Bitcoin confirmed a bullish inverse head and shoulders reversal near $112,511, with a decisive breakout above the $113,000 neckline and a confirmed retest — signaling potential price discovery while liquidation dominance at 18.1% warns of short-term volatility and forced selling.

-

Inverse head and shoulders confirmed

-

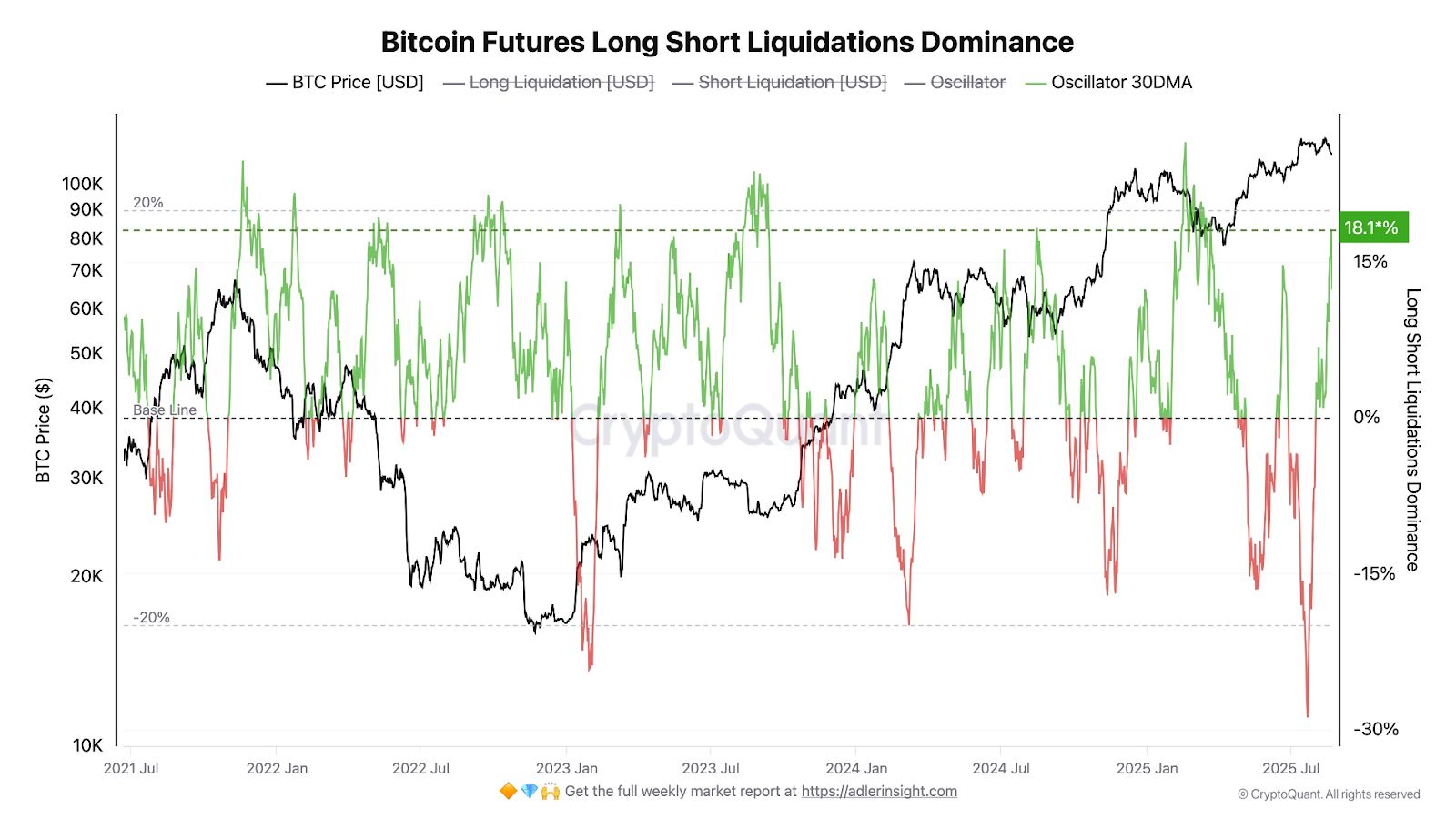

Liquidation dominance spiked to 18.1%, highlighting short-term risk.

