JPMorgan’s $500 Million Bet Fuels 130% Surge for NMR

NMR soared 130% after JPMorgan’s $500M hedge fund capacity, marking a pivotal moment for Numerai’s AI-powered, blockchain-backed model

Numeraire (NMR), the native token of decentralized hedge fund platform Numerai, rallied more than 130% in the past week.

Experts associate the surge with JPMorgan, after the asset manager secured a $500 million capacity for the firm’s flagship hedge fund.

JPMorgan Partnership Marks a Turning Point for Numerai

Numerai announced that JPMorgan, one of the world’s largest allocators to quantitative strategies, committed to invest and locked in $500 million of fund capacity.

The deal is significant, coming a decade after Numerai’s inception in 2015. It was initiated as an experimental hedge fund powered by crowdsourced AI signals.

“The point of Numerai has always been to create a hedge fund for the AI age…Our open platform lets any data scientist or AI submit stock market signals through a simple API. That openness is our edge,” the team said in its announcement.

Over the past three years, Numerai’s assets under management (AUM) have grown from $60 million to $450 million.

In 2024, its global equity hedge fund posted a 25.45% net return with a Sharpe ratio of 2.75, outperforming many established quant competitors. It was the firm’s strongest year on record, with just one down month.

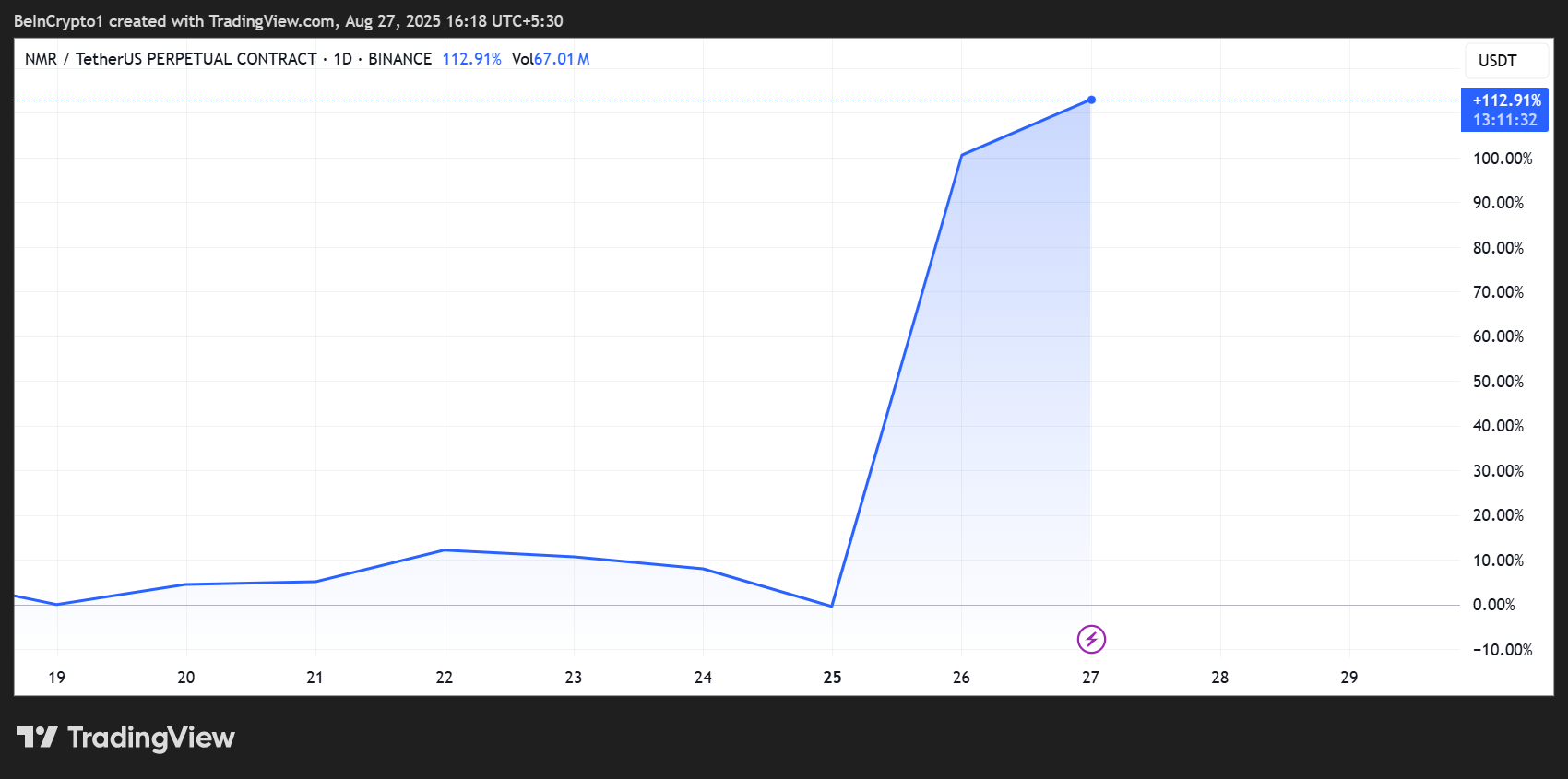

The news triggered a frenzy in NMR markets. The token surged 125% in just seven days, pushing trading volume close to $500 million in 24 hours.

Numeraire (NMR) Price Performance. Source:

TradingView

Numeraire (NMR) Price Performance. Source:

TradingView

“NMR is absolutely LIT right now, shooting skyward after the JPMorgan bombshell…many are betting it could blaze past $20–$25 in no time,” Altcoinpedia posted.

NMR is currently just below those levels, trading for $16.86 as of this writing. While there is still potential for more gains, skepticism remains.

