Institutional Investors Power Crypto ETF Outflows as ETH Takes the Spotlight

Crypto ETFs faced significant outflows, with Ethereum's rise outpacing Bitcoin. Institutional investors are key, but market volatility makes future trends uncertain.

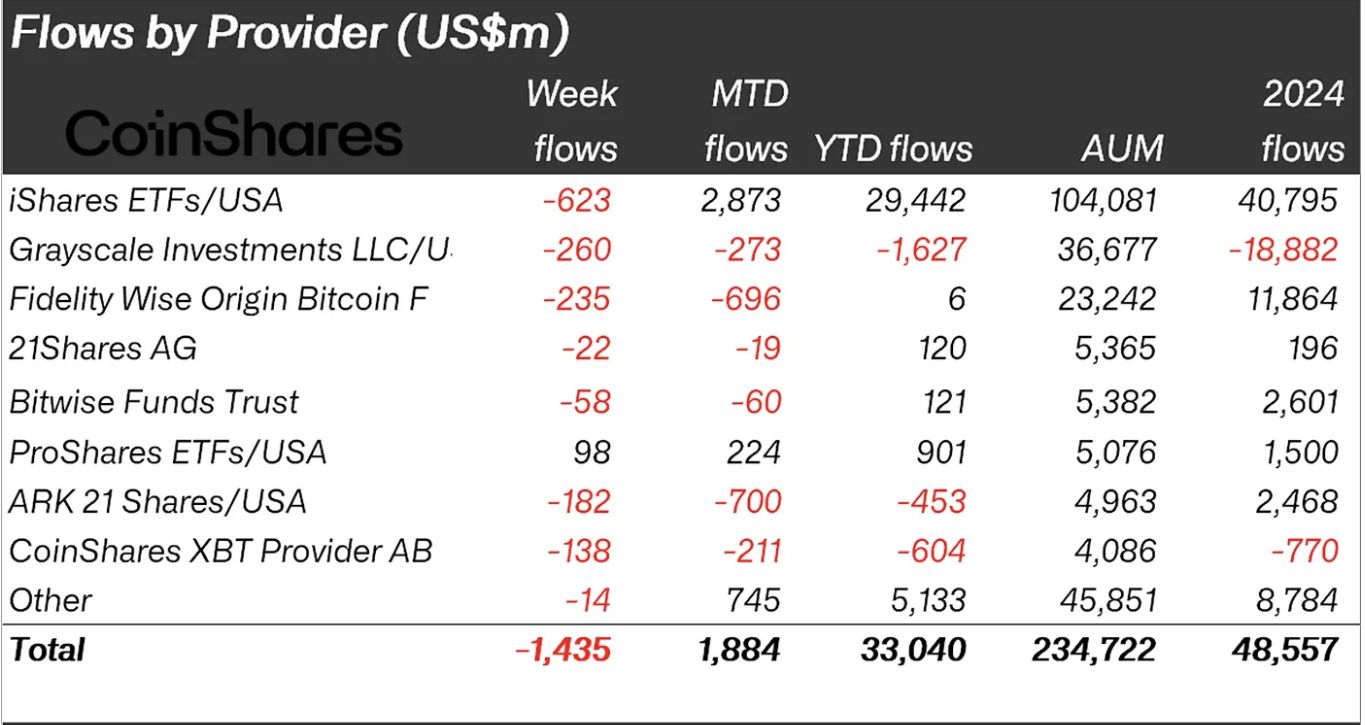

CoinShares released a report on weekly digital asset investment, analyzing the intense outflows across the crypto ETF market. In total, crypto investment products saw $1.43 billion in outflows in the last week.

Diminished hopes of lowered interest rates powered a lot of this pessimism, but there’s been something of a comeback. Still, the situation is volatile, and it’s unclear what will happen next.

Crypto ETF Outflows Last Week

Crypto ETF investment took the world by storm since early 2024, but a recent pattern of outflows has been making investors nervous. Shortly after ETH ETF inflows surpassed Bitcoin, the whole asset category began posting heavy losses.

CoinShares released a report on this trend to better analyze it:

Crypto ETF Outflows. Source:

CoinShares

Crypto ETF Outflows. Source:

CoinShares

Essentially, the report posits that bearish hopes for a US interest rate cut spurred these ETF outflows, and Jerome Powell’s unexpected reconciliation efforts during his Jackson Hole speech blunted some of the hostile momentum. Closer analysis of each of the leading funds and tokens provides helpful clues.

The Importance of Institutional Investors

For example, Ethereum was more sensitive than Bitcoin to these swings, reflecting its status as a hot commodity among institutional investors.

Throughout August 2025, ETH inflows exceeded BTC’s by $1.5 billion, a truly unexpected turnaround. In other words, the new investment narratives for Ethereum are having a real impact.

Presently, it seems that institutional investors are the primary market mover here. Independent data from other ETF analysts supports this hypothesis:

WHO Owns the spot Bitcoin ETFs??? I wrote about this last week but 'Advisors' are by far the biggest holders now. Pretty much every category we track on Bloomberg increased their Bitcoin ETF exposure over 2Q pic.twitter.com/piUlS73jAv

— James Seyffart (@JSeyff) August 25, 2025

CoinShares looked at all digital asset fund investments, not just ETFs, so its outflow data has a few interesting tidbits.

For example, XRP and Solana performed better than Bitcoin and Ethereum in this sector, but their relevant ETFs haven’t won approval.

In other words, digital asset treasury (DAT) investment may make up some of this total.

To be clear, though, this sector is also particularly vulnerable to macroeconomic factors.

Despite huge DAT inflows this month, investor misgivings and stock dilution concerns have caused significant problems for several major firms. Even Strategy, a clear market leader, has faced a few key warning signals.

All that is to say, the current situation is rather volatile.

It’s difficult to extrapolate this data to make a future prediction, but one thing seems clear. Ethereum’s new prominence is very visible, and it could have huge implications for altcoins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TheoriqAI Partners with OpenLedger to Build Accountable, Production-Ready DeFi AI Agents

Betting Shares Decline While NFL Prediction Wagers Rise on Gambling Platforms

Sui Blockchain’s Revolutionary Partnership with LINQ Transforms Crypto Access in Nigeria