ETH Outflows Signal Bullish Momentum as BTC Faces Correction Risk — CryptoQuant

On-chain data from CryptoQuant indicates a growing divergence between Bitcoin (BTC) and Ethereum (ETH), underscoring shifting market dynamics that could define the next phase of capital flows in digital assets.

On-chain data from CryptoQuant indicates a growing divergence between Bitcoin (BTC) and Ethereum (ETH), underscoring shifting market dynamics that could define the next phase of capital flows in digital assets .

According to CryptoQuant, Bitcoin’s exchange reserves remain steady at around 2.53 million BTC, showing little movement despite recent price swings. Historically, declining reserves suggest coins are leaving exchanges for long-term custody, reducing immediate sell pressure. This time, reserves are flat, signaling that a significant portion of supply remains liquid and potentially available for selling.

The trend coincides with BTC’s recent pullback from $123,000 to $113,000, raising the risk of a short-term correction. Analysts note that sustained elevated reserves often precede profit-taking, particularly during volatile market phases.

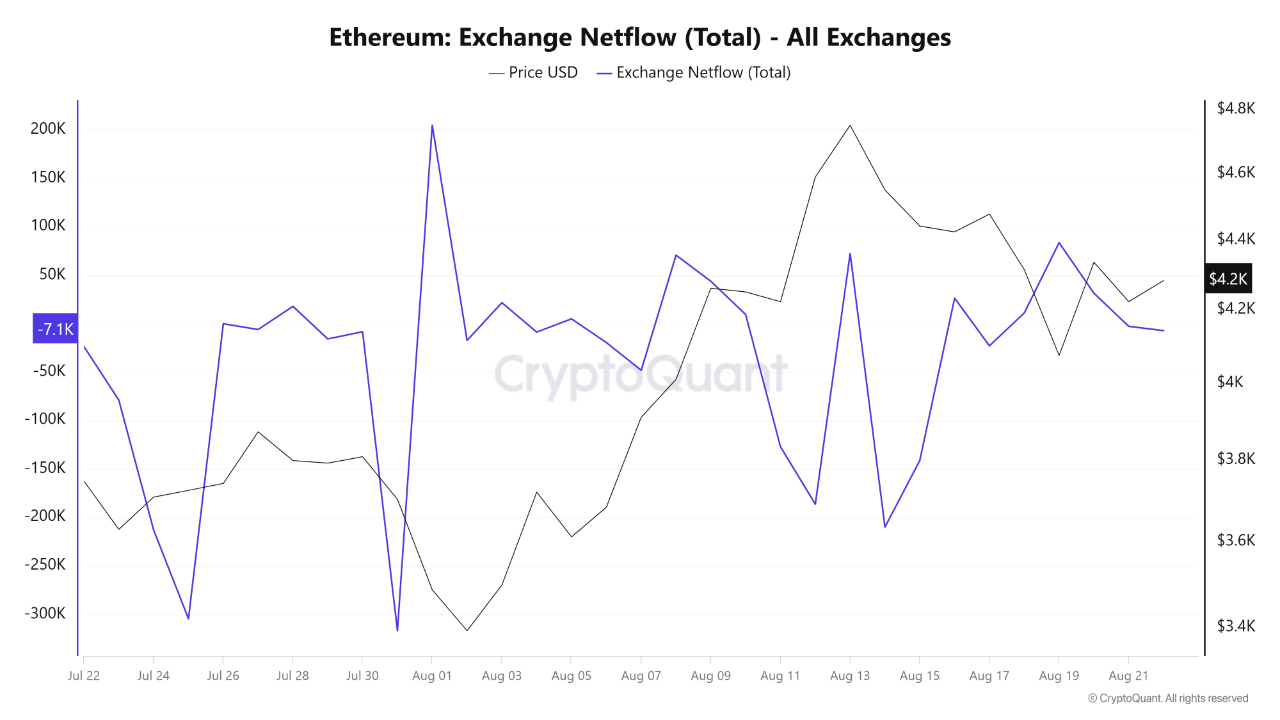

In contrast, Ethereum has recorded consistent net outflows from exchanges, with notable spikes of more than 300,000 ETH in late July and mid-August. These movements typically reflect coins being transferred into cold storage, staking pools, or institutional custody, reducing liquid supply.

Source:

CryptoQuant

Source:

CryptoQuant

ETH has traded between $4,150 and $4,400 in recent sessions, with its price action closely aligned to the outflow trend. The tightening of exchange balances supports a bullish narrative and points to growing institutional demand, with Ethereum increasingly positioned as a long-term asset.

The contrasting flows highlight a broader rotation of capital. While BTC consolidates with neutral-to-cautious signals, ETH appears to be gaining momentum from reduced sell-side pressure and expanding adoption.

For investors, the takeaway is clear: Bitcoin faces near-term correction risks if reserves remain elevated, while Ethereum shows stronger prospects for medium-term growth, supported by shrinking liquid supply and long-term positioning.

However, Bitcoin may be regaining ground technically. According to CryptoQuant contributor İbrahim Coşar, BTC has reclaimed its 50-day exponential moving average (EMA), a level that has historically marked the start of short-term rallies. If sustained, this could provide bullish momentum to counterbalance the current reserve-driven caution.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

As economic fissures deepen, Bitcoin may become the next "pressure relief valve" for liquidity

Cryptocurrency is one of the few areas where value can be held and transferred without relying on banks or governments.

Why do 90% of project TGEs end in disappointment?

Doing these things is the prerequisite for a successful TGE.

ETH volatility surges: On-chain liquidity and leverage risks trigger market turbulence

Bitcoin hits 6-month low as AI fears add to risk-off mood: How are pro traders positioned?