Token Incentives and Market Skepticism Shape NMR’s Next Chapter

Numerai’s model blends traditional asset management with blockchain-based incentives. Over $7 million worth of NMR is currently staked by data scientists worldwide who submit trading signals to improve the hedge fund’s performance.

The platform also revealed it had repurchased $1 million worth of NMR to strengthen community alignment.

Recent hires, including a former Meta AI researcher and a trading engineer from Voleon, signal the firm’s push to scale operations.

3rd leg up. Crossed through $14 On top of the news today, @numerai also announced in the latest blog they hired an AI researcher formerly at Meta, a trading engineer formerly at Voleon, and several others Last month they also repurchased $1M in $NMRThe news keeps flowing pic.twitter.com/AVK4zQkIbu

— Numerai Council of Elders August 26, 2025

Numerai is permanently open to new machine learning approaches, from transformers to LLM-driven reasoning, rather than being tied to a single quant strategy.

Meanwhile,the rally in NMR comes amid a mixed backdrop for AI-linked tokens. While Numerai has surged on concrete institutional backing, other AI plays have been pressured after Elon Musk filed a lawsuit against Apple and OpenAI, citing billions in damages and raising questions about governance in the AI industry.

Momentum is on Numerai’s side, at least for now, drawing from a combination of strong fund performance, institutional validation, and rising token activity.

As one of the early quant traders on @numerai nearly 8 years ago, I’m really happy to see this… they’ve just secured $500M from @jpmorgan. Numerai has always been one of the most serious builders in the space, and I’ve long admired the work @richardcraib and his team have… pic.twitter.com/wANy5LgL6i

— Julien B. August 26, 2025

These have positioned NMR as one of the hottest AI-driven assets in the market.

