The hunt continues: Hyperliquid XPL lightning short squeeze, losses may exceed $60 million

Author: Frank, PANews

Original Title: Another Catastrophe on Hyperliquid: XPL Flash Short Squeeze, User Losses May Exceed $60 Million, When Will the Whale Hunts End?

The Hyperliquid token HYPE hit a new all-time high again on August 27. However, just a day before, on August 26, a meticulously orchestrated "flash short squeeze" storm swept through the XPL pre-market contract market on Hyperliquid. In less than an hour, the price candlestick chart was violently pulled into an almost vertical line, wiping out countless short traders' accounts in an instant, while the manipulators walked away with more than $46 million in profits.

This event quickly caused a huge stir in the crypto community, with wailing, anger, and conspiracy theories intertwined. People can't help but ask: Was this an accidental extreme market fluctuation, or a precise "massacre" exploiting protocol loopholes? And why does Hyperliquid, at the center of the storm, repeatedly become the perfect hunting ground for whales?

A Long-Planned "Hunt"

This seemingly sudden market crash was, in fact, a carefully planned ambush.

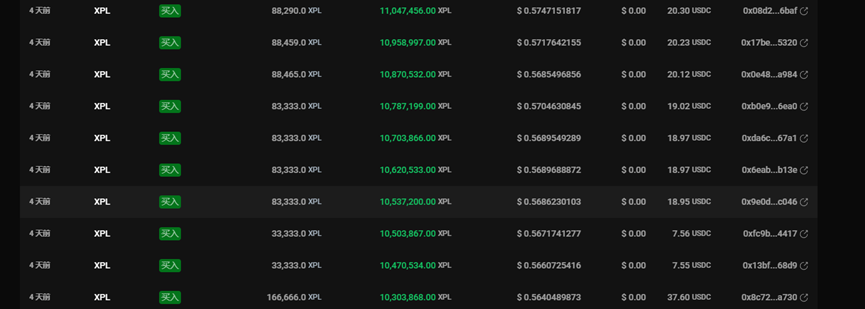

According to on-chain data tracked by AiYi, this coordinated attack was executed by at least four core wallet addresses. Among them, two main addresses played especially clear roles in capital deployment: one starting with 0xb9c0, and another with the DeBank username "silentraven". The other two addresses played supporting roles. These wallets exhibited similar behaviors, with three addresses transferring large amounts of funds to go long on XPL between the 23rd and 25th. Notably, the main address, 0xb9c0, preemptively deployed $11 million USDC to open XPL long positions on Hyperliquid at an average price of about $0.56.

The address with the DeBank username "silentraven" also established a long position of 21.1 million XPL at an average price of $0.56, using $9.5 million USDT over the past three days.

These addresses collectively invested over $20 million, accumulating massive long positions in almost the same price range, in batches and at different times. Some of these addresses clearly only ambushed XPL long positions after being created.

Around 5:30 am on August 26, while most traders in the Asia region were still asleep, the hunting moment quietly arrived.

