Token Valuation Remains Unclear, Artemis Introduces Smart Circulating Supply Drawing on Stock Market Experience

Introducing dual standards of "circulating supply" and "intelligent circulating supply" to enhance the transparency of crypto asset valuation.

Original Author: Artemis

Translation: Odaily

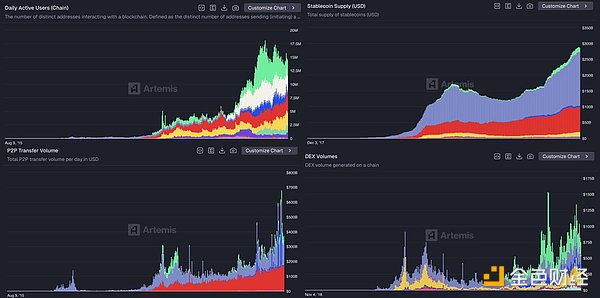

Editor's Note: The crypto world has long suffered from chaotic valuation systems—supply data for the same token can vary dramatically across different platforms, leading to distorted market cap calculations and inaccurate investment decisions. While traditional stock markets have long adopted standardized indicators such as shares outstanding, on-chain valuations are still in a rough exploratory phase. Recently, Artemis and Pantera Capital proposed the "Outstanding Supply" framework, introducing the mature concept of shares outstanding from the stock market into crypto by excluding protocol-held and other non-circulating tokens, thus providing the industry with a value benchmark comparable to traditional finance. This transformation could become a key infrastructure for institutional capital entry and may even reshape the entire valuation paradigm for crypto assets.

Editor's Note: The crypto world has long suffered from chaotic valuation systems—supply data for the same token can vary dramatically across different platforms, leading to distorted market cap calculations and inaccurate investment decisions. While traditional stock markets have long adopted standardized indicators such as shares outstanding, on-chain valuations are still in a rough exploratory phase. Recently, Artemis and Pantera Capital proposed the "Outstanding Supply" framework, introducing the mature concept of shares outstanding from the stock market into crypto by excluding protocol-held and other non-circulating tokens, thus providing the industry with a value benchmark comparable to traditional finance. This transformation could become a key infrastructure for institutional capital entry and may even reshape the entire valuation paradigm for crypto assets.

The following is the full content, translated by Odaily:

Summary

Currently, crypto data providers show huge discrepancies in supply metrics for the same token, which can severely affect calculations of market cap or valuation multiples (such as market cap/revenue ratio). Artemis and Pantera Capital jointly propose a simple framework called "Outstanding Supply," calculated as total supply minus protocol holdings. This model is similar to the "shares outstanding" concept in the stock market (i.e., total issued shares minus treasury shares). Our goal is to enable investors to make clearer like-for-like comparisons between tokens and stocks when conducting valuations.

Introduction

When buying stocks, investors typically focus on several key data points to understand the number of shares:

- Authorized Shares—the maximum number of shares a company is legally allowed to issue;

- Issued Shares—the total number of shares actually issued by the company;

- Outstanding Shares—the total number of shares held by all investors (excluding treasury shares held by the company);

- Float—the number of shares actually available for public trading.

Why are these data points crucial?

Because these indicators help investors clarify:

- Ownership—the economic interest in the company corresponding to the shares purchased by investors;

- Supply Risk—the number of additional shares that may enter the market in the future;

- Liquidity—the extent to which stocks can be traded smoothly without significantly affecting the price.

