Mysterious Whale Moves 171K ETH Worth $667M From Top OTC Firms

A mysterious institutional investor has been making significant Ethereum (ETH) transfers recently. Over the past four days, this entity created six new wallets. In total, it accumulated 171,015 ETH, worth approximately $667 million. The ETH originated from major over-the-counter (OTC) firms, including FalconX, Galaxy Digital, and BitGo.

Rapid Wallet Creation and Large Transfers

The activity began quietly but picked up pace quickly. According to blockchain analytics firm Lookonchain, the institution created new wallets regularly. In the last two hours alone, it moved 10,396 ETH, valued at around $40.6 million, from FalconX to one of its new wallets.

Earlier reports showed similar movements. For example, one hour prior, it received 11,062 ETH ($40.74 million) from FalconX into another freshly created wallet. Over three days, the whale set up five wallets and amassed 147,591 ETH ($541.66 million) from the same trio of OTC firms.

Sources and Transparency in Transactions

The transferred Ethereum primarily came from reputable OTC desks. FalconX, Galaxy Digital, and BitGo serve institutional clients and facilitate large trades off exchanges to minimize market impact. The whale’s activity highlights the growing trend of institutions moving substantial crypto assets discreetly.

Blockchain explorers reveal that these wallets remain untagged with any public identity. However, the scale and frequency of transfers suggest a well-funded institution or fund.

Implications for Ethereum Market

When whales make moves this big. It usually means they’re either repositioning their portfolios or getting ready for something strategic. These transfers could affect Ethereum’s price and how easily it can be bought or sold. Especially if the coins end up staked, locked in DeFi projects, or held long-term.

Traders and analysts will be watching closely to see what happens next. If the coins just sit still, it’s a good sign that the whale believes in Ethereum’s future. But if the tokens start moving out for sales, it could shake up the market and cause some volatility.

Outlook and Industry Context

This whale’s movements add to the narrative of increasing institutional involvement in cryptocurrencies. As regulatory frameworks evolve, OTC desks remain vital channels for large transactions. They enable institutions to acquire or shift assets without disrupting market prices.

The creation of multiple wallets may also reflect privacy concerns and strategic asset management. While anonymous, such activity underscores Ethereum’s growing role as a major digital asset for large-scale investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell admits that a rate cut in December is hard to determine, with officials remaining divided.

The probability of a Federal Reserve rate cut in December remains uncertain, with officials expressing both hawkish and dovish views. This meeting is filled with suspense!

Latin America's Crypto Gold Rush: Seizing Opportunities in Web3 On-Chain Digital Banking

From the perspective of traditional digital banking, Web3 on-chain banks built on blockchain and stablecoin infrastructures will, in the future, meet user needs and serve those populations that traditional financial services cannot reach.

Even major short sellers have started paid groups

Real opportunities only circulate quietly within closed circles.

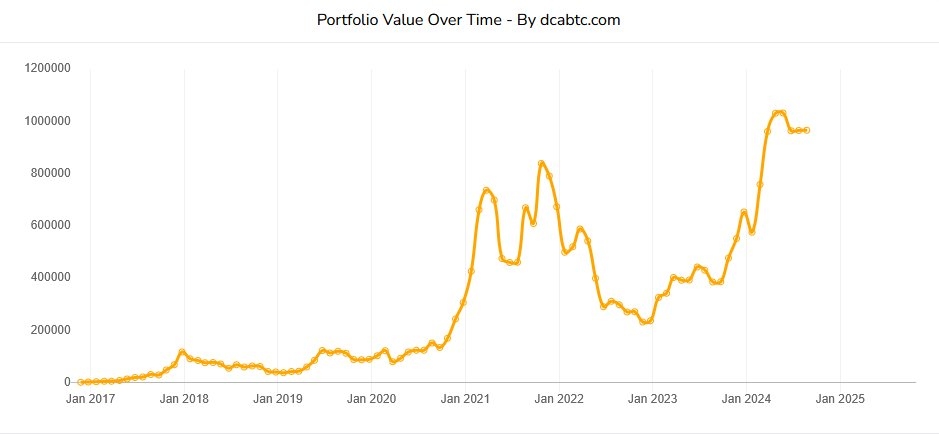

How to Survive the Bitcoin Winter? Investment Strategies, Advice, and Bottom Identification

Bitcoin is an outstanding savings technology for patient investors, but for those who lack patience or are excessively leveraged, it becomes a "wealth-destroying" tool.