Navigating the Diverging Trajectories of Shiba Inu, Dogecoin, and Solana in a Consolidating Crypto Market

- Late 2025 crypto market shows divergent paths for SHIB, DOGE, and SOL amid macroeconomic uncertainty and regulatory pressures. - SHIB's mini-golden cross hints at potential 85% rally but faces 200-day EMA resistance ($0.000014) and weak on-chain accumulation. - DOGE risks bearish breakdown below $0.23 amid flat 50-day EMA and 57% derivatives short dominance, threatening sub-$0.20 levels. - SOL demonstrates hidden resilience with 50-day EMA crossover and $188 support, offering rare bullish potential in be

The crypto market in late 2025 is a study in contrasts. While macroeconomic uncertainty and regulatory scrutiny weigh on broader sentiment, individual assets are carving out distinct paths. Shiba Inu (SHIB), Dogecoin (DOGE), and Solana (SOL) exemplify this divergence, with technical indicators painting a nuanced picture of cautious optimism, bearish fragility, and hidden resilience. For investors navigating this fragmented landscape, understanding these divergent trajectories is critical to positioning for Q4 and beyond.

Shiba Inu (SHIB): A Mini-Golden Cross Amid Structural Headwinds

SHIB's recent mini-golden cross—where the 100-day EMA crossed above the 50-day EMA—has sparked whispers of a potential rebound. Historically, such crossovers have signaled short-term bullish momentum, but in SHIB's case, the signal is muted by a broader bearish context. The token remains trapped in a symmetrical triangle pattern, with the 200-day EMA at $0.000014 acting as a formidable overhead resistance. This level has repeatedly denied SHIB's attempts to regain traction, and the RSI's sub-45 reading underscores weak buying pressure.

The key question for Q4 is whether SHIB can break out of its consolidation phase. A sustained move above $0.000014 would validate the mini-golden cross and potentially trigger a 85% rally to $0.000023, mirroring a similar move in November 2024. However, the absence of on-chain accumulation and the dominance of short positions in derivatives markets (57% as of late August) suggest that this scenario is far from guaranteed. Investors should treat SHIB's technical signals with caution, viewing them as a speculative opportunity rather than a definitive reversal.

Dogecoin (DOGE): A Bearish Crossroad

DOGE's technical outlook is far more precarious. The token is consolidating within a symmetrical triangle between $0.2115 (support) and $0.2407 (resistance), but bearish momentum is intensifying. The 50-day EMA has begun to flatten, while the 200-day EMA looms as a critical threshold. A breakdown below $0.23 would likely trigger a cascade of panic selling, with historical patterns suggesting a potential free fall to sub-$0.20 levels.

What makes DOGE's situation particularly concerning is the lack of institutional support. Despite 680 million tokens being added to large wallets in August, this accumulation has not translated into price stability. The RSI's neutral stance (hovering near 40) indicates the market is not yet oversold, reducing the likelihood of a short-term bounce. For DOGE , Q4 could be a make-or-break period: a failure to reclaim $0.24 and stabilize above $0.23 would likely cement its bearish trajectory.

Solana (SOL): Hidden Strength in a Bear Market

Amid the gloom, Solana (SOL) stands out as an anomaly. Trading near $188, the token has been trending upward along an ascending channel, with the 26-day EMA serving as a dynamic support line. The 50-day EMA crossing above the 200-day EMA—a classic bullish signal—suggests that SOL is reclaiming its medium-term momentum. The RSI at 51 indicates neutral momentum, leaving room for buyers to step in without signs of exhaustion.

SOL's strength lies in its ability to maintain structure. If it successfully retests the 26-day EMA and holds above $185, the next target is $215. A breakdown below $185, however, could see the price retreat to $175 or $167, where longer-term moving averages cluster. For investors seeking a counterbalance to the broader bear market, SOL's technical resilience makes it a compelling case study in strategic positioning.

Strategic Implications for Q4 2025

The divergent paths of SHIB, DOGE, and SOL highlight the importance of granular technical analysis in a consolidating market. SHIB's mini-golden cross offers a sliver of optimism but requires patience and risk management. DOGE's bearish risks demand a defensive stance, with stop-losses below $0.23. SOL, meanwhile, represents a rare opportunity to capitalize on hidden strength, provided it can hold key support levels.

For investors, the lesson is clear: macroeconomic trends and regulatory developments matter, but the micro-level dynamics of individual assets can diverge sharply. As Q4 approaches, the interplay between technical indicators and on-chain fundamentals will be the true barometer of success. Those who navigate these divergences with discipline and adaptability may find themselves well-positioned for whatever the market delivers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Popeyes operator managing more than 130 restaurants files for bankruptcy protection

Musk and Ryanair CEO clash over cost of Starlink Wi-Fi on planes

Dollar Weakens While Yen Strengthens Following Verbal Warnings

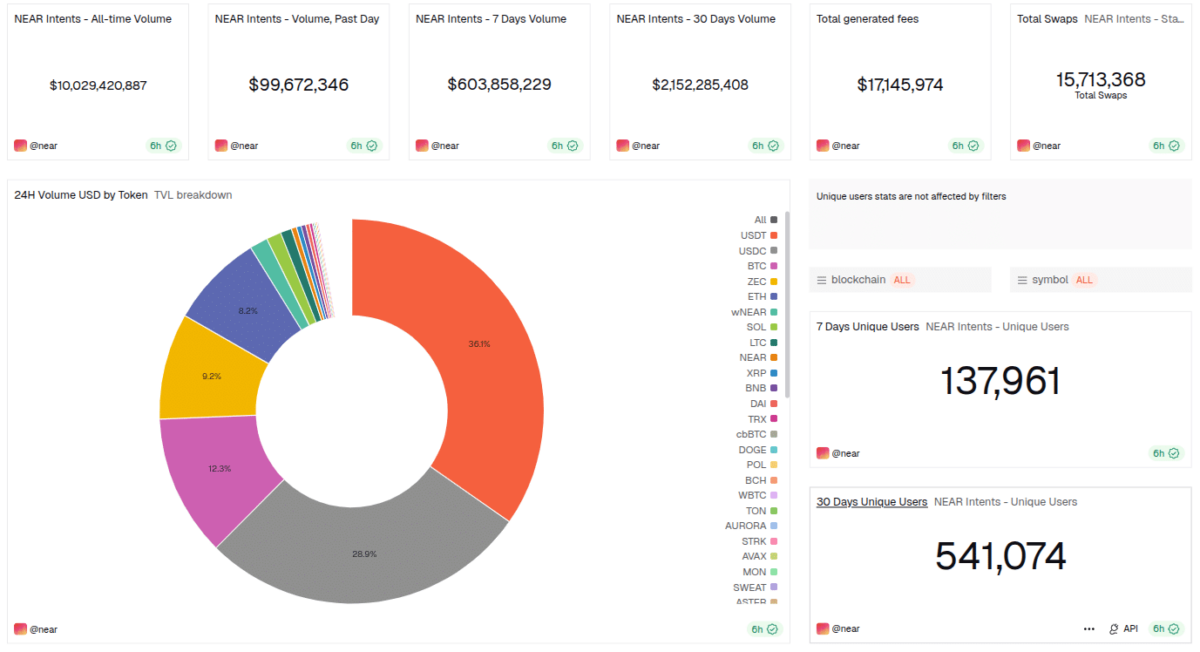

NEAR Intents Achieves $10B in Swap Volume as Industry Support, Adoption Grow