Bitcoin’s realized cap has reached a record $1 trillion, signalling growing investor conviction in BTC. With nearly $2 billion in short positions vulnerable near the $120K level, a short squeeze could rapidly accelerate any upward move, turning calm trading into sharp volatility.

-

Record realized cap: $1 trillion confirms inflows and longer-term holdings.

-

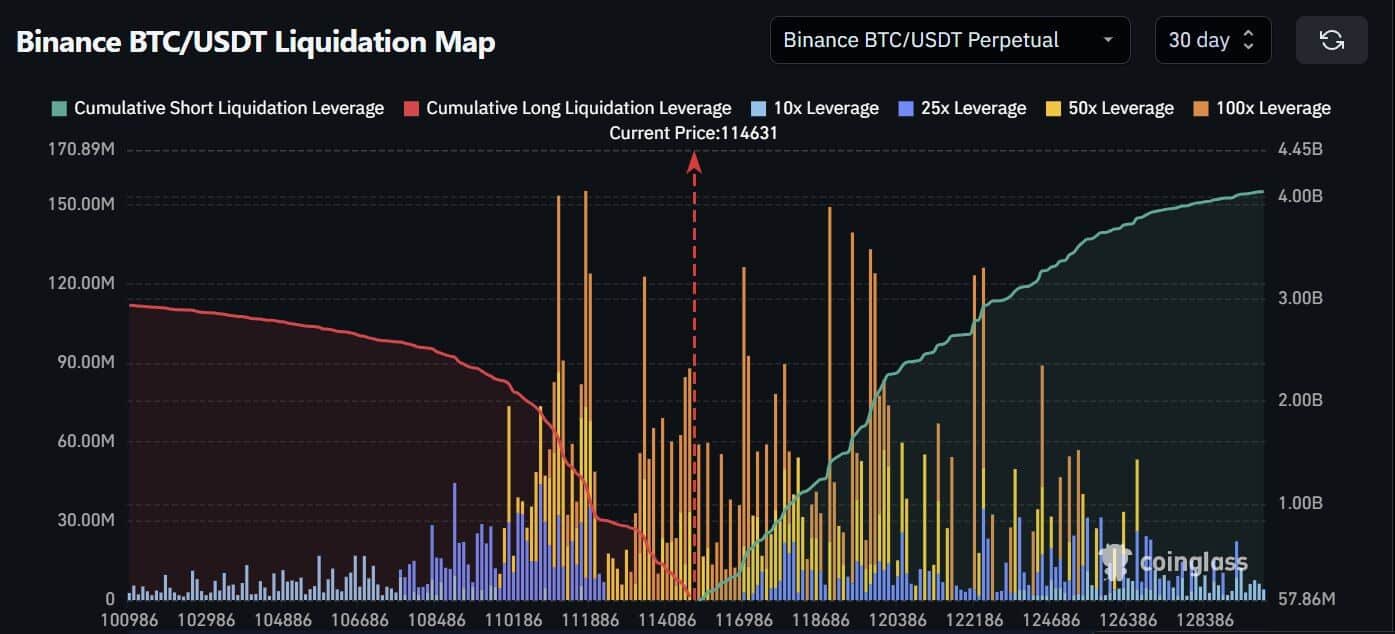

Nearly $2 billion in shorts sit near $120K, creating a high-risk liquidation zone.

