The Federal Reserve stirs up waves, Trump steps in to disrupt, and the crypto world suffers.

Trump has finally taken action against the Federal Reserve.

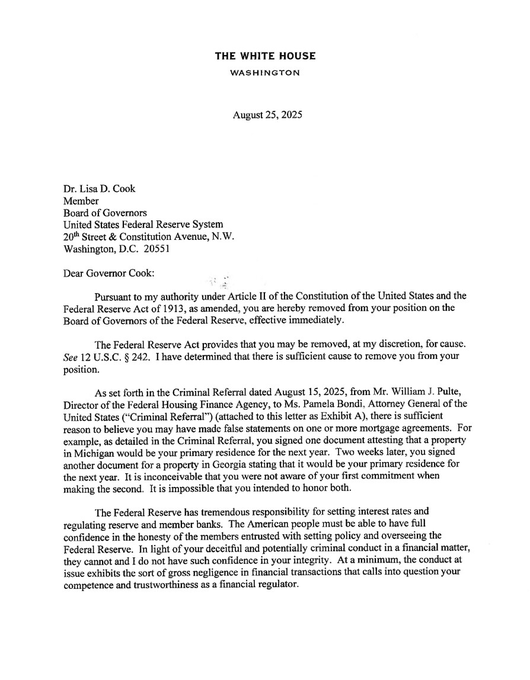

The issue of interest rate cuts has caused widespread anxiety, and Trump’s heavy hand could no longer be restrained, finally swinging toward the Federal Reserve. On the evening of August 25, Trump announced that he had dismissed Federal Reserve Governor Lisa Cook due to her alleged “mortgage fraud.” This marks the first time in the 111-year history of the Federal Reserve that a president has removed a governor. In response to the accusation, Cook has firmly defended herself, clearly stating that she will file a lawsuit over her dismissal. The showdown between the president and the Federal Reserve is about to erupt.

Amid this once-in-a-century chaos, the crypto market has suffered. Just yesterday, BTC briefly fell below $109,000, hitting a low of $108,600, a 12.7% drop from recent highs. Ethereum, after hitting a new high of $4,954, flash crashed to $4,311. According to Coinglass data, as of noon yesterday, over $935 million was liquidated across the network in 24 hours, with long positions being the main victims, accounting for over $821 million in liquidations, and 168,320 people globally were liquidated.

Can Trump really dismiss Cook? Can he truly control the Federal Reserve? Ultimately, Trump’s grand performance will make the entire market pay the price.

Let’s first review the major crypto events of recent days. Just last week, Federal Reserve Chairman Powell delivered a speech at the annual economic symposium in Jackson Hole, Wyoming, hinting that despite current inflationary risks in the US, the Fed may still cut rates in the coming months. He stated, “In the short term, US inflation risks are tilted to the upside, while employment risks are rising. Based on changes in the economic outlook and risk balance, the Fed’s monetary policy stance may need adjustment.”

Overall, this is a clear “softening” signal, and it can be basically assumed that a rate cut in September is a foregone conclusion. The market’s reaction was direct: on that day, all three major US stock indices closed higher, with the Dow up 1.89%, the S&P 500 up 1.52%, and the Nasdaq up 1.88%. Even the much-criticized A-shares rose by more than 3,800 points, with the market echoing the sound of a bull run. The chain reaction was also obvious in the crypto market, with BTC rebounding to $117,000 and ETH performing even more impressively, breaking $4,800 on the day and reaching a new all-time high of $4,956 on August 25.

But good times never last. Along with the rate cut came fears of recession. On August 25, Moody’s Chief Economist Zandi warned that downside risks to the US economy are intensifying. States accounting for nearly one-third of US GDP are already in recession or highly likely to enter recession, another third are stagnant, and only the remaining third are still expanding. Subsequently, the internationally renowned investment bank Barclays also released its latest forecast, stating that during Trump’s presidency, the probability of a US economic recession is 50%. The market sobered up from the joy of rate cuts, with US stocks starting to pull back first, and BTC clearly following the US stock trend, while only ETH continued to rise, supported by institutional buying.

Coincidentally, on the morning of August 26 (East 8th time zone), another major news event drew market attention. Trump suddenly announced that he had signed the dismissal document for Federal Reserve Governor Lisa Cook, citing her alleged involvement in mortgage fraud. At the same time, Trump publicly released an open letter to Cook on social media, stating that he had sufficient grounds to remove her, using strong language: “Given your deceptive and potentially criminal behavior in financial matters... I have lost confidence in your integrity.”

As to whether this reason holds water, we need to rewind the timeline to last week. Also on social media, Bill Pulte, Director of the Federal Housing Finance Agency, accused Cook of declaring two properties as her primary residence to obtain more favorable mortgage rates, and stated that he had submitted this accusation to the Department of Justice. What seemed like a minor mortgage rate issue has been stirred into a storm by Trump’s relentless efforts. After this incident, Trump immediately reposted the report and bluntly said, “Cook should resign immediately.” Cook then responded on social media, stating she would never resign due to bullying.

Breaking down the language, it’s merely about paying less on a mortgage, yet a Federal Reserve governor is being labeled as “utterly lacking in integrity” and even facing dismissal. Regardless of the truth, it seems rather absurd. After the social media standoff yielded no results, the incident escalated, and on the 25th, Trump signed the aforementioned dismissal document, marking the first time in the Federal Reserve’s 111-year history that a president has removed a governor by executive order.

Cook herself has taken a very tough stance, not only publicly stating that Trump has no authority to fire her but also hiring renowned lawyer Abbe Lowell to take Trump to court. It is foreseeable that this will be a protracted legal battle.

