Solana’s proprietary AMMs are reshaping liquid asset markets for users

Prop AMMs like SolFi, HumidFi and Obric are taking over liquid capital markets

This is a segment from the Lightspeed newsletter. To read full editions, subscribe .

When one thinks of DeFi’s greatest innovations, automated market makers (AMMs) come to mind.

Popularized by early OG teams like Bancor and Uniswap in 2018, AMMs enabled permissionless liquidity provision without the need for professional market makers to manage an order book.

This permissionless structure has immense benefits for bootstrapping markets around illiquid tokens, but it comes with many well-known tradeoffs.

Since liquidity positions and execution is public, LPs are vulnerable to MEV attacks, manifesting in price impact and slippage problems for the end-user.

Protocol designers have tried to tackle these problems in a variety of ways over the years (e.g. Uniswap v3’s concentrated liquidity or dark pools). Others such as Hyperliquid have simply opted for the reliability of the central limit order book (CLOB) design.

In recent months, a wave of new AMM DEXs on Solana has been charting its own path to address these issues.

These DEXs are popularly referred to as prop (short for proprietary) AMMs, or dark AMMs; they include players like HumidFi, SolFi, Tessera, ZeroFi, GoonFi and Obric.

You’ve probably never heard these names, and that’s by design.

Prop AMMs do not use a frontend. They quote prices privately and rely on vault-based liquidity supplied by one proprietary market maker as opposed to external liquidity pools.

By centralizing liquidity provision in the hands of a few, this design choice enables prop AMMs to protect order flow execution from MEV attacks by high-frequency traders that public AMMs are susceptible to.

How then do prop AMMs find users? They simply plug into a DEX aggregator — such as Jupiter or Titan — on the backend, which allows the aggregator to query across DEXs for the best price quotes.

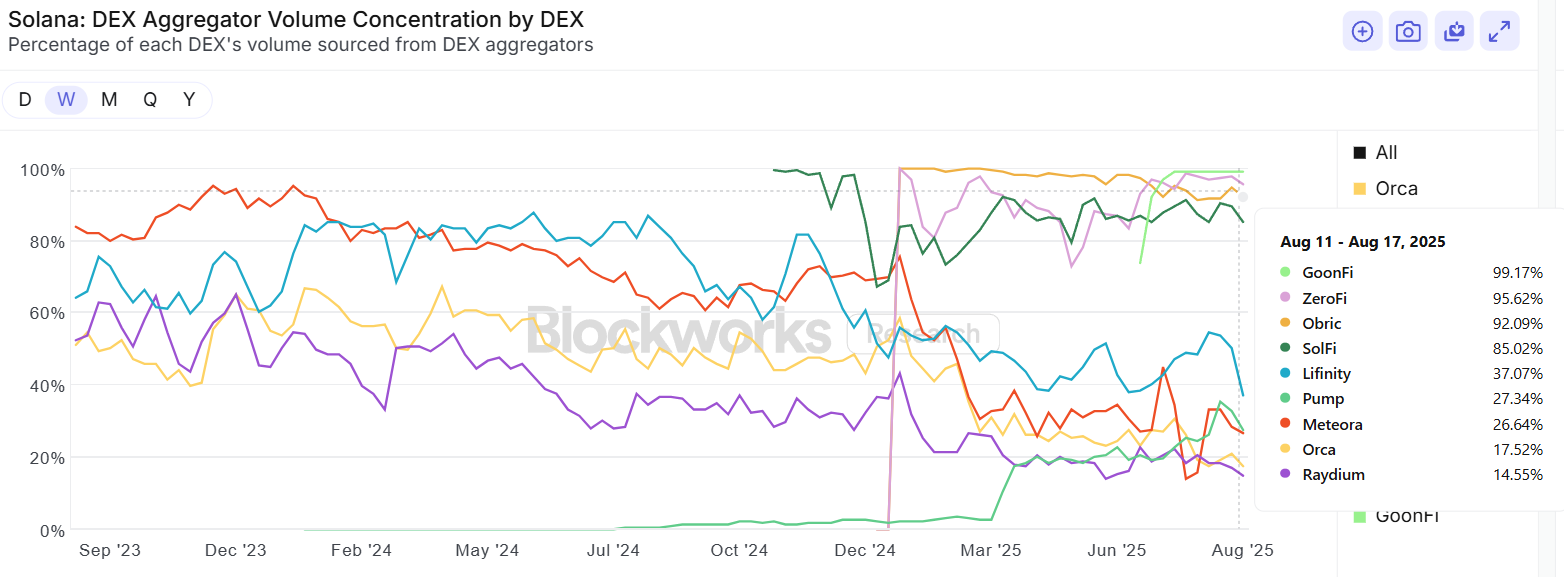

Almost all of prop AMMs’ volumes are routed from DEX aggregators, as per the below chart.

