Tokenized Stocks: Innovation or Market Disruption?

- Tokenized equities face global regulatory scrutiny as WFE warns they lack voting rights and dividend entitlements compared to traditional stocks. - Liquidity challenges persist with $500M market cap, limited to accredited investors, and opaque pricing due to absence of market makers and DeFi integration. - Investors are advised to prioritize compliance frameworks (e.g., EU DLT MTFs) and hybrid models blending centralized oversight with decentralized trading to mitigate risks.

The rise of tokenized equities has ignited a global debate: Are they a revolutionary step toward modernizing financial systems, or a destabilizing force that undermines investor protections and liquidity cohesion? As regulators and market participants grapple with this question in 2025, the answer hinges on balancing innovation's promise with the risks of uncharted territory.

Regulatory Frameworks: A Double-Edged Sword

Tokenized equities—digital representations of traditional stocks on blockchain networks—have attracted scrutiny from global regulators. The World Federation of Exchanges (WFE) has sounded alarms, warning that these assets often mimic traditional equities without offering equivalent rights, such as voting power or dividend entitlements. This regulatory skepticism is not unfounded. In the U.S., the SEC's dual approach—embracing tokenization's economic potential while enforcing securities laws—reflects a cautious optimism. Meanwhile, the EU's Markets in Crypto-Assets (MiCA) regulation, now fully operational, has set a global benchmark for compliance, requiring crypto-asset service providers (CASPs) to meet stringent operational standards.

Regulatory clarity, however, remains fragmented. The UK's Digital Securities Sandbox (DSS) and Singapore's Project Guardian exemplify efforts to harmonize innovation with oversight, but cross-border alignment is still nascent. For investors, this means navigating a patchwork of rules that vary by jurisdiction, complicating asset management and liquidity strategies.

Liquidity Risks: The Hidden Cost of Tokenization

While tokenized equities promise 24/7 trading and fractional ownership, their liquidity challenges are stark. As of mid-2025, the total market capitalization of tokenized equities stands at roughly $500 million, with low turnover and restricted access. Most tokens are limited to accredited investors, creating a narrow trading pool. Platforms like Exodus and Swarm operate on permissioned systems, further stifling the decentralized trading environment tokenization was meant to enable.

The absence of market makers and integration with decentralized finance (DeFi) protocols exacerbates these issues. Unlike commodities-backed tokens (e.g., PAXG for gold), tokenized equities lack on-chain liquidity mechanisms such as automated market makers (AMMs). This results in wider bid-ask spreads and opaque pricing, deterring active participation. For example, a tokenized share of Tesla (TSLA) might trade at a premium or discount to its real-world counterpart due to limited price discovery.

High custodial risks and jurisdictional restrictions also hinder adoption. Investors must trust platforms to securely manage private keys and comply with anti-money laundering (AML) rules, a challenge in an industry still maturing. Gas fees on blockchains like Ethereum further erode returns for small transactions, making frequent trading impractical.

The Path Forward: Strategic Insights for Investors

Tokenized equities are neither a panacea nor a pariah. Their potential to democratize access and streamline settlement processes is undeniable, but realizing this vision requires addressing liquidity and regulatory gaps. Here's how investors can position themselves:

- Prioritize Regulatory Alignment: Focus on tokenized equities issued under recognized frameworks, such as the EU's DLT Market Trading Facilities (DLT MTFs) or the U.S. Reg A+ exemption. These structures offer clearer compliance pathways and investor protections.

- Leverage Hybrid Market Structures: Support platforms that blend centralized compliance with decentralized trading. For instance, hybrid models could use traditional market makers to provide liquidity while leveraging blockchain for settlement efficiency.

- Diversify Exposure: Allocate only a small portion of portfolios to tokenized equities until liquidity improves. Pair these investments with traditional assets to mitigate volatility and regulatory uncertainty.

- Monitor Technological Adoption: Track developments in cross-border sandboxes (e.g., U.S.-UK collaborations) and infrastructure upgrades, such as layer-2 solutions to reduce gas fees. These advancements could unlock broader participation.

Conclusion: A Calculated Bet on the Future

Tokenized equities represent a pivotal experiment in financial modernization. While they risk fragmenting markets and exposing investors to untested risks, their potential to enhance accessibility and efficiency is too significant to ignore. For now, the key lies in adopting a measured approach—embracing innovation while hedging against its uncertainties. As regulators and technologists refine the framework, investors who balance curiosity with caution will be best positioned to navigate this evolving landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Iran’s Covert Cryptocurrency Transfers Bypass Sanctions

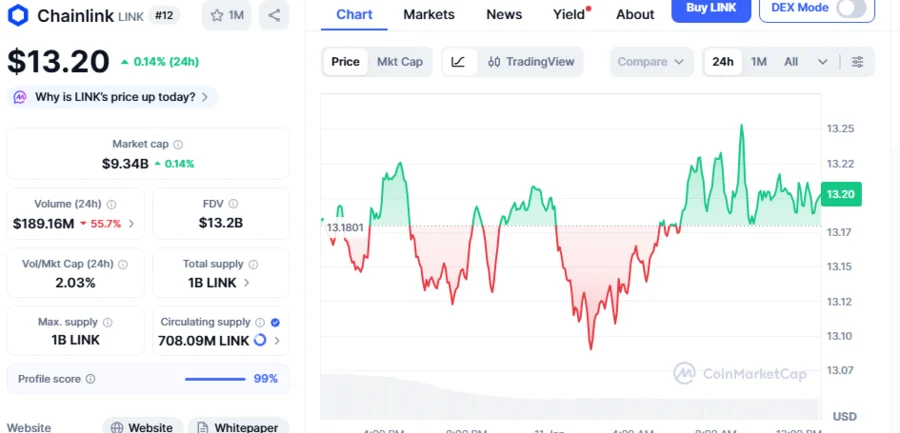

Is Chainlink Heading To $18? Analyst Points Out A Range-Bound Pattern Suggesting 36.3% LINK Rally Amid Growing Buying Pressure

Dan Ives: Massive AI Investments Mark Only the Beginning of the ‘Fourth Industrial Revolution’

Borderlands Mexico: Flexport cautions importers that tariff concerns will remain prominent in 2026