- JPMorgan commits $500M to AI-driven hedge fund Numerai.

- Numeraire (NMR) price surges from $8.11 to $19.55 with heavy trading.

- Numerai’s AUM is set to nearly double to about $950 million.

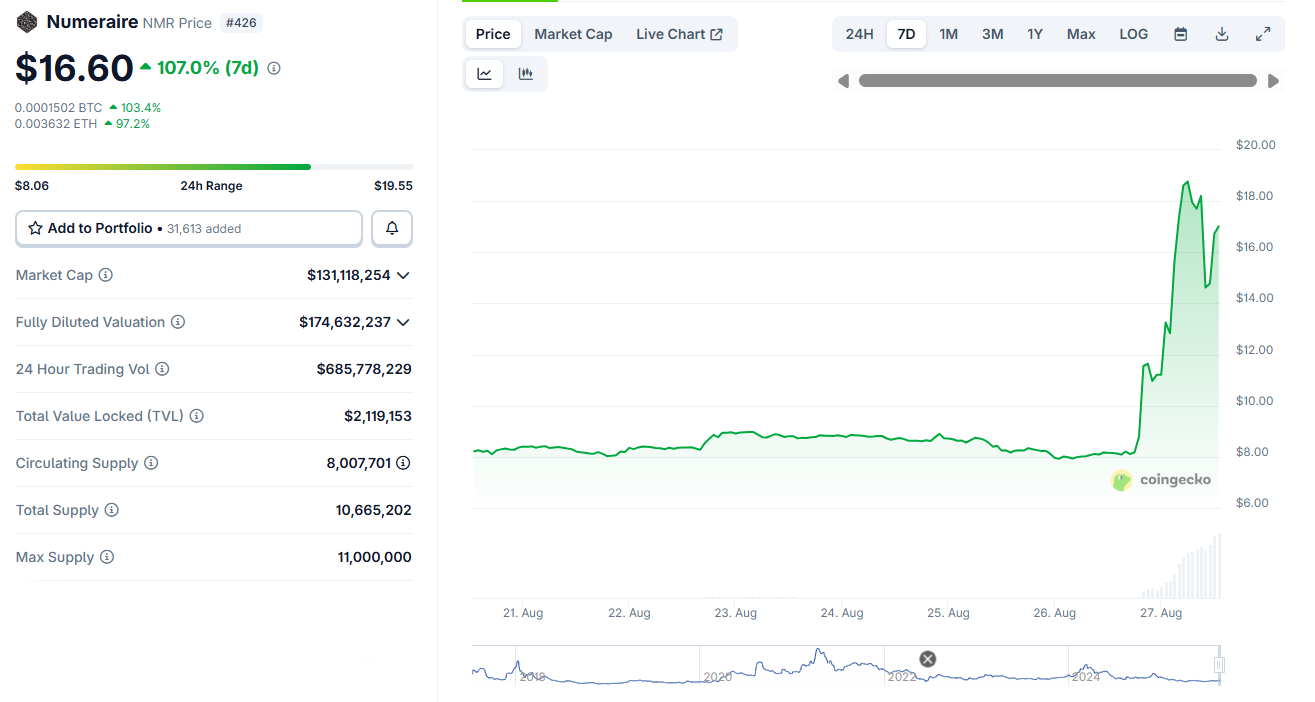

The price of Numeraire (NMR) shot to a high of $19.55 within hours of Numerai securing a $500 million commitment from JPMorgan.

The cryptocurrency rose from around $8.11 on August 26 to hit a high of $19.55 before pulling back to $14.62 and climbing again to $16.60 at press time.

The surge highlights the growing influence of institutional investors in crypto, particularly when combined with artificial intelligence-driven financial models.

JPMorgan deal ignites investor excitement

The $500 million allocation that the San Francisco-based hedge fund backed by Paul Tudor Jones received from JPMorgan Asset Management is expected to be deployed over the next year and will directly support Numerai’s crowdsourced AI trading models, developed by thousands of data scientists globally.

Notably, Numerai has steadily grown its assets under management since its founding in 2015 and currently holds about $450 million.

With JPMorgan’s commitment, Numerai’s capital base could nearly double to $950 million.

The investment not only strengthens Numerai’s financial position but also signals growing confidence from traditional finance in crypto-friendly hedge funds.

A wider trend of Wall Street exploring crypto and AI integration

JPMorgan’s investment in Numerai reflects a wider trend of Wall Street exploring crypto and AI integration.

Beyond hedge funds, traditional players are increasingly experimenting with blockchain, stablecoins, and crypto-backed lending.

Numerai stands out as an early example of how decentralised, AI-driven models can attract mainstream capital and compete alongside established investment vehicles.

According to a report by the UNCTAD indicate that artificial intelligence will be one of the world’s most valuable technology sectors over the next decade, with its share of the global frontier tech market expected to quadruple in eight years.

Numerai’s model demonstrates how combining blockchain with AI can capture investor attention and capital, even amid volatile markets.

Numeraire (NMR) price surge

Numerai’s AI-based hedge fund model bridges the worlds of decentralised finance and traditional finance, attracting attention from retail traders and large investors alike.

Numeraire (NMR) is the native cryptocurrency of Numerai, and it is central to the hedge fund’s unique operating model.

Data scientists stake NMR tokens to back predictions, with strong models earning rewards while weaker ones lose their stake.

This system incentivises accurate forecasting and creates a market-driven approach to AI development.

The JPMorgan announcement triggered massive Numeraire (NMR) trading volumes, surging over 880% in a single day and pushing NMR to $11.40 before the broader rally took it even higher.

Despite the surge, NMR remains far below its all-time high of $93.15, and the token is highly volatile.

While JPMorgan’s backing and the token buyback program that started in July provide a strong fundamental catalyst, prices could swing sharply in response to market sentiment or trading activity.