Crypto in 401(k) plans could unlock billions for Bitcoin by broadening institutional and retail retirement demand. A modest 1% allocation across US defined‑contribution accounts could channel roughly $122 billion into Bitcoin ETFs, supporting a possible BTC push toward $200,000 within 2025, analysts say.

-

Major catalyst: 401(k) inclusion gives retirement managers access to Bitcoin ETFs for widespread allocation.

-

Analyst estimates assume a conservative 1% allocation across a $12.2 trillion US defined‑contribution market.

-

Bitwise’s research projects ~ $122 billion in new inflows; corporate treasury buys and DeFi flows add further demand.

Crypto in 401(k) plans could unlock billions for Bitcoin, potentially pushing BTC to $200,000 by 2025 — expert analysis and data from COINOTAG. Read full analysis.

How could crypto in 401(k) plans affect Bitcoin’s price?

Crypto in 401(k) plans would enable retirement portfolio managers to allocate to Bitcoin via regulated ETFs, expanding demand from millions of accounts. A small, industry‑wide allocation can create substantial capital inflows that materially raise BTC valuation expectations.

How realistic is a $200,000 Bitcoin target from 401(k) inflows?

Bitwise’s European head of research, André Dragosch, estimates that a 1% allocation of the $12.2 trillion US defined‑contribution market implies roughly $122 billion of new capital. Combined with existing ETF and corporate treasury demand, this scale of inflows is a plausible driver toward materially higher BTC price targets in 2025.

Could 401(k) crypto access be a bigger catalyst than US spot Bitcoin ETFs?

Yes. Access inside retirement vehicles creates persistent, recurring demand from a much larger investor base than the initial ETF investor pool. Analysts note ETFs concentrate trading demand, while 401(k) inclusion institutionalizes exposure across salary‑deferral accounts, magnifying steady inflows over years.

What recent market moves highlight shifting institutional demand?

Corporate treasury allocations and large block trades continue to reshape order flow. A recent Nasdaq‑listed healthcare firm made a substantial Bitcoin treasury purchase, and an on‑chain whale converted a large BTC position into a leveraged long and spot ETH exposure in the same session—signaling cross‑market liquidity and appetite.

How are other sectors reacting to crypto macro momentum?

Notable activity includes a planned $250 million SPAC filing targeting DeFi and AI, and senior hires into major stablecoin issuers to coordinate U.S. strategy. In addition, synthetic stablecoin protocols report rapid revenue and supply growth, reflecting market appetite for alternatives to traditional cash instruments.

