Europe's Second Largest Insurance Company, Allianz, Changes Its Mind on Bitcoin! "BTC Is Now…"

Allianz, Germany's largest and Europe's second-largest insurer with $2.5 trillion in assets under management, has changed its stance on Bitcoin (BTC).

In a recent report, Allianz described Bitcoin as a “trusted store of value.”

Allianz, which has been skeptical and hesitant about Bitcoin since 2019, has reversed its position on Bitcoin, classifying it as a “trusted store of value.”

The company announced in 2019 that it was avoiding Bitcoin investments, citing regulatory uncertainty and volatility concerns.

However, Allianz said in a recent report titled “Bitcoin and Cryptocurrencies: The Future of Finance” that Bitcoin has evolved from an experimental protocol to a major asset class.

Allianz stated that Bitcoin's deflationary design, decentralized governance, and low correlation with both traditional stocks and gold have contributed to its transformation into a significant, accepted, and attractive asset class.

Allianz also noted clearer global regulations that encourage institutional adoption and highlighted Bitcoin's low correlation with the S&P 500 and gold as a diversification advantage.

Bitcoin's deflationary design, decentralized governance, and low correlation with traditional markets make it an attractive hedge and long-term asset. Bitcoin has a limited supply of 21 million. This scarcity makes it inherently deflationary, which in turn provides a hedge against inflation in the long run.

Its decentralized governance, meaning it is not controlled by a single entity, makes Bitcoin independent of central banks and governments. This independence also increases its appeal as a hedge against traditional financial system risks.

Finally, Bitcoin's low correlation with assets like the S&P 500 and gold makes it stand out. This characteristic makes it an attractive tool for portfolio diversification, potentially reducing overall risk for investors.

Finally, the report stated that unless a major disaster occurs, Bitcoin should be viewed as a permanent asset of the financial system, not as a speculative asset.

The endorsement of Bitcoin by Allianz, one of Europe's largest asset managers, represents a significant milestone in Bitcoin's mainstream adoption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

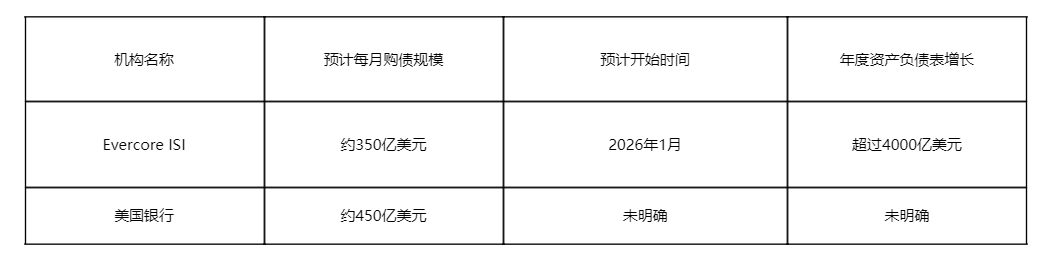

Trump Takes Control of the Federal Reserve: The Impact on Bitcoin in the Coming Months

The U.S. financial system is undergoing its most significant transformation in a century.

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

Move forward with pragmatic optimism.

Undercurrents Surge: Crypto Whales Spark Another Wave of Accumulation

Fed Decision Preview: Balance Sheet Expansion Signals Are More Important Than Rate Cuts