Analysis: The Federal Reserve will undergo significant "Trumpification" by 2026

Jinse Finance reported that Evercore ISI analysts Krishna Guha and Marco Casiraghi stated in a report that Trump's attempt to dismiss Federal Reserve Governor Cook could become a turning point, allowing the Fed to be gradually "reshaped" according to the president's wishes. They wrote: "We believe the current baseline scenario should be that the Fed will undergo a very significant 'Trumpification' by 2026." Although this does not necessarily mean there will be a dramatic shift in policy and practice, "we must take very seriously the possibility that this could lead to a break from past approaches and a fundamentally different reaction function." If Cook is forced to leave, the Fed's independence could be eroded, and this may "manifest as a steeper yield curve, increased inflation compensation, and a higher inflation risk premium."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

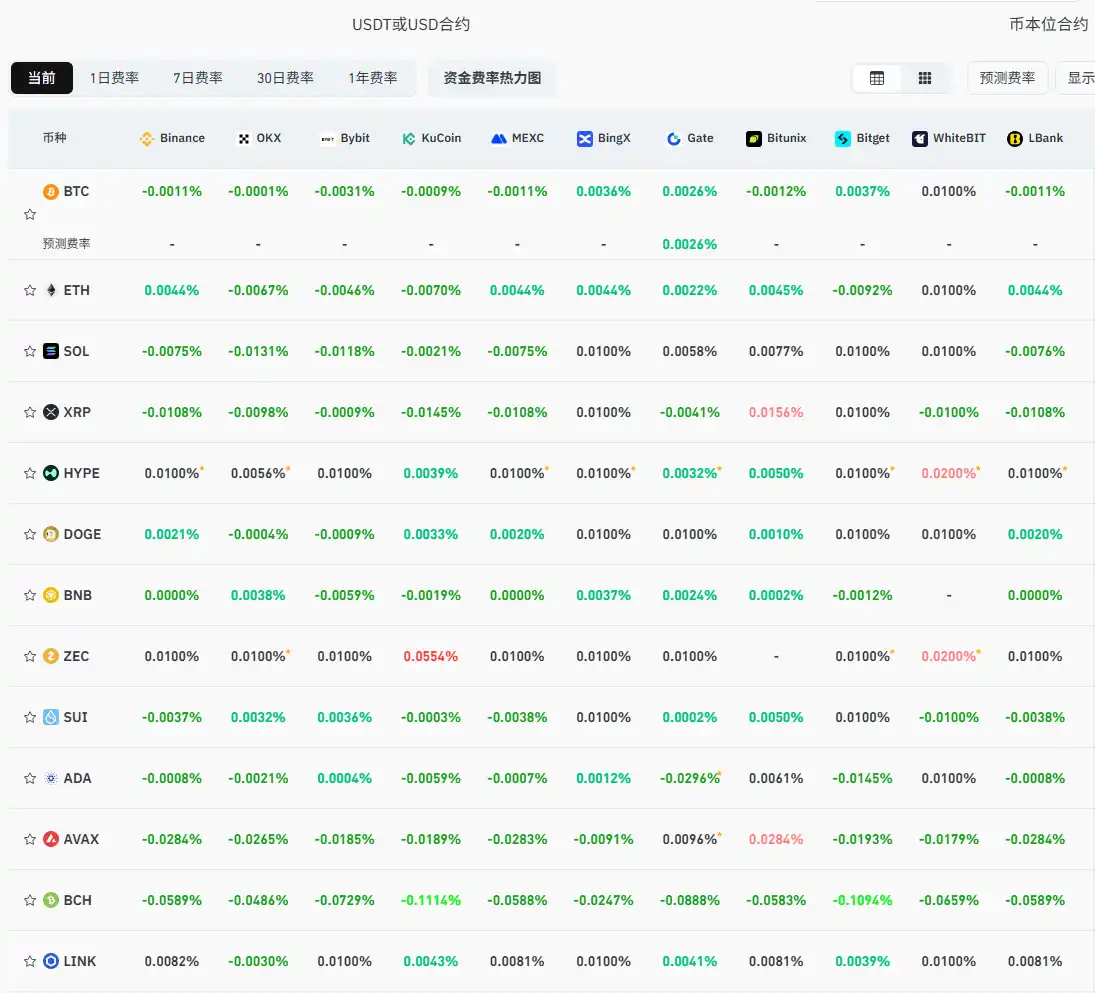

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish

The Crypto Fear Index rises to 28, escaping the "Extreme Fear" zone

Analyst: The current macro environment is similar to the pandemic period, and bitcoin still has room to rise

The Hyperliquid team wallet has unstaked 2.6 million HYPE and conducted small-scale selling and transfer tests.