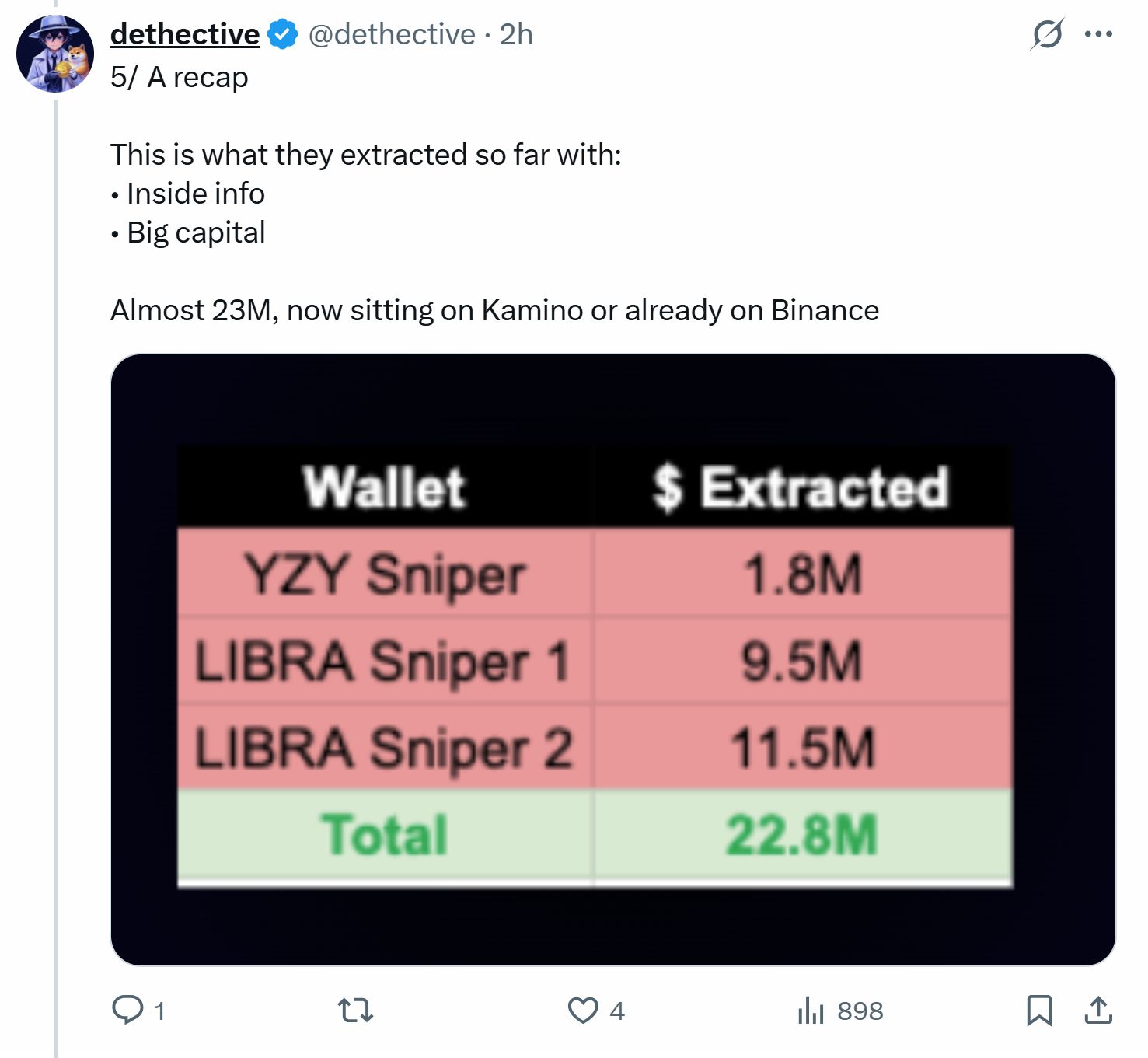

YZY sniper wallet linked to LIBRA extraction scheme

On‑chain research by the pseudonymous analyst Dethective linked a wallet that sniped a Kanye West‑themed token (YZY) to wallets tied to LIBRA token launches. The investigation reports combined extractions near $23 million, consolidated later to major liquidity venues.

Sleuth links YZY sniper wallet to Libra. Source: Dethective

SPAC filing targets DeFi, AI and blockchain integration

Investor Chamath Palihapitiya filed to raise $250 million for a blank‑check vehicle focused on decentralized finance, AI, energy and defense. The filing signals continued investor interest in bridging traditional markets with blockchain innovations.

Ex‑White House crypto director joins Tether as adviser

Tether appointed a former White House crypto director as strategic adviser to advance U.S. market coordination. The hire underscores stablecoin issuers’ focus on policy engagement and domestic expansion heading into a potentially broader regulatory environment.

