Institutional Trust Turns to Chainlink as ETF Filing Sparks Bullish Shift

- Bitwise files S-1 for Chainlink (LINK) ETF, tracking CME CF benchmark as Delaware trust. - Market reacts with LINK price surge over 26% amid ETF speculation and whale activity. - Institutional partnerships, like ICE for on-chain data, boost Chainlink's traditional finance integration. - Analysts predict $29–$46 price targets if LINK holds $24 support, but warn of volatility risks. - ETF approval could drive institutional demand, aligning with deflationary tokenomics and tokenized asset growth.

Bitwise Asset Management has filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) to launch a spot Chainlink (LINK) exchange-traded fund (ETF), a development that has intensified market speculation about institutional-grade exposure to the decentralized oracle network. The proposed ETF will be structured as a Delaware statutory trust and will track the CME CF Chainlink–Dollar Reference Rate (New York Variant), a benchmark administered by CF Benchmarks. Shares are expected to trade on a U.S. national exchange, though the specific venue has yet to be finalized. The fund will allow for in-kind and cash-based creations and redemptions in blocks of 10,000 shares, offering institutional investors and retail participants a regulated vehicle for exposure to the LINK token, currently ranked as the 11th-largest cryptocurrency by market capitalization [1].

The filing has already triggered increased market activity, with LINK’s price surging above $24 amid heightened whale transactions and elevated trading volumes. The token has appreciated by over 26% in the past month, driven by growing optimism surrounding the potential approval of a regulated product. Analysts highlight that the structure of the ETF may amplify demand for LINK, particularly as tokenomics continue to reduce circulating supply through mechanisms such as staking rewards being locked in the Reserve model, which effectively reduces supply by half of monthly staking revenues [1].

Technical analysis of LINK’s price chart reveals a consolidation pattern, with the token currently testing a multi-year symmetrical triangle formation. On-chain data indicates that 2.07 million LINK tokens were withdrawn from exchanges within a 48-hour period, signaling reduced near-term selling pressure and potential accumulation by long-term holders. This trend, coupled with a rare Golden Cross event—where the 50-day moving average crosses above the 200-day moving average—has been historically associated with upward momentum in LINK’s price. Analysts have set price targets ranging from $29 to $46, contingent on the token maintaining key support levels above $24 [3].

Institutional interest in Chainlink is not limited to ETF speculation. The protocol recently secured a partnership with Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, to deliver institutional-grade foreign exchange and precious metals data on-chain. This collaboration supports Chainlink’s broader strategy to expand its utility in traditional financial markets while also integrating with the tokenization of real-world assets, a sector projected to grow into a $30 trillion market by 2030 [4]. Additionally, the project’s Reserve model, which locks staking rewards into time-locked tokens, contributes to supply scarcity and aligns with broader market trends favoring deflationary tokenomics.

Despite the bullish narrative, analysts caution that near-term volatility remains a risk. The LINK price has shown signs of consolidation in the $23–$25 range, with Fibonacci extension levels suggesting potential resistance at $31, $52, and $98 if the token manages to break out of its current pattern. However, a pullback below $21–$22 could trigger further retests of support levels, potentially leading to short-term uncertainty [3]. Market observers also highlight that secondary trading of the ETF may lead to premiums or discounts relative to its net asset value, a common feature of ETF structures, especially in emerging asset classes like cryptocurrencies.

Chainlink’s ecosystem developments and macroeconomic factors suggest a compelling case for continued growth. With tokenized asset adoption gaining traction and institutional partnerships expanding, the potential for institutional inflows through a regulated ETF could accelerate demand for LINK. While the token is currently trading below $25, technical indicators and on-chain activity indicate that the market is in a critical phase, with the coming weeks likely to determine whether LINK sustains its recent momentum or faces further consolidation. Analysts remain divided on the magnitude of the potential upside, with some projecting a move toward $100, while others anticipate a more gradual appreciation toward $40 by late 2025 [5].

Source:

[1] Bitwise Submits S-1 Filing to US SEC for Spot Chainlink ETF

[2] Bitwise Asset Management: Crypto Index Fund & ETF Provider

[3] Chainlink Price Analysis Shows Potential Rally After ...