-

Breakout above $113,000 suggests potential price discovery; volume supported the move.

Bitcoin inverse head and shoulders confirmed near $112,511; read market implications and risk signals. Learn what traders should watch next — actionable analysis inside.

Bitcoin confirms a bullish reversal pattern near $112,511 as analysts warn of rising liquidation pressure and heightened market volatility.

Bitcoin is showing notable momentum after completing a powerful inverse head and shoulders structure that pushed price near $112,511. Analysts report a confirmed breakout with a neckline retest at $113,000, indicating a credible technical reversal even amid rising liquidation pressure.

What is the Bitcoin inverse head and shoulders pattern?

The Bitcoin inverse head and shoulders is a bullish reversal pattern that forms after a downtrend and signals a potential shift to sustained upward movement when the price breaks and retests the neckline. This pattern typically includes a lower “head” between two higher “shoulders” and gains confirmation on volume-supported breakout and retest.

How was the breakout confirmed and who verified it?

Trader Merlijn publicly noted a neckline retest following the breakout, which is a classic confirmation signal. Volume increased during the August breakout, and September’s continuation phase reinforced the move. Source: Merlijn The Trader (plain text).

How strong is the bullish signal versus liquidation risk?

Technical strength is clear, but liquidation risk remains material. Liquidation dominance rose to 18.1% as long positions were rapidly closed, per analyst Axel Adler Jr (plain text). Historical comparisons to 2022 and 2024 corrections show similar liquidation spikes during steep drawdowns.

What does 18.1% liquidation dominance mean for traders?

At 18.1%, forced selling has trimmed leveraged long exposure and increased intraday volatility. Traders should expect abrupt price swings and use position sizing, stop management, or reduced leverage to limit drawdowns.

Key technical timeline and price levels

- Left shoulder: ~ $105,000 (December 2024)

- Head: $75,100 (March 2025 low)

- Right shoulder: $101,000–$105,000 (June–July 2025)

- Neckline breakout: $113,000 (August 2025)

- Current price area: ~ $112,511 with confirmed retest (September 2025)

Source: Merlijn The Trader

Recovery began in April as buyers re-entered, building momentum into May and strengthening through June and July. The August breakout above $113,000 included a surge in traded volume, improving the signal’s reliability. September’s continuation and retest suggest sellers failed to reclaim the neckline.

Why does liquidity matter now?

Deleveraging has historically preceded both deep corrections and eventual bullish cycles. While deleveraging increases short-term liquidity-driven declines, it can also clear imbalances and enable stronger long-term rallies when on-chain and macro fundamentals align.

Source: Axel Adler Jr

Frequently Asked Questions

Is the breakout above $113,000 confirmed?

The breakout is confirmed after a neckline retest and supportive volume, but confirmation does not rule out short-term pullbacks driven by liquidation events and macro volatility.

Should traders expect more liquidations?

Yes. With liquidation dominance at 18.1%, further episodic liquidations are possible during rapid price moves, so traders should manage risk and avoid excessive leverage.

Key Takeaways

- Pattern confirmed: Inverse head and shoulders indicates a bullish reversal after the $113,000 neckline breakout.

- Risk remains: Liquidation dominance at 18.1% signals elevated short-term volatility and forced selling.

- Actionable insight: Use risk controls, monitor volume and liquidation metrics, and watch for sustained price discovery above recent highs.

Conclusion

Bitcoin’s inverse head and shoulders breakout near $113,000 signals a potentially major bullish shift, yet elevated liquidation dominance keeps short-term risk high. Traders should weigh confirmed technical structure against liquidity metrics and maintain disciplined risk management as the market pursues price discovery.