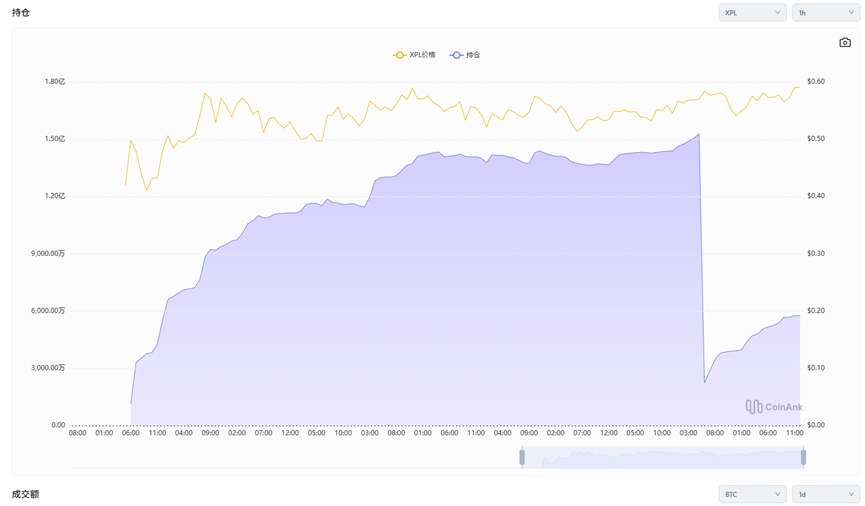

The 0xb9c0 address transferred an additional $5 million to the Hyperliquid platform, then indiscriminately pumped the token. In the already extremely illiquid XPL pre-market, this capital was like a spark thrown into a barrel of gunpowder, instantly igniting the entire order book. Within just a few minutes, XPL's price surged from around $0.6 to $1.8, an increase of over 200%.

Such a rapid pump led to several obvious outcomes. First, most traders had no time to add margin to raise their liquidation prices. Second, even the lowest 1x leveraged hedging orders were liquidated. Third, as many short positions were liquidated one by one, forced buy orders further pushed the price up, creating the most terrifying "short squeeze" phenomenon in financial markets.

Finally, at the peak price, the manipulators began to close their positions at $1.1~$1.2. According to AiYi's statistics, this ambush brought the manipulators over $46 million in profits.

$60 Million in Wails and the Platform's "Indifference"

Every capital feast is inevitably accompanied by the wails of another group. As the manipulators walked away with full pockets, all that was left for other market participants were bloody loss accounts and endless questions.

Crypto KOL @Cbb0fe stated that he allocated 10% of his funds for hedging on Hyperliquid, resulting in a $2.5 million loss, and he will never touch isolated markets again.

Other media reported that a single address suffered a maximum loss of about $7 million, though no specific address information was provided, so doubts remain.

Judging from the manipulators' profits, the maximum profit at the time did indeed exceed $46 million, and whether there were other undiscovered accomplices remains unknown.

Looking at the contract position changes, before the attack, the XPL contract open interest on Hyperliquid peaked at $153 million, then quickly plummeted to $22.44 million, a reduction of over $130 million. It is estimated that the total loss for short users may reach $60 million.

This loss even exceeds the $11 million floating loss caused by the JELLY token incident on Hyperliquid in March. Perhaps because the official team did not directly suffer losses this time, the victims could only swallow their losses in silence.

During community discussions, a familiar name was repeatedly mentioned: Justin Sun, founder of Tron. Some users pointed out that one address involved in the attack had transferred ETH to an address associated with Justin Sun years ago, but this action does not directly prove any actual connection between the address and Justin Sun.

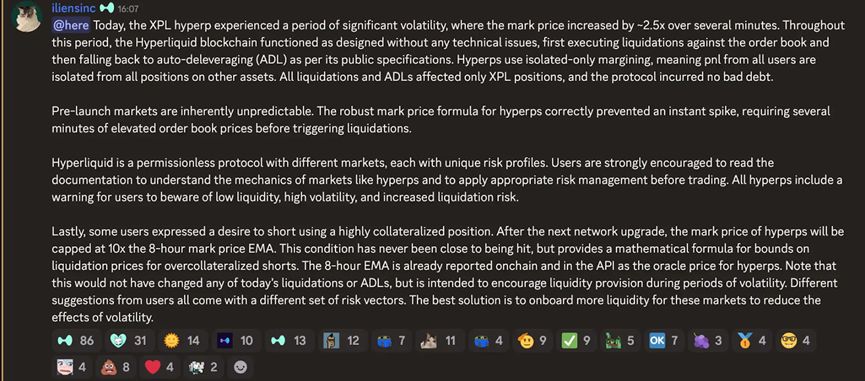

After the incident, many users pinned their hopes on Hyperliquid, expecting the platform to provide an explanation or remedy. However, this time Hyperliquid did not take the drastic measures it did in March when it closed profitable orders and directly shut down related accounts during the JELLY token manipulation. Instead, they responded in the official Discord community, stating that the XPL market experienced extreme volatility, but Hyperliquid's blockchain operated as designed during this period, with no technical issues. Liquidations and automatic deleveraging (ADL) mechanisms were executed according to public protocol, and because the platform uses a fully isolated margin system, this incident only affected XPL positions and did not result in any bad debt for the protocol.

