Aave Surpasses $41.1B TVL, Matches US Bank Size: DeFi's Disruptive Leap into Traditional Banking

- Aave's Total Value Locked (TVL) surpassed $41.1B in August 2025, matching the 54th largest U.S. bank by deposit size. - Strategic expansion to non-EVM chains like Aptos and institutional partnerships drove $1.3B TVL growth within months. - With 62% DeFi lending market share and $71.1B combined value, Aave challenges traditional banks through 24/7 accessibility and uncorrelated yield. - Upcoming Aave V4 Liquidity Hubs and regulatory alignment position it as a blue-chip DeFi asset amid evolving U.S. crypto

In the ever-evolving landscape of finance, decentralized finance (DeFi) has emerged as a formidable challenger to traditional banking systems. Aave , one of the most prominent DeFi protocols, has recently achieved a landmark milestone: its Total Value Locked (TVL) surpassed $41.1 billion on August 24, 2025. This figure places Aave in the same financial echelon as the 54th largest U.S. commercial bank by deposit size, according to Federal Reserve data as of June 30, 2025. By including Aave's $28.9 billion in outstanding borrows, the combined value reaches $71.1 billion, rivaling the 37th largest U.S. bank—a position within the top 1.7% of all commercial banks in the country.

The Mechanics of Aave's Growth

Aave's TVL surge is not an isolated event but a culmination of strategic innovations and institutional adoption. The protocol's expansion into non-EVM (Ethereum Virtual Machine) chains, particularly the Aptos blockchain, has been a game-changer. By rewriting Aave V3 in Move, a secure and high-performance programming language, the protocol leveraged Aptos' capacity for 150,000 transactions per second and low-cost transactions. This move injected $1.3 billion in TVL within months, with projections of exceeding $1.5 billion by year-end.

Moreover, Aave's partnerships with institutions like Ethena Labs and Fireblocks have driven over $1 billion in USDe-related deposits, while Nasdaq-listed BTCS uses Aave to generate yield on its Ethereum holdings. These collaborations underscore Aave's transition from a DeFi experiment to institutional-grade financial infrastructure.

DeFi's Disruption of Traditional Banking

Aave's TVL growth reflects a broader shift in how capital is managed. Traditional banks, constrained by regulatory overhead and low-interest-rate environments, face a competitor that offers uncorrelated yield generation and 24/7 accessibility. For instance, Aave's TVL now exceeds the deposit figures of Prosperity Bank ($38.4 billion) and trails Bank OZK by just $300 million. This is not merely a DeFi victory—it signals a redefinition of financial infrastructure.

Aave's founder, Stani Kulechov, emphasized that the protocol functions as an open financial network where institutions can access yield independent of the Federal Reserve. This decentralization of liquidity creation challenges the monopoly of traditional banks, which have long controlled capital allocation.

Strategic Advantages and Future Outlook

Aave's dominance in the DeFi lending sector is underscored by its 62% market share, far outpacing competitors like Morpho ($7 billion TVL). The protocol's upcoming Aave V4 Liquidity Hubs, set for Q4 2025, aim to further centralize cross-chain liquidity, enhancing capital efficiency and institutional appeal.

The AAVE token , Aave's native governance token, has surged 177% since April 2025, reflecting investor confidence. However, token volatility remains a risk. For long-term investors, Aave's alignment with regulatory frameworks (e.g., the U.S. GENIUS Act) and its multichain strategy position it as a blue-chip DeFi asset.

Investment Implications

Aave's TVL milestone is a testament to DeFi's potential to disrupt traditional banking. For investors, this represents an opportunity to allocate capital to a protocol that is redefining financial infrastructure. However, due diligence is critical:

1. Diversify Exposure: While Aave's institutional adoption is robust, DeFi remains a high-risk, high-reward sector.

2. Monitor Regulatory Developments: U.S. regulatory clarity (e.g., SEC's Project Crypto) could impact Aave's growth trajectory.

3. Leverage Cross-Chain Opportunities: Aave's expansion into non-EVM chains like Aptos offers scalable, low-cost solutions that could attract further liquidity.

Conclusion

Aave's $41.1 billion TVL is more than a number—it is a harbinger of a financial ecosystem where decentralized protocols rival traditional institutions. As DeFi continues to mature, Aave's strategic innovations and institutional partnerships position it as a cornerstone of the future financial system. For investors, the key lies in balancing optimism with caution, recognizing that while DeFi's disruption is inevitable, its path is still evolving.

In the race between tradition and innovation, Aave has proven that the future of finance is not just decentralized—it is democratized.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

Move forward with pragmatic optimism.

Undercurrents Surge: Crypto Whales Spark Another Wave of Accumulation

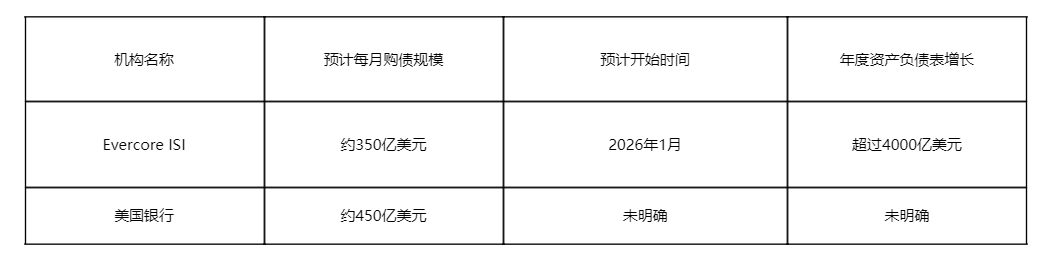

Fed Decision Preview: Balance Sheet Expansion Signals Are More Important Than Rate Cuts

The Federal Reserve cuts interest rates as expected, what happens next?