Numerai’s partnership with JPMorgan could prove to be the inflection point it has been building toward since inception. This is as investors eye the intersection of blockchain, data science, and finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

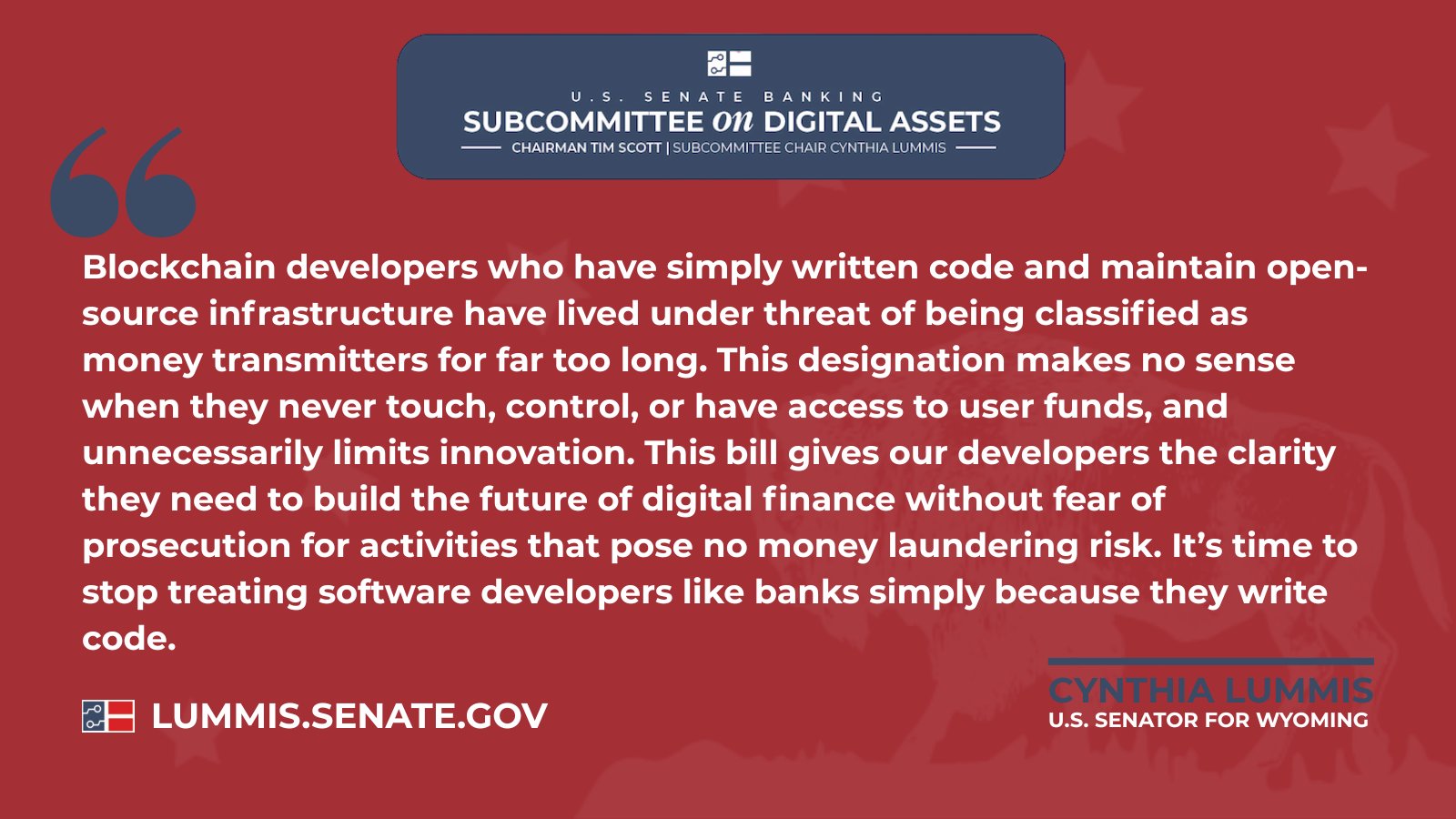

Senate Judiciary flags DeFi oversight ‘gaps’ in U.S. crypto bill

Morph Integrates RedStone Oracle for Real-Time, Secure Pricing for On-Chain Payments

SwissBorg Hooks Base for Killer Crypto Swaps – Kriptoworld.com

TRON Holds Long-Term Ascending Channel as Weekly Trend Stays Firm