Date: Mon, Aug 25, 2025 | 08:20 AM GMT

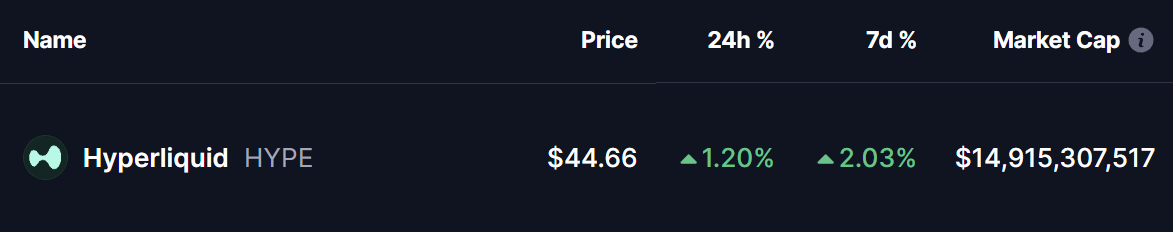

The cryptocurrency market is giving back its initial gains that came after Jerome Powell hinted at potential rate cuts in September during today’s Jackson Hole event. Bitcoin (BTC) retraced to $111K from its 24-hour high of $115K, while Ethereum (ETH) dipped 4% today, adding downside pressure on major altcoins. However, Hyperliquid (HYPE) managed to stay in the green, supported by strong metrics growth.

