Crypto Adoption Breaks Out of the Gen Z Chain

Crypto adoption in the US is rising among those over 40, motivated by retirement savings and inflation hedging, despite challenges with platform complexity.

According to new research, crypto adoption in the US seems to be growing among older generations. Rates of crypto education and ownership in the over-40 demographic are rising steadily.

Retirement savings and hedging against inflation are this cohort’s biggest concerns, while platform complexity is their biggest barrier to entry. Crypto Schools exclusively shared this survey data with BeInCrypto.

Older Generation Is Getting Into Crypto

Crypto adoption is a clear and pressing concern for this industry, and Millennials have been the vanguard for several years at this point, with ongoing levels of interest. Gen Z (Zoomer) crypto adoption is also fairly high, but a new study shows that older generations may now be leading the charge.

Crypto Schools just released its data on Web3 adoption by generation, revealing a few useful insights. It claims that 28% of new crypto learners were older than 40 last year, while this number was only 19% in 2023.

Additionally, this same demographic was 6% more likely to actually complete courses than younger users.

“These statistics clearly show a significant shift in who’s engaging with cryptocurrency. While younger generations were early adopters, we’re now seeing a surge of interest from those over 40 who recognise the potential benefits for their financial futures,” claimed Ran Neuner, CEO of Crypto Schools.

Retirement planning has spurred crypto adoption for several years now, and this is a particular topic of interest for older generations.

39% of over-40 new learners listed this as their primary motivation to gain more knowledge, and using crypto to hedge against inflation was also very popular.

Possible Caveats and Opportunities

To be fair, though, this adoption by generation data comes from Crypto Schools’ own enrollment statistics. These over-40 students listed the complexity of platforms as their biggest barrier to entry.

Meanwhile, other studies show that Zoomers use advanced trading tools and other such platforms at a heightened rate, so they may not need this in-depth tutelage.

Luckily, Crypto Schools also included some data that isn’t platform-specific, supporting its conclusions. For example, it claimed that 37% of US crypto owners are either Gen X or Baby Boomers, compared to 13% in other countries.

In the US, crypto adoption in older generations outpaces the global standard.

If accurate and representative, this data could have some interesting implications for the market. President Trump’s plan to put crypto in pensions and 401(k)s has already excited investors, potentially opening up new investment niches.

If older demographics keep showing interest in Web3 like this, those markets could grow much larger.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Musk and Ryanair CEO clash over cost of Starlink Wi-Fi on planes

Dollar Weakens While Yen Strengthens Following Verbal Warnings

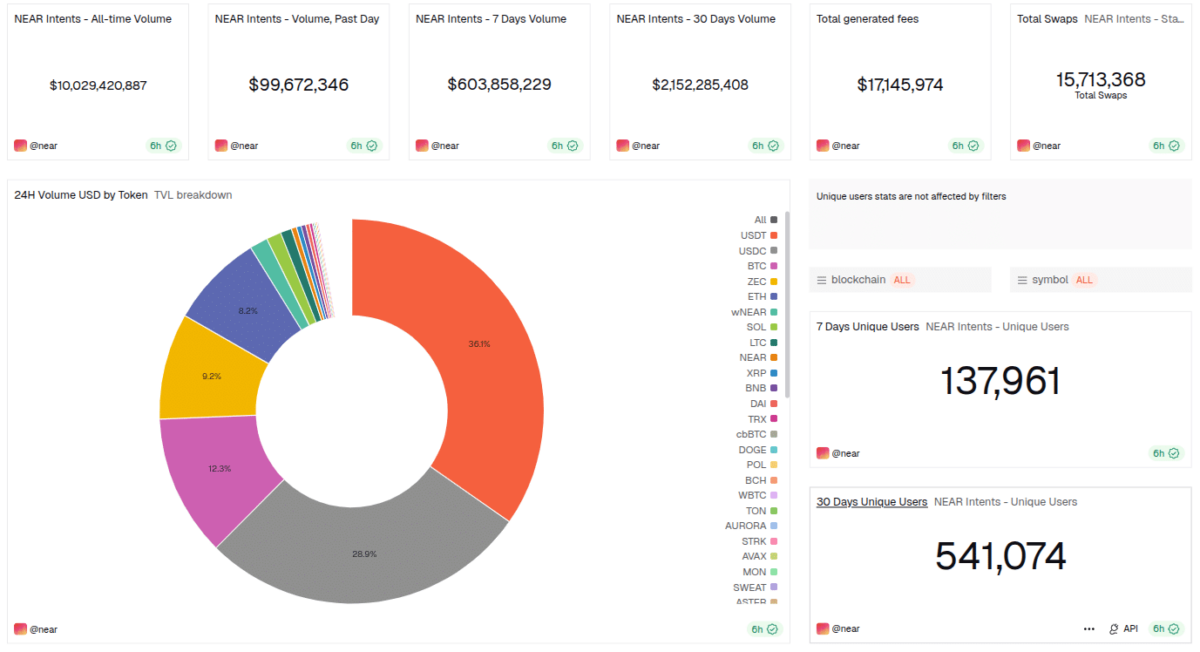

NEAR Intents Achieves $10B in Swap Volume as Industry Support, Adoption Grow

PNC Bank CEO says stablecoins must choose: be a payment tool or a money market fund