Chris Chung, CEO and co-founder of Titan told me: “Initially, when prop AMMs first launched, you had to be integrated with all of them to even stand a chance of finding the best route due to their dominance. The first three (SolFi, ZeroFi and Obric) had a stranglehold over the market, but standard onchain AMMs could still compete.

“With the influx of many new prop AMMs, the market share of prop AMMs has continued to keep going up, but each successive one has seen less of an impact on a router’s success vs. its peers.”

Prop AMM dominance

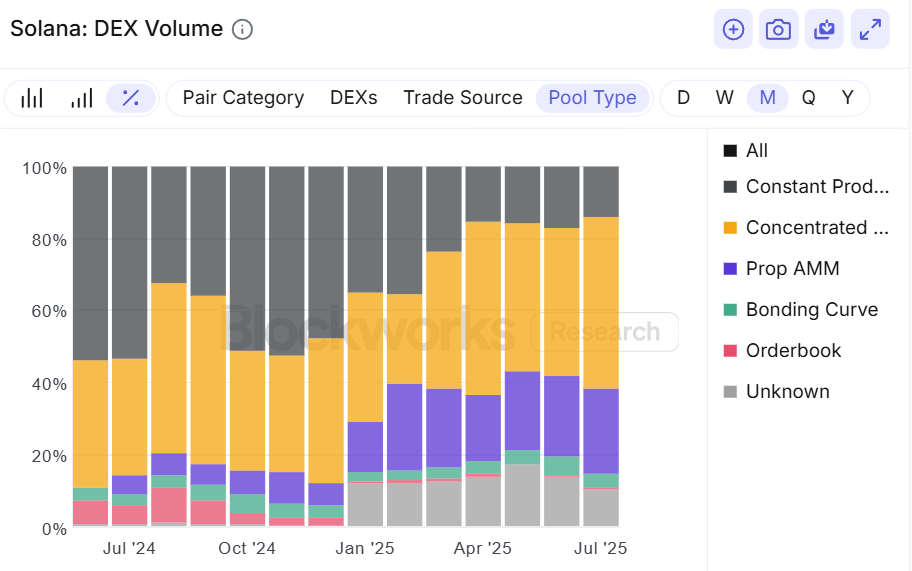

Since January 2025, prop AMM volumes have consistently made up about 13% to 24% of monthly DEX volumes.

