FIL +121.32% on 24-Hour Surge Amid Market Volatility

- FIL surged 121.32% in 24 hours to $2.328 but fell 748.51% in 7 days, highlighting extreme market volatility. - Analysts attribute the spike to algorithmic trading and speculative strategies, with technical indicators showing overbought conditions. - Historical patterns suggest rapid gains often precede steep corrections, raising concerns about FIL's long-term bearish trend.

On AUG 28 2025, FIL rose by 121.32% within 24 hours to reach $2.328, while registering a 748.51% drop within 7 days, a 234.11% decline over 1 month, and a staggering 5283.67% fall over the past year.

The recent price surge highlights the extreme volatility currently affecting the FIL market. While short-term traders have benefited from the sharp increase in the last 24 hours, the broader picture over a longer time frame remains grim. The 7-day performance, for instance, indicates significant uncertainty in market sentiment and suggests that any positive momentum is short-lived. Analysts have noted that such erratic behavior is not uncommon in markets with low liquidity or high speculative activity.

(text2img)

Technically, FIL has experienced a dramatic breakout over the past day, which aligns with key resistance levels that had previously prevented upward movement. This breakout appears to be driven by a concentrated buying interest that emerged overnight. However, historical patterns show that such rapid gains are often followed by steep corrections, as seen in the 7-day and 1-month declines. The use of technical indicators like RSI and MACD has shown overbought conditions, suggesting caution for traders considering long positions.

(text2visual)

The price movement has also sparked debate among market participants regarding the underlying causes of the spike. While no major on-chain events were reported, some observers have speculated that the rise may have been triggered by a combination of algorithmic trading and market-making strategies. These mechanisms can create artificial price swings in highly leveraged or thinly traded assets. The broader ecosystem has yet to determine whether the rise will have a lasting impact or if it will be followed by a continuation of the bearish trend.

Backtest Hypothesis

The technical indicators used to analyze the recent FIL price action can form the basis for a backtesting strategy. A strategy could be constructed to enter long positions when FIL breaks above key resistance levels confirmed by volume expansion and MACD crossover. The strategy would then aim to exit before the RSI indicates overbought levels or before a bearish divergence appears. Given the recent price trajectory, backtesting could focus on whether such signals would have produced profitable outcomes in similar past scenarios.

(backtest_stock_component)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

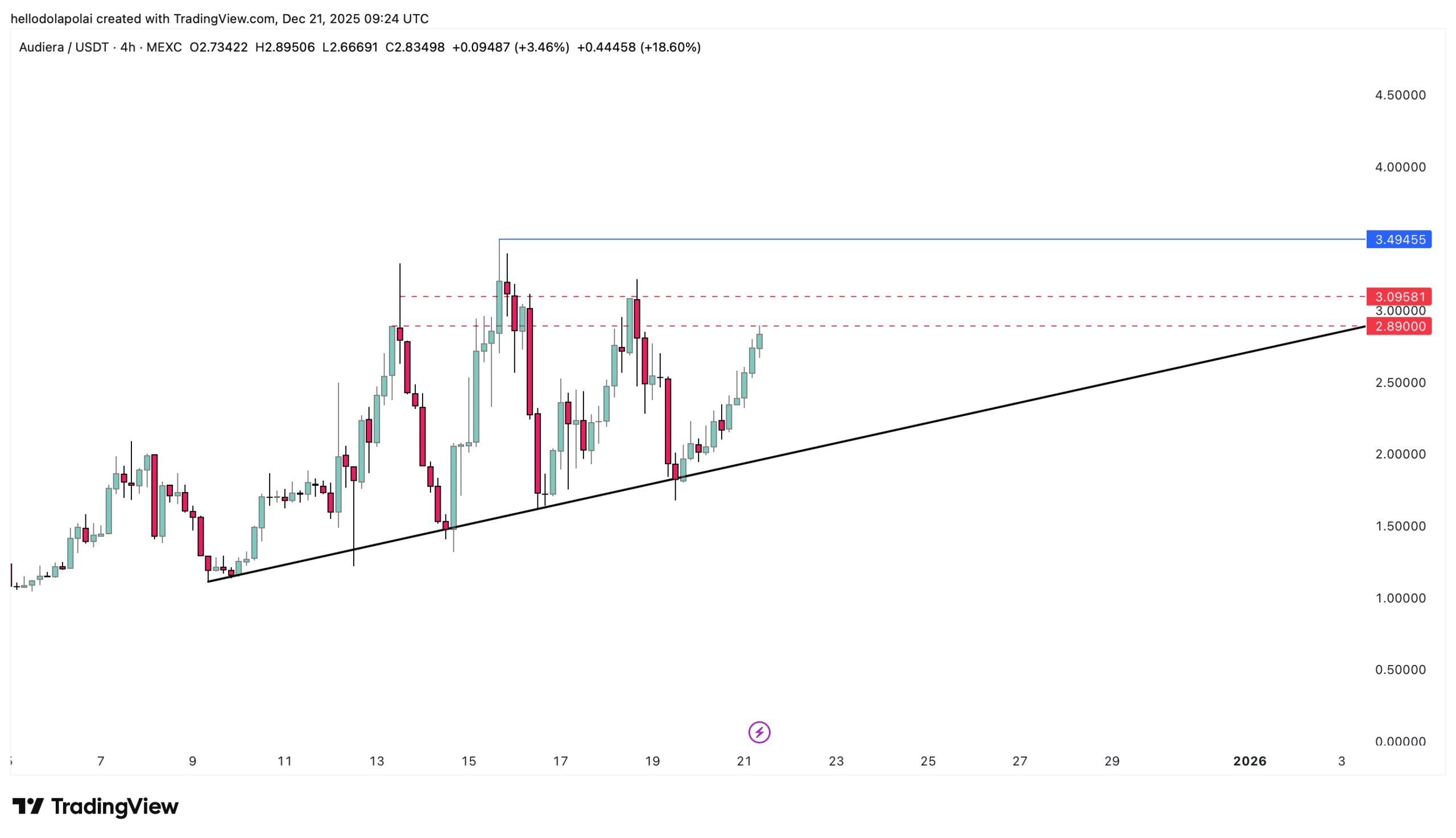

BEAT heats up, rallies 30%! A key level stands before Audiera’s ATH

Trending news

MoreDTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

Bitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low