- Pepe stabilized near $4.2B after an overnight drop, with strong holder support sustaining momentum despite weaker daily trading volume.

- Bonk rebounded to $1.67B following a sharp decline, reflecting resilience powered by its high circulation rate on the Solana network.

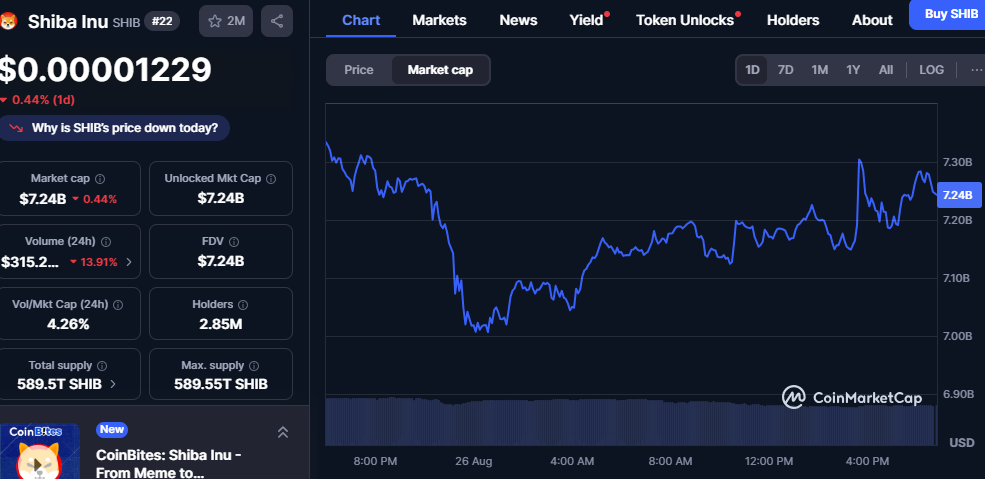

- Shiba Inu held firm at $7.24B, regaining ground after falling below $7.0B, supported by full supply circulation and strong community presence.

The meme coin market showed mixed signals as Pepe, Bonk, and Shiba Inu posted modest daily declines but quickly staged rebounds. Each token displayed resilience after sharp overnight dips, with market caps recovering to key support levels. Despite weaker trading volumes, strong community backing and high circulation rates helped maintain stability across these popular assets.

Pepe Shows Signs of Recovery

Pepe (PEPE) traded at $0.00059996 after recording a 1.91 percent daily decline, pushing its market cap to $4.2 billion. The 24-hour trading volume fell over 20 percent to $941.6 million, reflecting lower participation compared with recent activity. Despite this decline, the circulating supply remains nearly maxed at 420.68 trillion tokens, supported by more than 480,000 holders.

The market cap chart showed a sharp decline overnight before regaining stability during the day. Pepe recovered gradually and stabilized around $4.20 billion, reflecting consolidation after volatility. The token maintained its ranking among leading meme coins despite weaker momentum.

Pepe’s long-term outlook remains tied to its established community base and broad circulation. Strong holder participation has helped absorb market shocks. With supply nearly fully distributed, price movements continue to depend on volume and external sentiment.

Bonk Displays Resilience

Bonk (BONK) traded at $0.00002075, showing a 1.23 percent daily drop that reduced its market cap to $1.67 billion. The 24-hour volume slipped nearly 25 percent to $284 million, underlining weaker trading participation compared with previous sessions. Circulating supply stood at 80.83 trillion BONK out of a maximum supply of 88.87 trillion tokens.

The chart displayed an overnight fall toward $1.57 billion in market cap. However, Bonk rebounded steadily through the day and ended stronger at $1.67 billion. This recovery highlighted resilience despite overall bearish pressure.

Bonk continues to hold relevance as a Solana-based meme coin. Its relatively high circulation rate has strengthened market stability. The token’s performance reflected strong support levels, even with declining daily activity.

Shiba Inu Maintains Stability

Shiba Inu (SHIB) is currently trading at a price of $0.00001229 which represent a 0.44 percent decrease compared to the previous session and a market cap of $7.24 billion. The 24 hours trading volume of the token decreased by 13.91 percent to come to $315.2 million indicating decreasing market engagement. Circulating supply stood at 589.55 trillion SHIB, matching its total maximum supply.

On its part, the market activity registered a steep overnight decline and this has sent the market cap below 7.0 billion dollars. Nevertheless, during the day, the token gradually recovered lost positions, and it ended at $7.24 billion.This stabilization reflected consolidation after the earlier pullback.

Shiba Inu’s community-driven presence continues to support market positioning. Full supply circulation has helped maintain liquidity in trading. The token’s rebound emphasized strong support levels despite subdued momentum.