For many onlookers, not making adjustments seems reasonable. After all, when XPL was launched, Hyperliquid had already issued warnings about high volatility and risk, and such manipulation was all carried out within the rules of the market.

But for those users who suffered heavy losses, such a response inevitably feels a bit cold.

Causes of the Catastrophe: The Deadly Collusion of Platform, Asset, and Timing

Looking back at the entire process, this is not the first time Hyperliquid has experienced similar market manipulation. Clearly, this was the result of premeditated and carefully planned actions by the manipulators. On the other hand, it is also closely related to Hyperliquid's own platform design.

First, such short squeezes are not uncommon in financial markets, often occurring in illiquid, price-isolated markets. The operation on Hyperliquid this time was based on several of its features: first, the extreme transparency on-chain, which allows manipulators to calculate the funds needed and the effects of market manipulation using publicly available data on positions, liquidation prices, and funding rates. Second, Hyperliquid's isolated oracle system—since XPL uses an independent pricing system on Hyperliquid and does not rely on external oracles, manipulators can freely control prices within this "enclosure" without worrying about price balancing with other exchanges.

Additionally, there are tricks in the choice of asset. The manipulated XPL (and another token, WLFI, which experienced a similar but less dramatic situation) are both tokens not yet listed, meaning they are "paper contracts" with no spot delivery or spot sell-off pressure, making them easier to manipulate.

Finally, the timing. Before the attack, XPL's five-minute trading volume was only a few hundred thousand tokens, equivalent to about $50,000. This was right after the initial trading enthusiasm had faded, at the weakest point in liquidity, giving attackers the perfect opportunity to manipulate the market with minimal capital.

The XPL incident exposes deep structural risks, reminding us to reflect on both the platform and user levels.

From the platform perspective, the first issue is the vulnerability of the mechanism. Since 2025, Hyperliquid has experienced three market manipulation incidents. Each time, vulnerabilities in Hyperliquid as a decentralized derivatives exchange have been exposed. The result is repeated losses for ordinary users and a weakening of trust in the Hyperliquid platform. In this case, one issue is the "enclosure" created by the isolated oracle system, and another is the lack of proactive liquidity intervention by the platform when abnormal positions appear.

Second, is it more important to treat all actors equally or to maintain the shell of decentralization? In the JELLY incident, Hyperliquid did not hesitate to initiate an on-chain vote, ultimately saving the treasury from losses and expelling the bad actors. The rationale at the time was that the platform was forced to take actions detrimental to decentralization to protect user funds. But when faced with losses far exceeding the previous incident, is it because the platform treasury was not affected, or to avoid undermining the banner of decentralization, that the platform chose to ignore it? This may leave a big question in users' minds.

Finally, for users, the XPL manipulation incident once again reminds us to be vigilant about illiquid and isolated markets. In the market, pre-market contracts with extremely low liquidity and no spot market anchors are often the "hunting grounds" favored by whales. In addition, lowering leverage and setting stop-losses—these old trading principles are never just empty words.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoins in 2025: You Are in Dream of the Red Chamber, I Am in Journey to the West

But in the end, we may all arrive at the same destination through different paths.

XRP’s Extreme Fear Level Mirrors Past 22 % Rally

Critical Bitcoin Bear Market Signal: 100-1,000 BTC Wallet Buying Slows Dramatically

Stunning Bitcoin Whale Awakening: Dormant Addresses Move $178M After 13 Years