Three Steps to Control the Federal Reserve: Revealing Trump’s Clear Roadmap to Reshape the US Central Bank

U.S. President Trump has suddenly announced the removal of Federal Reserve Governor Lisa Cook, causing market turmoil. This move is seen as the first step in systematically undermining the Federal Reserve's independence, with the goal of bringing interest rate decision-making under the control of the White House by controlling the Fed's Board of Governors and the Federal Open Market Committee (FOMC). This plan could trigger legal battles and threaten the central bank's independence, leading to increased interest in decentralized assets such as bitcoin, while also heightening concerns about the stability of the traditional financial system. Summary generated by Mars AI. The accuracy and completeness of content generated by the Mars AI model is still being iteratively improved.

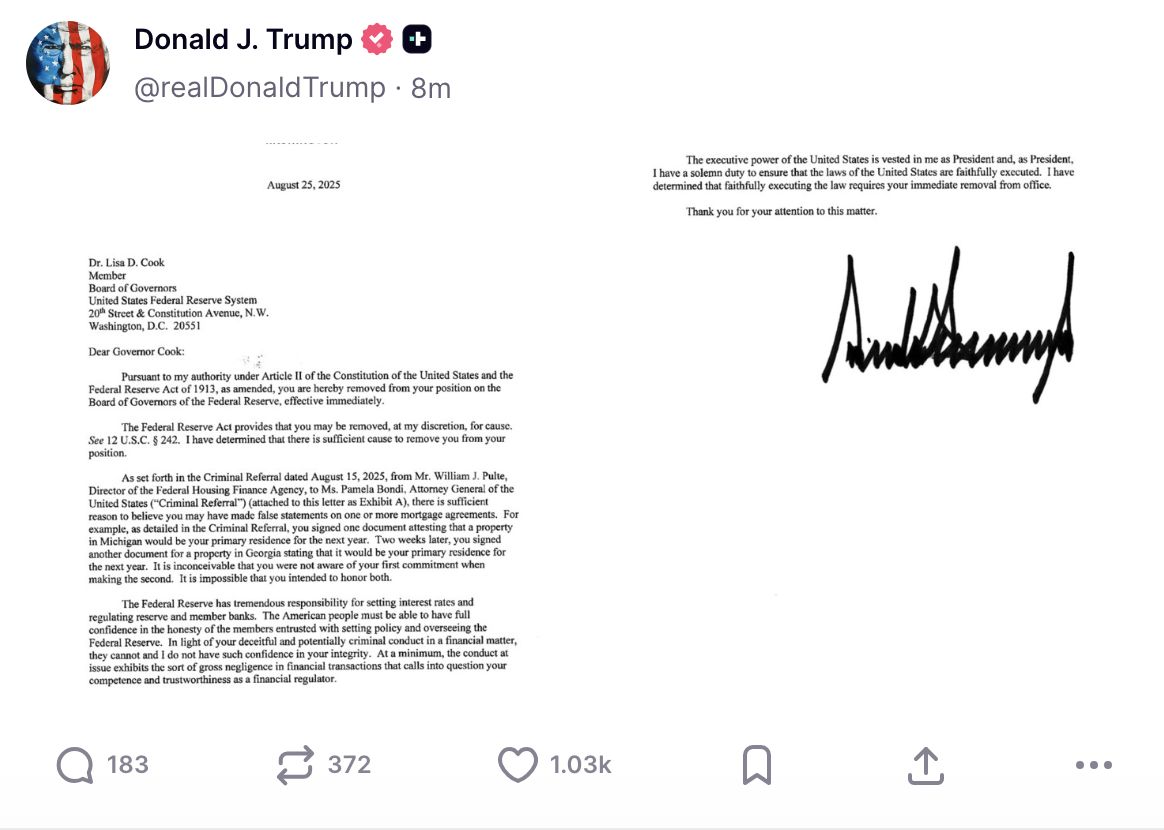

On Tuesday evening, a social media post shattered more than a century of political convention in Washington. In his characteristically dramatic fashion, U.S. President Donald Trump announced an unprecedented decision: the immediate removal of Federal Reserve Governor Lisa Cook from her position.

As the news broke, global financial markets reacted instantly. On Wall Street trading screens, U.S. stock futures turned downward, while gold, as a safe-haven asset, surged. The market's reaction was not simply to a personnel change, but stemmed from a deeper fear: this was not a spur-of-the-moment act of political retaliation, but the first step in a systematic plan to fundamentally reshape the U.S. central bank—a clear “three-step” roadmap formally set in motion.

The goal of this plan is singular: to completely dismantle the Federal Reserve’s independence and place the power to decide the dollar’s interest rates firmly in the hands of the White House.

Step One: Seize the Board—Starting with Cook’s Removal

The first and most crucial step of the plan is to secure stable majority control within the seven-member Federal Reserve Board of Governors.

The Board of Governors is the power center of the entire Federal Reserve system, and Trump’s strategy has long been underway. During his current term, he has already successfully appointed two governors. Recently, with the early resignation of Biden-appointed governor Adriana Kugler, Trump quickly nominated his economic advisor Stephen Miran to fill this third seat.