-

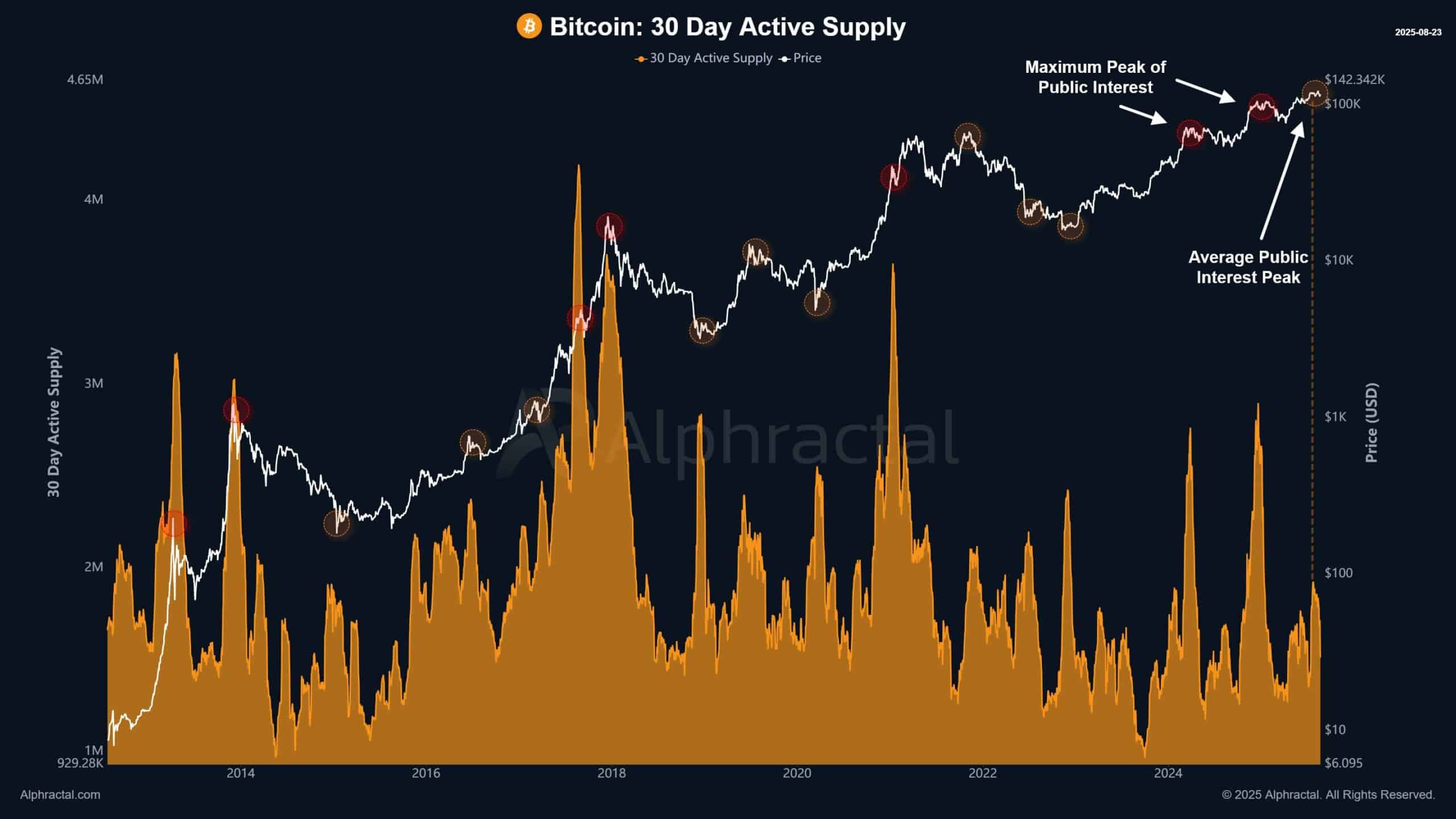

Active supply has cooled, historically preceding sudden volatility and potential rallies.

Meta description: Bitcoin realized cap hits $1 trillion; prepare for a potential short squeeze as $2B in shorts could fuel a rapid BTC rally — read analysis and takeaways.

What is Bitcoin’s realized cap milestone?

Bitcoin’s realized cap is a market valuation metric that sums BTC value at the price when each coin last moved; it just hit $1 trillion, showing significant capital locked into long-term holdings. This milestone suggests increased investor confidence and deeper market participation at higher valuations.

How could $2 billion in short positions influence Bitcoin’s next move?

Nearly $2 billion of short exposure concentrated near $120K creates a liquidation risk. If BTC approaches that level, forced buy-ins could trigger a short squeeze, rapidly compressing supply and amplifying price moves. Historical patterns show large clustered liquidations often precede sharp rallies.

Key takeaways

Bitcoin’s realized cap has hit a record $1 trillion, while billions in short positions could trigger a sharp rally if BTC climbs toward $120K.

Bitcoin’s market state: The market is in a quieter phase after intense trading, but underlying indicators point to latent volatility.

Realized cap significance: The $1 trillion mark reflects capital locked into the network at elevated prices, which can withstand routine drawdowns and supports upside resilience.

Why is the realized cap milestone important?

The realized cap measures the aggregate price paid for coins when they last moved, offering a clearer view of investor cost basis than market cap. A higher realized cap suggests that a larger share of the supply is held by investors who paid more, reducing the pool of readily sellable, low-cost supply and potentially cushioning dips.

Active supply cools

After several weeks of heavy rotation, active supply has eased. Historically, such cooldowns can reset the market and set up sharp directional moves when new catalysts arrive.

Source: Alphractal

Periods of low on-chain and trading activity often precede volatile breakouts because market participants digest previous moves before positioning anew. The current cooldown suggests the market is consolidating gains ahead of potential trend continuation.

Billions on the line: short exposure near $120K

Derivatives data shows nearly $2 billion of short positions clustered in higher price bands. If BTC advances toward $120K, cascading liquidations could force rapid buys, producing an amplified upward move well beyond the initial catalyst.

Source: X

Historical precedents show that clustered liquidations fuel short-term rallies. Market participants should note that concentrated leverage near psychological price points often determines the speed and magnitude of breakouts.

Frequently Asked Questions

How reliable is realized cap as a market signal?

Realized cap is a reliable indicator of investor cost basis and long-term accumulation, but it should be used with on-chain activity and derivatives data for a complete view.

What triggers a short squeeze in Bitcoin?

A short squeeze occurs when rising prices force leveraged short positions to close, creating urgent buy orders that rapidly push prices higher and intensify volatility.

Summary table: Key metrics

| Realized cap | $1 trillion | Higher accumulation and investor conviction |

| Short exposure near $120K | ~$2 billion | High liquidation risk if price advances |

| Active supply | Cooling | Potential for faster moves when momentum returns |

Key Takeaways

- Realized cap milestone: Confirms strong accumulation and deeper investor conviction.

- Short liquidation risk: Concentrated shorts near $120K could catalyze a rapid rally if tested.

- Market posture: Cooling activity often precedes volatile breakouts; monitor on-chain and derivatives signals closely.

Conclusion

Bitcoin’s $1 trillion realized cap and clustered short exposure create a market environment where a measured advance could quickly morph into a decisive breakout. Investors and traders should monitor realized cap trends, on-chain transfer volumes, and derivatives open interest to assess risk and opportunity as the market evolves. COINOTAG will continue to track developments and provide timely updates.