This raises questions: Why Cook? Does Trump really have the authority to fire her? Legislatively, while the president’s power to remove is limited to ensure the Fed’s independence, this authority does exist. The Federal Reserve Act stipulates that Fed governors serve long, fixed terms, and the president can only remove them “for cause.” However, this “cause” is relatively vague, and no one has attempted such action for many years, but rationally, serious misconduct or moral issues could be considered grounds.

As for why Cook, the signal is even clearer: in his confrontation with the Fed, Trump’s cards are running out. The Federal Open Market Committee (FOMC), which decides the US federal funds rate, consists of seven Fed governors and five regional Federal Reserve Bank presidents, making the Board of Governors the Fed’s core decision-making body. All seven seats on the Board are nominated by the president and confirmed by the Senate. Except for the chair and vice chair, who serve four-year terms, each governor’s theoretical term lasts 14 years, spanning up to four presidential terms. This system is designed to reduce the impact of presidential turnover and help maintain the Fed’s stability and independence.

Looking at the current Board composition, apart from Chairman Powell, only two of the remaining six members were nominated and appointed by Trump during his first term. The other four were all nominated by former President Biden. The impeached Cook is the first Black female governor of the Fed, taking office in May 2022 with a term until 2038. Previously, she was an economics professor at Michigan State University and served on the Council of Economic Advisers during the Obama administration. Cook has also stated that the current president’s trade policies may suppress US productivity.

It is clear that the Fed’s internal structure is very stable, but this stability also has a natural drawback: a lack of flexibility and adaptability, with everything based on data. This long-standing characteristic of the Fed has greatly dissatisfied Trump. However, the long terms make it difficult for him to intervene quickly, leaving him struggling to balance policy advocacy and inflation control. Previously, Trump had repeatedly criticized Powell for delaying rate cuts. After various failed attempts, he naturally shifted his focus to the governors. Cook, who is “not from his party” and caught in a scandal, became the political target of choice, with Trump attempting to use her case to intimidate the Board. In fact, “mortgage fraud” is nothing new, as several Democratic Party members have been investigated by the Trump administration.

In essence, with legal protections in place, the Fed’s independence faces no immediate risk of being undermined. Trump’s move is more of a show of force, pressuring the Fed to follow his personal agenda and further attempting to overhaul the Board to increase his influence. Earlier this month, Trump nominated his confidant Stephen Milan to replace the resigning governor Kugler, whose term ends in January next year. If Cook is successfully dismissed, he will have succeeded in placing more of his own people in the Fed. According to sources, Trump intends for either Milan or former World Bank President Malpass to succeed Cook. Just yesterday, Trump stated on social media, “We will soon have a majority on the Federal Reserve Board. We may move Milan to another longer-term position at the Fed. Interest rates must be lowered to ease housing cost pressures.”

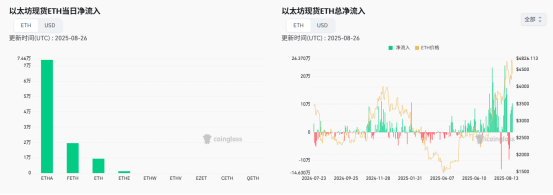

It is precisely under the multiple games of rate cuts, recession fears, and the Trump-Fed standoff that the market experienced a flash crash yesterday. BTC broke below the $112,000 support level, dropping to a low of $108,000, while ETH fell to $4,311, a 12.97% drop from its high. Panic was indeed present, as BTC’s turnover rate surged after breaking below $112,000, and even small holders showed signs of exiting. Overall, although it dropped to $108,000, the bottom support remains effective, and ETH performed even better. From an ETF perspective, as of August 26 (Eastern time), the Ethereum spot ETF had a net inflow of $455 million, marking four consecutive days of net inflows, with daily inflows more than five times that of BTC.

From a capital flow perspective, it appears that more funds are moving from BTC to ETH. On the day of the flash crash, about $2 billion in Bitcoin funds were reallocated to Ethereum, indicating that capital holds a more positive outlook for ETH. Institutional accumulation continues as well. In the past 12 hours, BitMine, the leading ETH miner, received 131,736 ETH from the institutional business platform addresses of BitGo, Galaxy Digital, and FalconX.

Currently, US stocks show no signs of widespread systemic risk, and market panic has eased. BTC has returned above $111,000, and ETH is back above $4,600. SOL has risen to $202, supported by treasury news, and BNB has returned to $859.

On another front, besides exerting influence on the macro level, Trump’s other major crypto event is also underway. On August 23, the Trump family’s crypto project World Liberty Financial (WLFI) announced that the initial claim and trading of WLFI tokens will open on September 1, meaning the WLFI token is about to be listed.

In terms of unlocking, to maintain price stability, early supporters will only have 20% unlocked, with the remaining 80% to be decided by community governance voting. Notably, tokens for the founding team, advisors, and partners will not be unlocked at launch. According to current pre-market contracts, WIFI has dropped from $0.55 to $0.26, although this is still a significant increase compared to the early purchase prices of $0.015 and $0.05. However, in its current state, WIFI’s fully diluted valuation is only $26 billion, which can only be described as mediocre. Although the founding team will not unlock at launch, hedging contracts to realize value early is nothing new.

It is foreseeable that on September 1, Trump’s promotional efforts and calls to action will be plentiful. However, whether this move will drain liquidity like Trump’s previous actions or pump the price to benefit the public remains to be seen. More likely, Trump will release new positive news for this crypto “backyard” that can be cashed out at any time on September 1.

From a crypto perspective alone, with US stocks pulling from the outside and policy support from within, the independent trend of the crypto market is fading. But whether inside or out, it all seems closely tied to Trump. Ultimately, as the politicization of the crypto market continues, Trump and the crypto world are already inextricably linked.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.