SBI Partners with Chainlink to Drive Tokenization in Japan

- SBI Holdings partners with Chainlink for tokenization drive.

- 76% of Japanese banks expected to invest.

- Agreement aims to enhance financial asset tokenization.

SBI Holdings has partnered with Chainlink to foster the adoption of tokenized securities in Japan, targeting institutional integration with 76% of local banks expressing investment interest according to a recent survey.

The partnership could significantly impact Japan’s $16 trillion RWA tokenization sector, potentially increasing liquidity and reducing settlement times, despite initial negative market reactions like LINK’s 6% price drop.

The partnership between SBI Holdings and Chainlink seeks to expand the adoption of tokenized securities and stablecoins in Japan. This alliance leverages Chainlink’s interoperability and verification protocols to influence Japan’s financial landscape significantly.

SBI Holdings, Japan’s prominent financial conglomerate, in collaboration with Chainlink, announced a strategic initiative to enhance tokenization technologies. 76% of surveyed Japanese banks have expressed interest in investing in these technologies.

This initiative could reshape Japan’s financial market, impacting the adoption of tokenized assets and stablecoins. Anticipated improvements include enhanced liquidity, more efficient settlement procedures, and increased compliance with regulatory standards to support the financial ecosystem.

Financial implications are noteworthy, with the potential for reduced transaction times and increased market liquidity. Regulatory support from Japan’s Financial Services Agency is crucial for the integration of new technologies in the banking sector.

Technological Infrastructure and Cross-Border Potential

Chainlink’s technological infrastructure will empower cross-chain applications, crucial for enabling cross-border financial transactions. This move aligns with the broader trend of blockchain integration in traditional finance, promising significant market advancements.

Insights suggest the potential for extensive adoption of tokenized financial assets. The strategic usage of Chainlink’s protocols could bring about increased transparency and accountability, crucial for gaining regulatory compliance in Japan’s financial sector.

Industry Leaders’ Perspectives

“We have been building very advanced fund tokenisation and stablecoin DvP use cases with SBI for a while now, and I am excited to see our great work move towards a state of production usage at a large scale.” – Sergey Nazarov, Co-Founder, Chainlink

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin futures demand rises even as BTC sells off: What gives?

Bitget Debuts First-Ever RWA Index Perpetuals Featuring Major Real-World Assets

Cap Labs attracts capital with EigenLayer-backed credit model

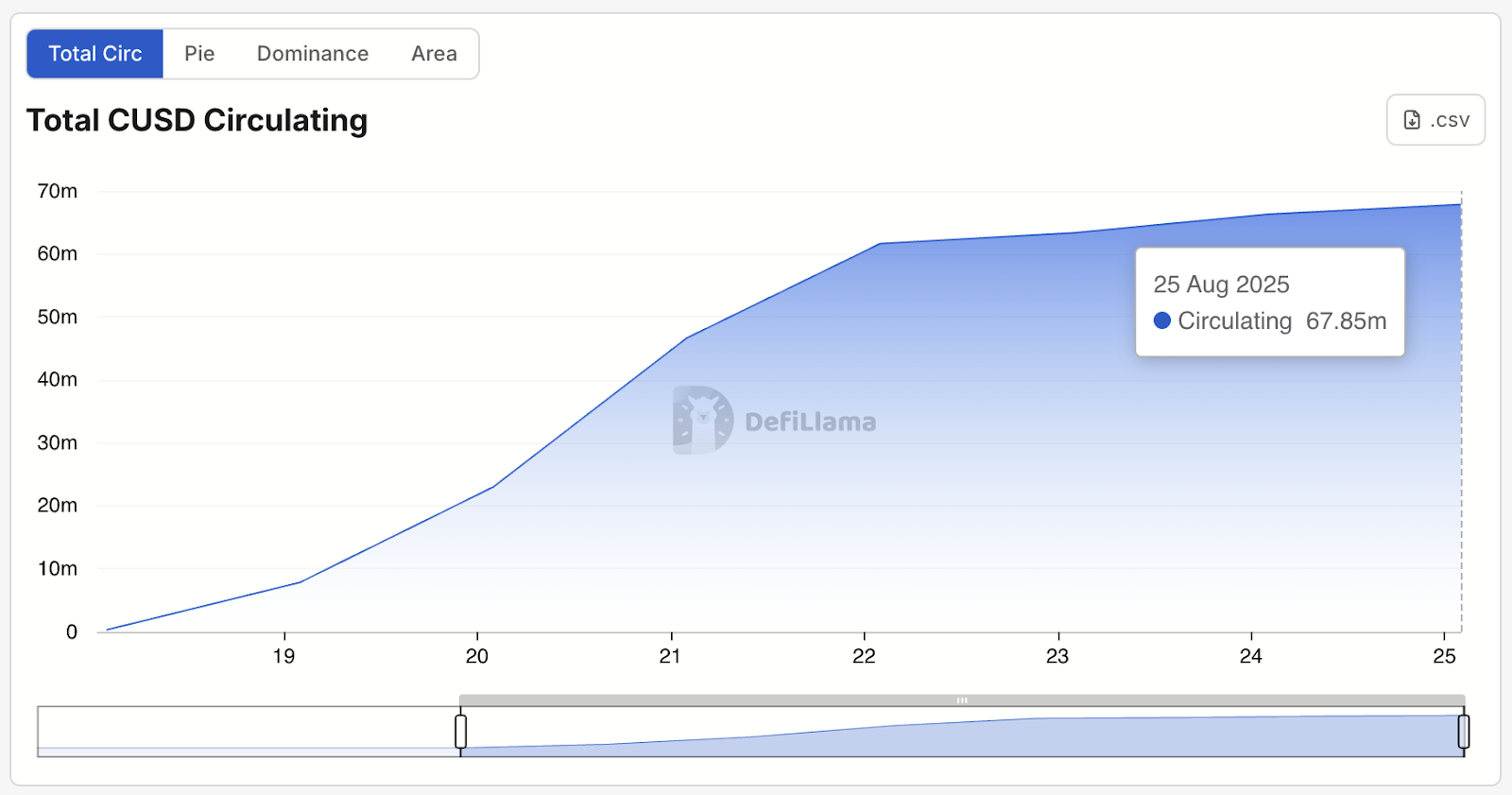

The GENIUS-compliant cUSD stablecoin surges past $67M in one week

Metaplanet Acquires 103 BTC, Strengthening Treasury Position