Source: Coinmarketcap

Source: Coinmarketcap

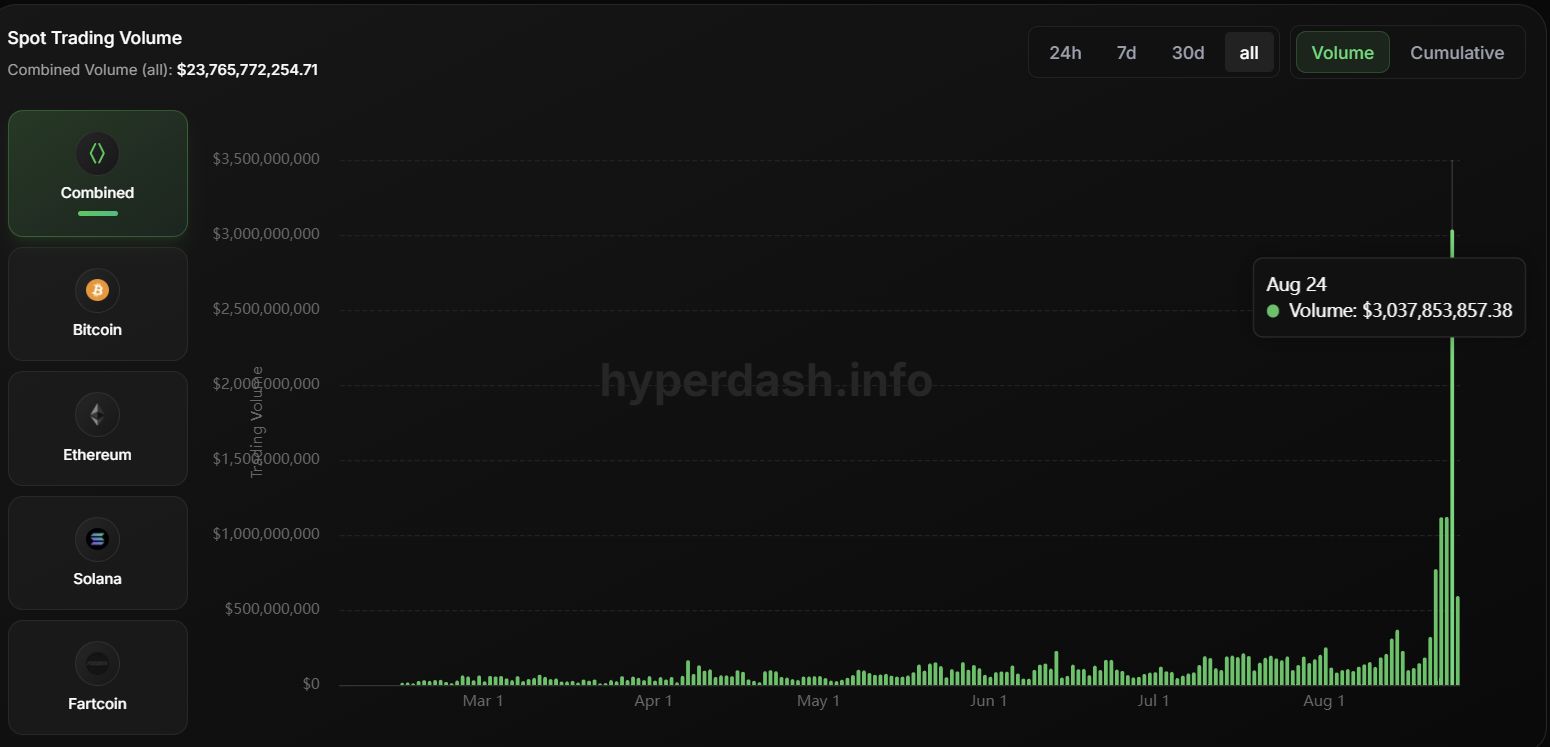

Earlier, with bullish sentiment building, investors appeared to increase deposits and trading activity on Hyperliquid. As a result, the platform’s key performance indicators have seen a significant surge.

According to live data, Hyperliquid’s spot volume hit a new 24-hour all-time high (ATH) of $3 billion. This surge was driven mainly by increased deposits of BTC and ETH, along with higher spot trading activity, largely facilitated by @hyperunit.

Hyperliquid Spot Volume/Source: hyperdash

Hyperliquid Spot Volume/Source: hyperdash

Notably, this makes Hyperliquid the second-largest venue for trading spot BTC across both centralized and decentralized exchanges, recording an impressive $1.5 billion in 24-hour BTC volume alone.

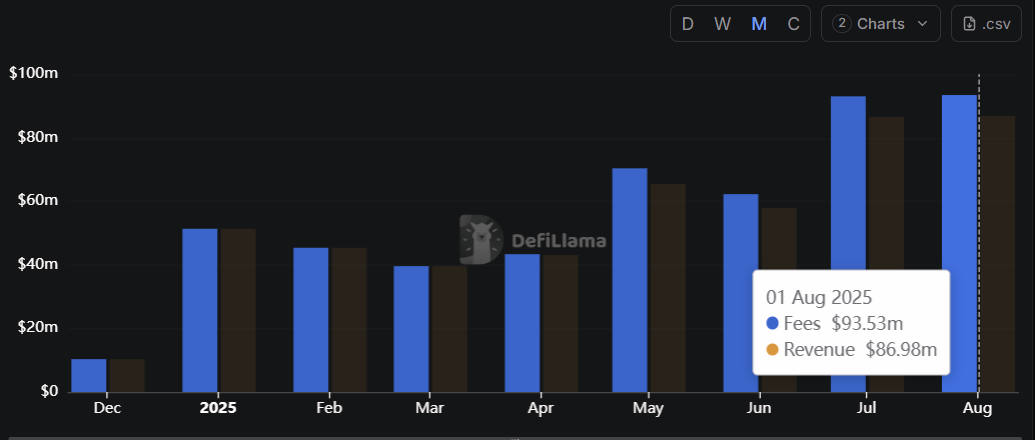

Beyond trading volumes, Hyperliquid has also set new records in fees and revenue this month. The exchange generated $93.53 million in fees and $86.98 million in revenue, marking its strongest month yet.

Hyperliquid Fees and Revenue/Source: defillama

Hyperliquid Fees and Revenue/Source: defillama

With trading volumes soaring and revenue climbing to new highs, Hyperliquid is positioning itself as one of the fastest-growing players in the crypto exchange ecosystem, even during a market pullback.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.