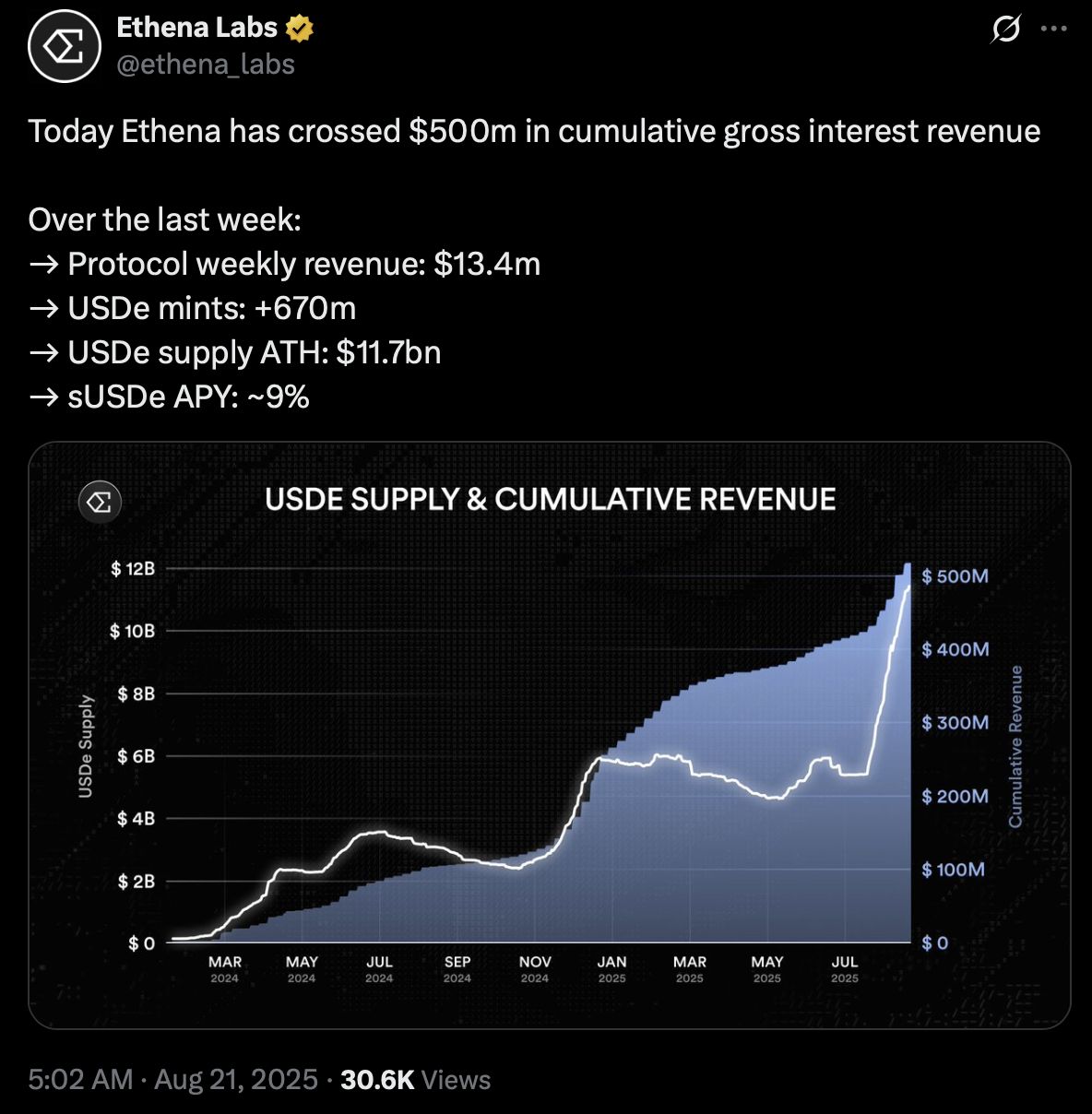

Ethena protocol crosses $500M in cumulative revenue

Ethena Labs reported more than $500 million in cumulative revenue alongside rapid growth in its synthetic stablecoin supply. On‑chain analytics platforms highlight strong month‑over‑month market cap gains for synthetic dollar products, while noting systemic risks tied to non‑collateralized designs.

Source: Ethena Labs

Frequently Asked Questions

How much capital could 401(k) inclusion channel to Bitcoin?

Analysts estimate a 1% allocation of the roughly $12.2 trillion US defined‑contribution market would equate to about $122 billion of new capital into Bitcoin ETFs, a material contributor to long‑term price support.

When could retirement flows begin to impact BTC prices?

Implementation timing varies by plan provider and regulatory guidance; analysts project visible inflows within months to a year after plan adoption, with price impact accelerating as allocations scale and ETFs remain available.

Key Takeaways

- Scale matters: A small allocation across a massive retirement market can create outsized capital inflows.

- Institutional and corporate demand: Treasury buys and large on‑chain trades complement retirement inflows.

- Risk and governance: Adoption requires plan governance, custody solutions and clear regulatory guidance for fiduciaries.

Conclusion

Crypto inclusion in US 401(k) plans represents a structural demand shift that could materially affect Bitcoin’s market trajectory. Based on conservative allocation scenarios and current institutional flows, analysts see a credible path for BTC to reach higher price benchmarks by 2025. Monitor plan rollouts, ETF flows, and on‑chain activity for evolving signals.