back in February, Ye shared a conversation with Shelton in which he told him: “You are the brand. Whatever it is will do well. Some things are better than others. It’s about who you trust.”

After YZY’s launch, Shelton’s Instagram Stories circulated widely. In one, over a black screen, he wrote “Best day.” Attached was a chat message:

“We made $160k in first 10 min. Still haven’t sold just under $300.”

The implication was clear: Shelton and his circle had secured insider access, reaping six-figure gains within minutes of the token going live.

So the guy who is behind $YZY token is publicly bragging about insider trading and rugging for MILLIONS of dollars on his IG

— Gordon (@AltcoinGordon)

Whether this was simple bragging or a direct admission, the optics added fuel to claims of insider trading around YZY.

Now, Mikey Shelton’s online presence is also mysterious. His last Twitter post was in August 2023. He is seemingly active on Instagram, but maintains a private profile.Notably, Shelton mentions Baylor University and Stanford in his Insta bio. Did a Stanford graduate orchestrate this pump-and-dump?

On-chain Evidence of Insider Activity

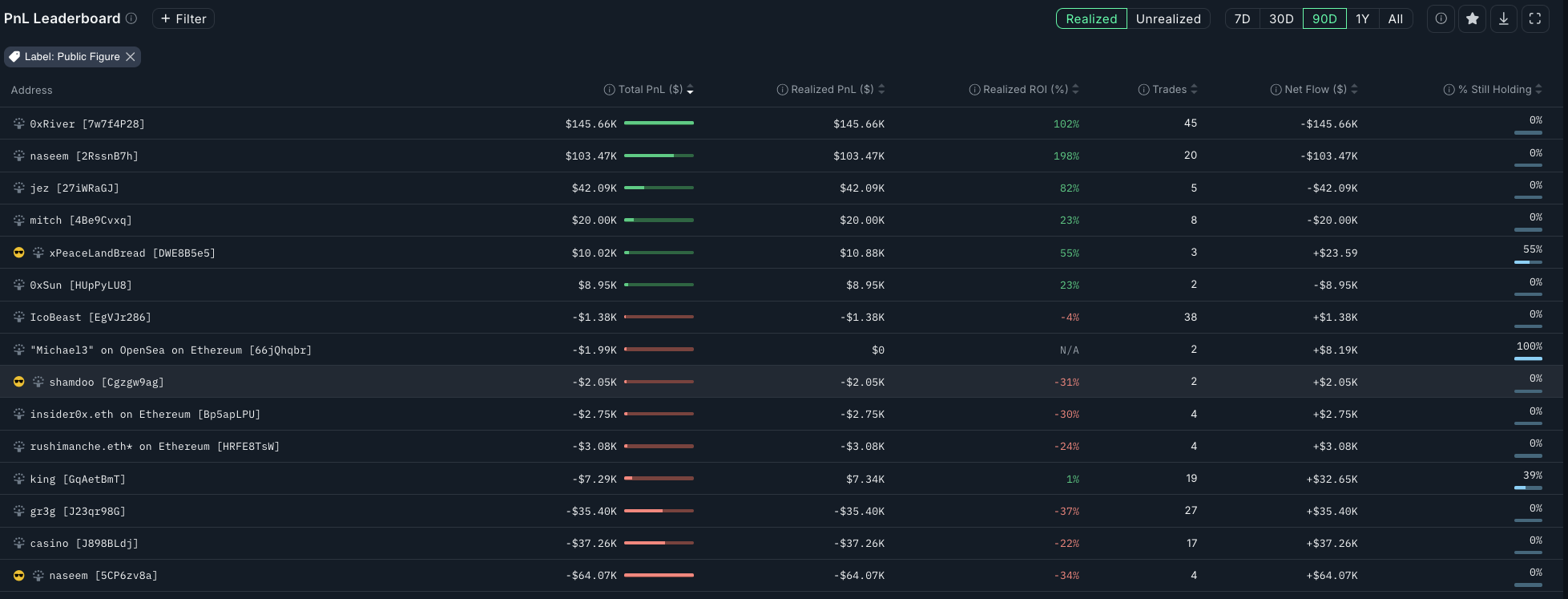

Several on-chain analysts corroborated those suspicions with wallet traces. Dethective identified two “sniper” wallets that extracted a combined $23 million across YZY and another coin, LIBRA.

These wallets were prepared before launch and pushed large amounts through liquidity pools. On-chain data shows they only sniped YZY and LIBRA — never other tokens — suggesting inside knowledge rather than luck.

YZY and LIBRA Insider Trading Connection. Source:

YZY and LIBRA Insider Trading Connection. Source:

Meanwhile, Bubblemaps reported that the very first YZY buyer was Naseem. This is the same trader who made over $100 million on the TRUMP meme coin earlier this year.

The analysis linked wallets between TRUMP, LIBRA, and YZY, showing consistent early access. The first YZY purchase was a $250,000 buy on August 21, and that wallet has already realized $800,000 in profit while still holding $600,000.Together, these findings raise serious questions: how do the same wallets repeatedly end up first in line for celebrity meme coin launches? And is this skillful sniping — or privileged access?

2/Naseem first made headlines this year after turning $1.1M into over $100M on $TRUMP We were surprised to find him again on $YZY

— Bubblemaps (@bubblemaps)

Many popular crypto figures even claimed they knew early about Kanye West’s token launch. However, some refrained from participating due to ethical and moral reasons.

This narrative is reinforced by Nansen’s numbers: only 9,413 wallets booked more than $10 in profit, while nearly 16,000 wallets booked more than $10 in losses.

What This Means for YZY and Future Celebrity Coins

The YZY episode reveals repeating patterns in 2025’s celebrity token scene:

- Pre-loaded insiders: Wallets appear primed before contracts are public, entering with huge size.

- Bragging rights: Figures close to the project — like Mikey Shelton — amplify suspicions by openly celebrating windfalls.

- Repeat players: The same wallets surface across TRUMP, LIBRA, and now YZY, raising the question of organized insider groups.

- Retail losses: Tens of thousands of smaller wallets consistently lose out, becoming the exit liquidity for early buyers.

Compared to TRUMP’s $29.5 billion opening volume, YZY’s $724 million may look smaller. But the dynamics are the same: insiders win, latecomers lose, and transparency is lacking.

Bottom Line

YZY was supposed to mark Ye’s entry into Web3. Instead, its first day underscored how celebrity tokens have become hunting grounds for insiders.

Mikey Shelton’s Instagram posts, on-chain wallet analysis, Bubblemaps’ TRUMP-YZY link, and Nansen’s hard data all point in the same direction: the launch heavily favored a few well-positioned players.

Whether Ye himself orchestrated this or was leveraged by those around him remains unclear. What is clear is that YZY has added another cautionary tale to the growing list of celebrity crypto experiments, and retail investors once again paid the price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

IOSG Weekly Report|Application Cycle: The Golden Age for Asian Developers

How can the network effect of cryptocurrencies become a valuation trap?

MicroStrategy stops buying BTC, is the market panicking?

A Record of Crypto Whales Battling Long and Short Positions