Chainlink's LINK Rallies 12% to New 2025 High Amid Token Buyback, Broader Crypto Rally

Oracle network Chainlink's (LINK) native token sharply rebounded with the broader crypto market following Federal Reserve Chair Jerome Powell's dovish remarks in Jackson Hole, Wyoming.

LINK rallied 12% over the past 24 hours, hitting $27.8, its strongest price since December. Bitcoin BTC$116,870.71 appreciated 3.5% during the same period, while the broad-market CoinDesk 20 index jumped 6.5%.

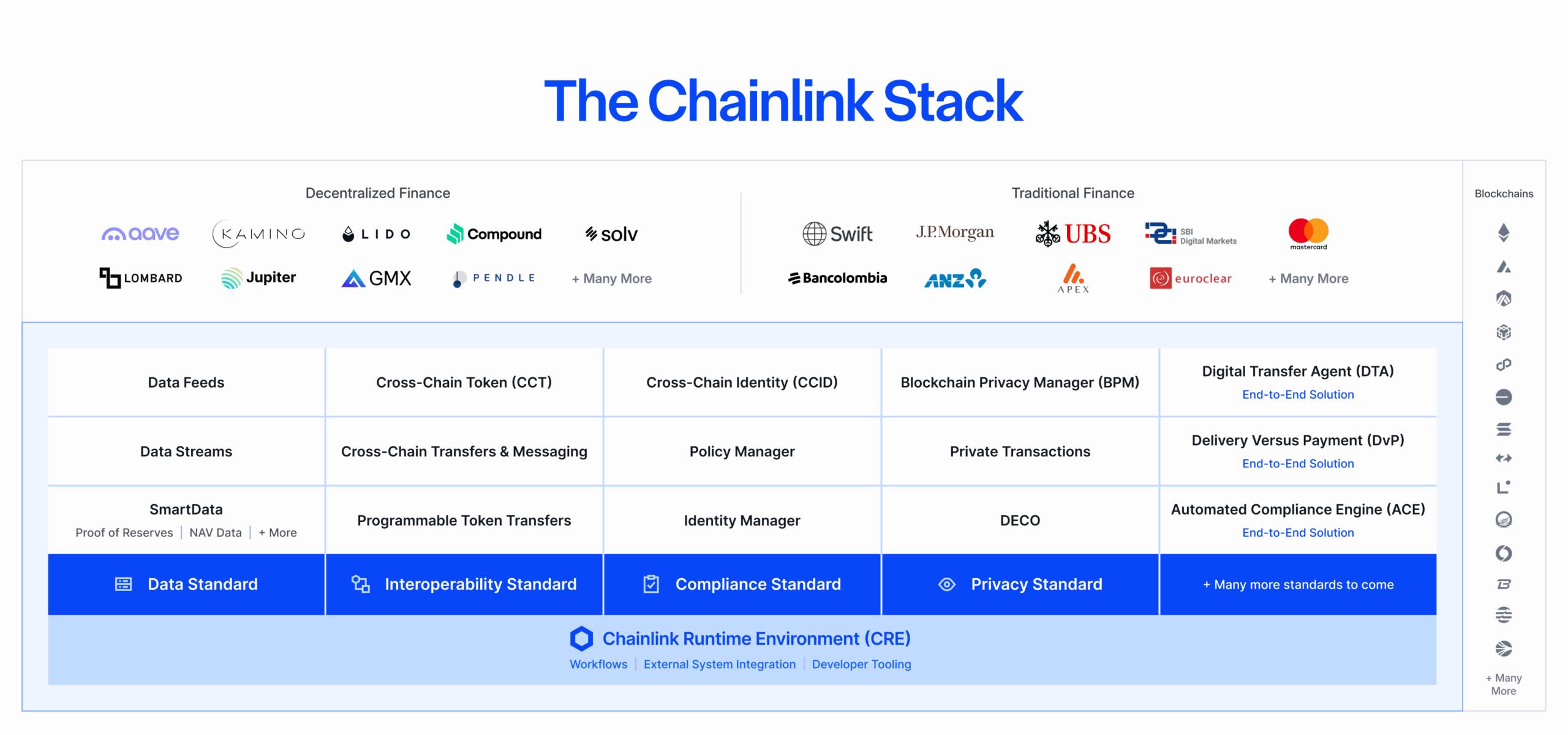

In protocol-specific news, Chainlink obtained two major security certifications this week: ISO 27001 and a SOC 2 Type 1 attestation, marking a first for a blockchain oracle platform. The audits, carried out by Deloitte, covered Chainlink’s price feeds, proof-of-reserve services and the Cross-Chain Interoperability Protocol (CCIP).

The oracle provider says the move strengthens trust in its data services and can bolster adoption among banks, asset issuers and decentralized finance protocols.

Further supporting the rally, the Chainlink Reserve, which periodically purchases LINK tokens on the open market using protocol revenues, bought 41,000 tokens on Thursday, worth roughly $1 million at that time. That brought total holdings to 150,778 tokens, around $4.1 million at current prices.

Technical analysis

- Support Levels: Substantial defense established at $24.15 with high-volume confirmation, according to CoinDesk Research's technical analysis data.

- Resistance Penetration: Systematic advancement through $25.00, $25.50, and $26.00 levels with volume validation from institutional participants.

- Trading Volume Analysis: Exceptional 12.84 million volume surge during breakout phase, representing five times the 24-hour average of 2.44 million units.

- Consolidation Patterns: Extended tight range consolidation around $24.70-$25.10 preceding explosive institutional-driven breakout.

- Momentum Indicators: Sustained upward trajectory with measured advance characteristics and institutional accumulation signals from corporate treasury operations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.