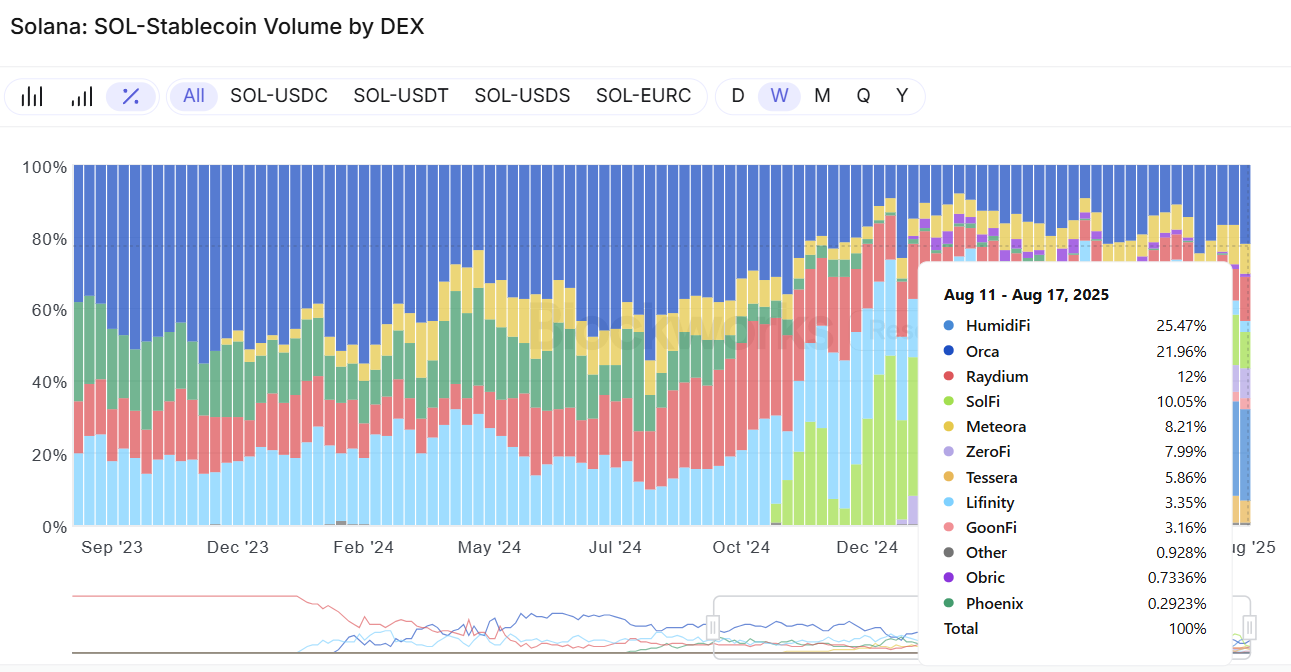

Isolating volumes data down to highly liquid trading pairs, like SOL-stablecoin, brings the growing usage of prop AMMs into clearer view.

For SOL-stablecoin volumes in the last week, prop AMMs are collectively processing ~53% ($7.42 billion) of all DEX volumes, per Blockworks Research data.

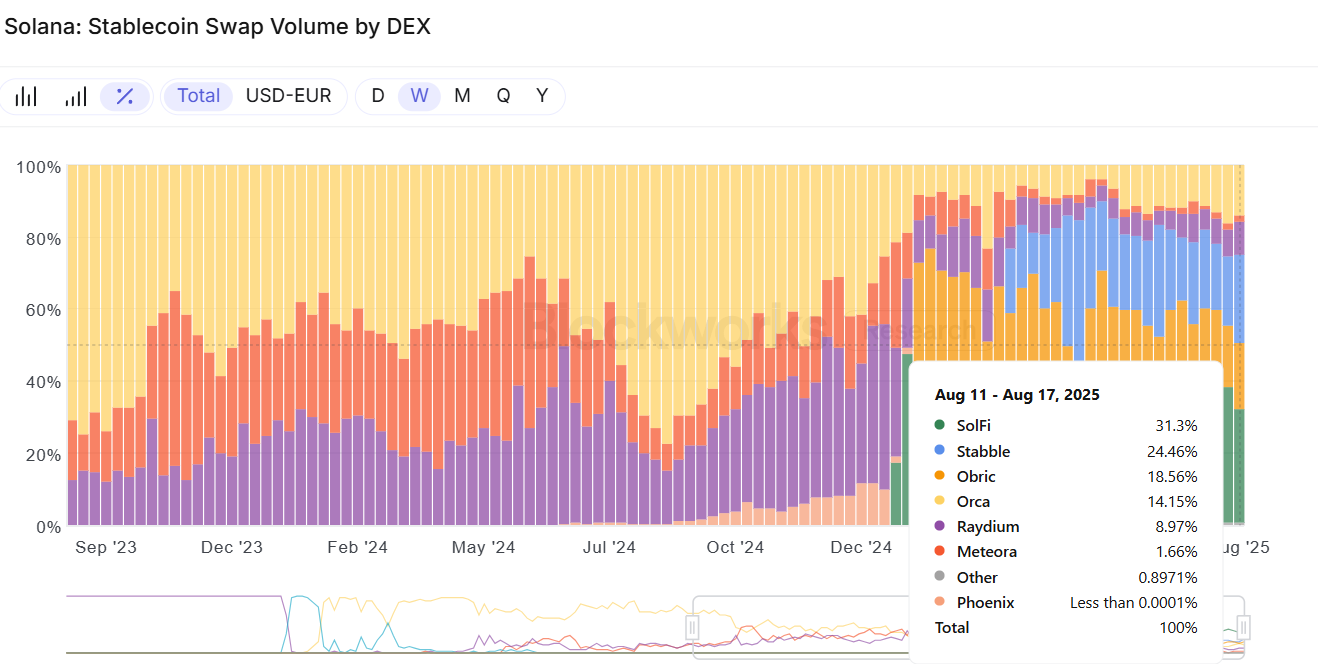

Blockworks Research data shows a similar story emerges on stablecoin pairs — SolFi and Obric together captured ~50% of the $1.1 billion in trading volumes over the last week.