At this point, Trump is just one step away from controlling the Board. Removing Lisa Cook is precisely to free up this critical fourth seat. Once successful, Trump would be able to appoint four of his own people, thus holding a majority on the seven-member Board and, in theory, controlling all major decisions of the Federal Reserve.

Of course, this step is fraught with legal risks. Trump’s stated reason for dismissal—alleged fraud in Cook’s mortgage application prior to joining the Fed—is widely seen as a political pretext. Cook has already filed a lawsuit, and a legal battle over the ambiguous “for cause” removal clause in the Federal Reserve Act is now inevitable. This case is highly likely to reach the Supreme Court, whose ruling will define the boundaries of future presidential power in the U.S. But in Trump’s script, launching this legal battle is itself a necessary path to achieving the first step.

Step Two: Conquer the FOMC—A Fundamental Extension of Power

Once the first step is completed—controlling the Board of Governors—Trump’s plan will quickly move to the second phase: indirectly controlling the Federal Open Market Committee (FOMC), which truly determines the direction of interest rates, through the Board.

The FOMC is the world’s most closely watched decision-making body in financial markets, consisting of seven Fed governors and five regional Fed presidents, for a total of twelve voting seats. On the surface, even controlling all seven governors does not guarantee full dominance of the FOMC. However, “New Fed News Agency” and Wall Street Journal reporter Nick Timiraos have revealed Trump’s deeper strategy.

According to law, the presidents of the 12 regional Feds are appointed by their respective regional boards, but must ultimately be approved by the Washington-based Board of Governors. Timiraos points out that if Trump succeeds in controlling the Board by next March, his “majority” could refuse to reappoint regional Fed presidents whose terms expire and who are not aligned with White House policy.

This is a fundamental extension of power. By rejecting the appointments of regional Fed presidents, a Trump-controlled Board could gradually “cleanse” the FOMC of independent voices, ensuring that at interest rate decision meetings, the will of the White House prevails unimpeded. This would completely break the key firewall protecting the Fed’s independence since its founding in 1913.

Step Three: Implement New Policies—Creating a “Rate-Cut Majority”

With the power structure established in the first two steps, the final goal of the plan naturally follows: to make the Fed’s monetary policy fully serve the political agenda, creating a steadfast “rate-cut majority.”

Trump has never hidden his policy preferences. He stated bluntly in a cabinet meeting: “People are paying too much in interest rates right now. That’s our only problem.” He desires a Federal Reserve that will cut rates sharply for him, to stimulate economic growth, boost the real estate market, and create a prosperous economic backdrop for his political agenda.

A fully controlled Federal Reserve would become the president’s most powerful tool for implementing economic policy. At that point, interest rate decisions would no longer be based primarily on economic data such as inflation and employment, but would instead be more influenced by the White House’s short-term political needs.

Historical Alarms and the “Echo” in the Crypto World

The reason Trump’s interconnected plan has caused such panic is that it touches on one of the core principles of modern economics: the independence of central banks. History has repeatedly sounded the alarm—from the U.S. hyperinflation triggered by Nixon’s pressure on the Fed in the 1970s, to the currency crises in Turkey, Argentina, and other countries due to the loss of central bank independence—the lessons are painful.

And this power struggle unfolding in 2025 is causing a profound “echo” in the crypto world. Since its inception, one of bitcoin’s core narratives has been as a hedge against distrust in centralized financial systems. When Satoshi Nakamoto embedded a newspaper headline about banks on the brink of bankruptcy in the genesis block, it set the tone for resisting fragile centralized institutions.

Now, as the “guardian” of the world’s reserve currency—the Federal Reserve—faces an open challenge to its independence, bitcoin’s value proposition stands out even more. Supporters in the crypto world believe that when monetary policy can be changed at any time to suit a president’s political needs, an asset governed by code, with a fixed issuance schedule and beyond anyone’s control, will become exponentially more attractive.

What’s even more noteworthy is that Trump’s reshaping of financial regulatory agencies is not an isolated case. As the Cook incident unfolds, the U.S. Commodity Futures Trading Commission (CFTC) is experiencing a wave of high-level resignations, and Trump has been working to bring pro-crypto Republican leaders into his administration. Regardless of the original intent, this series of moves objectively brings a more favorable regulatory outlook for the crypto industry, while further highlighting the uncertainty of the traditional financial system.

No matter the final outcome, this storm has already damaged the credibility of the dollar and the U.S. financial system. In a world that is increasingly multipolar and technologically advanced, every shock to the stability of the traditional financial system may objectively drive people to explore new possibilities. As the Wall Street Journal’s warning still rings in our ears: this country will ultimately regret it. And for the rising world of digital assets, this may once again be a moment to prove its value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Markets Face a Rollercoaster: What Happened in the Past 24 Hours?

In Brief Bitcoin price dropped by 2.4%, influencing overall crypto market sentiment. The top 10 cryptocurrencies saw a general decline over the past 24 hours. Market seeks stability amid cautious investor behavior and potential short-term volatility.