[4] Massive 2.07M Chainlink Outflow Fuels Hype as Golden ...

[5] Chainlink Price Prediction: Can LINK Hit $40 Between Sept ...

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who would be the most crypto-friendly Federal Reserve Chair? Analysis of the candidate list and key timeline

Global markets are closely watching the change of Federal Reserve Chair: Hassett leading the race could trigger a crypto Christmas rally, while the appointment of hawkish Waller may become the biggest bearish factor.

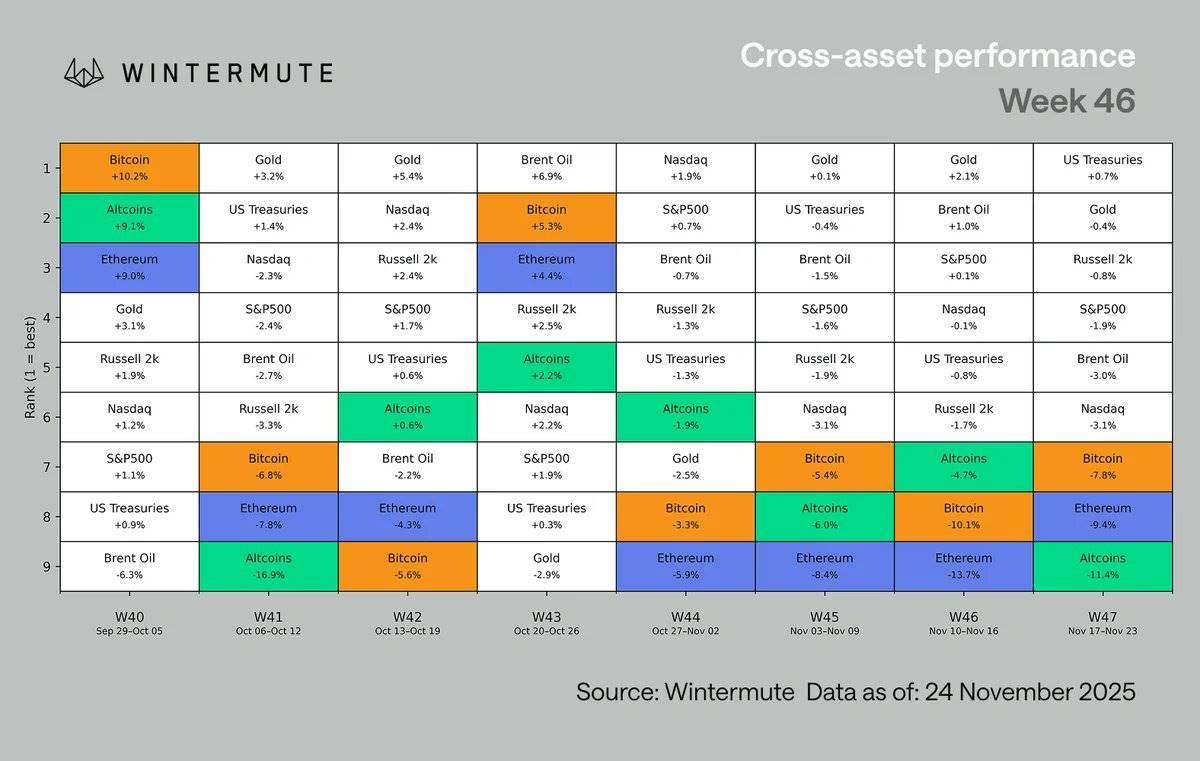

Wintermute Market Analysis: Cryptocurrency Falls Below $3 Trillion, Market Liquidity and Leverage Tend to Consolidate

This week, risk appetite deteriorated sharply, and the AI-driven stock market momentum finally stalled.

Former a16z Partner Releases Major Tech Report: How AI Is Eating the World

Former a16z partner Benedict Evans pointed out that generative AI is triggering another ten-to-fifteen-year platform migration in the tech industry, but its final form remains highly uncertain.