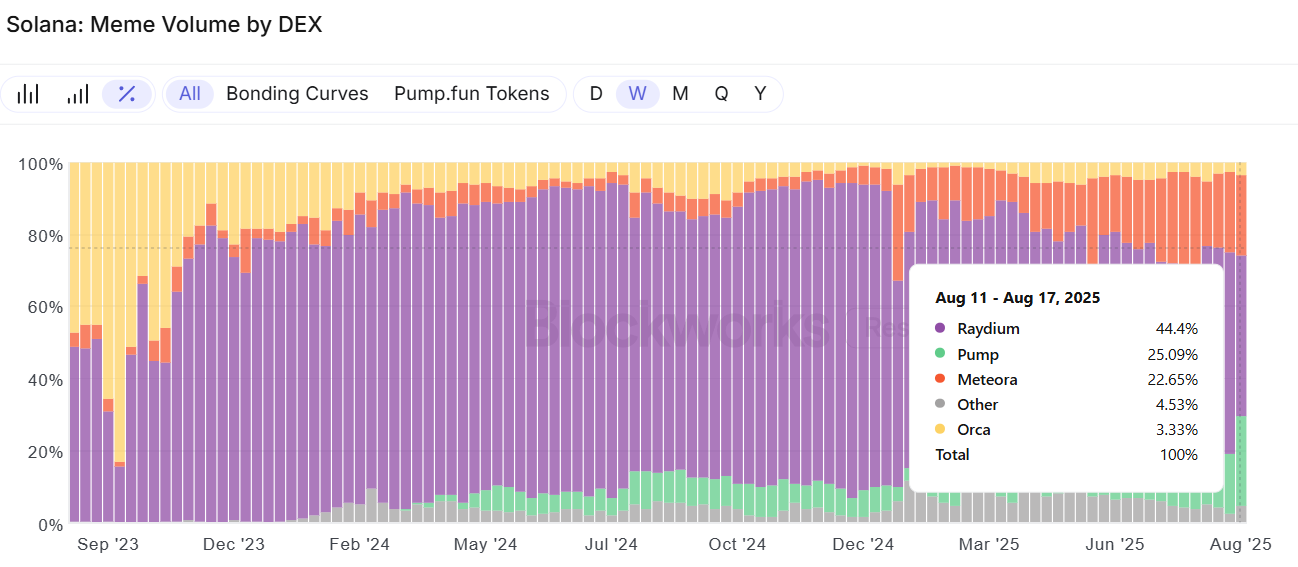

And as expected, illiquid assets like memecoins are still traded on traditional AMMs (there’s a caveat, though: larger memecoins like POPCAT and FARTCOIN are showing up on prop AMM routes).

Blockworks’ Carlos Gonzalez Campo predicts that tokens will increasingly bifurcate into traditional AMMs vs. prop AMMs based on asset maturity:

“On the one hand, long-tail assets (e.g. new memecoins) will be dominated by traditional AMMs like Raydium and Pump. On the other hand, it appears that prop AMMs like HumidiFi and SolFi will gradually dominate liquid markets (e.g. SOL-USD, stable-to-stable pairs).”

It looks like traditional AMMs will continue to power long-tail speculation and early price discovery as long as there’s demand to gamble on illiquid memecoins.

But for mature assets, liquidity is consolidating around AMMs that deliver tighter spreads and more predictable execution. The dominance of aggregators on Solana is steering its market structure toward a more efficient equilibrium where ideology matters less than fill quality.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown : Decoding crypto and the markets. Daily.

- 0xResearch : Alpha in your inbox. Think like an analyst.

- Empire : Crypto news and analysis to start your day.

- Forward Guidance : The intersection of crypto, macro and policy.

- The Drop : Apps, games, memes and more.

- Lightspeed : All things Solana.

- Supply Shock : Bitcoin, bitcoin, bitcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"I'm panicking, what happened?" Cloudflare outage causes global internet chaos

The incident once again highlights the global internet's heavy reliance on a few key infrastructure providers.

Mars Morning News | Starting this Thursday, the United States will fill in missing employment data and release a new batch of economic data

The United States will fill in missing employment data and release new economic data. The Coinbase CEO is looking forward to progress in crypto regulatory legislation. Market participants predict the market is nearing a bottom. Phantom has launched a professional trading platform. Trump hints that the candidate for Federal Reserve Chair has been decided. Summary generated by Mars AI This summary was generated by the Mars AI model, which is still being iteratively updated for accuracy and completeness.

Countdown to a comeback! The yen may become the best-performing currency next year, with gold and the US dollar close behind

A Bank of America survey shows that more than 30% of global fund managers are bullish on the yen's performance next year, with undervalued valuations and potential central bank intervention possibly paving the way for its rebound.