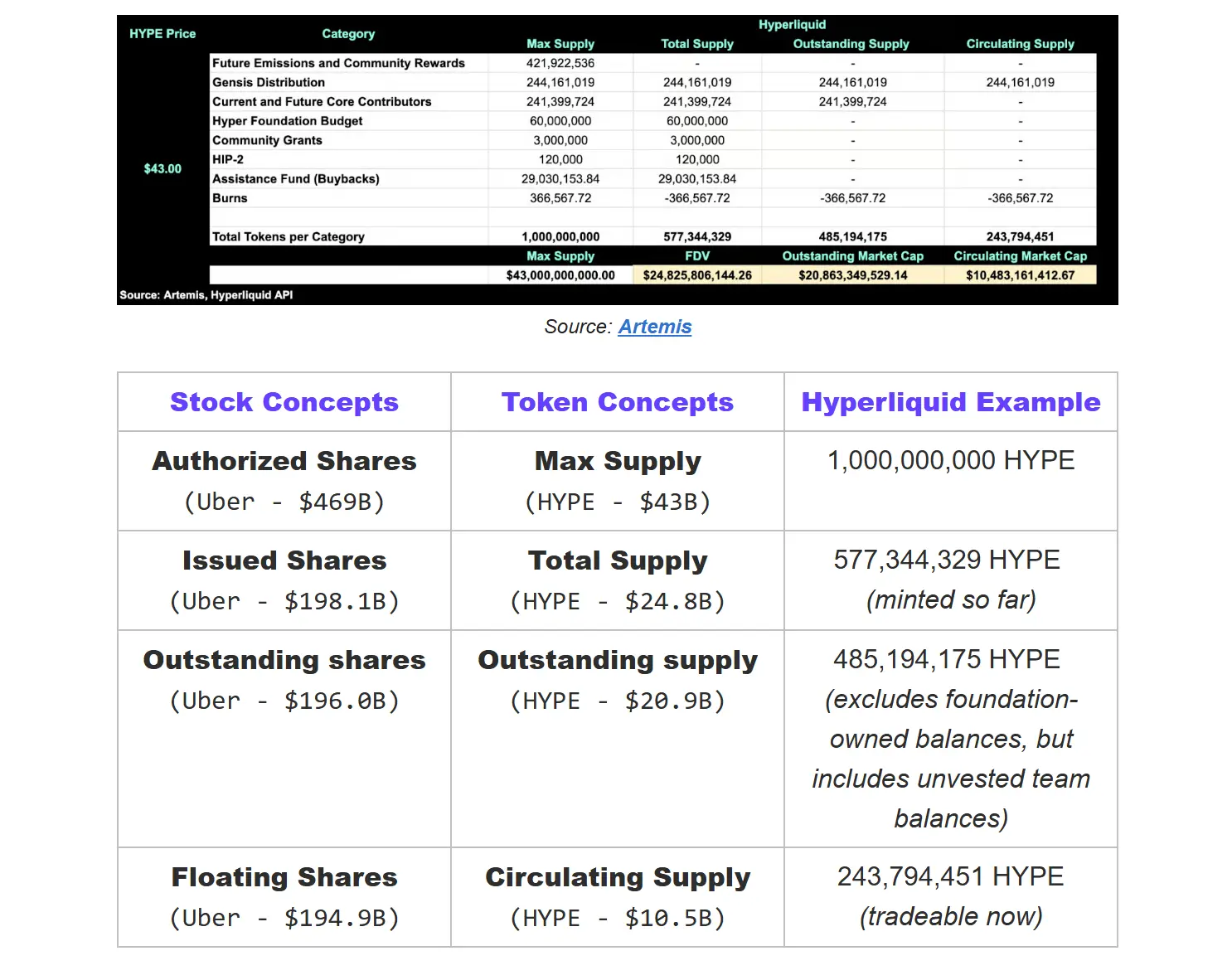

Source: Artemis

Let's take Uber as an example for in-depth analysis:

- Authorized Shares: 5 billion shares → the maximum number of shares Uber is legally allowed to issue. Public market investors almost never refer to authorized shares;

- Issued Shares: about 2.1 billion shares → the total number of shares actually issued by Uber;

- Outstanding Shares: about 2.09 billion shares → the number of shares currently held by Uber investors. This is the share count that public market investors truly care about;

- Float: about 2.07 billion shares → the number of shares actually available for trading in the market.

Imagine: if Uber were valued based on authorized shares, its market cap would soar to $469 billion, and its expected P/E ratio would jump to 70x—clearly unreasonable. Authorized shares have never been used by investors as a basis for corporate valuation, because "authorized shares × share price" does not reflect real economic value.

In reality, investors value Uber based on outstanding shares (about 2.09 billion shares). As of August 17, 2025, its market cap is about $195.9 billion, with an expected P/E ratio of 30x. Outstanding shares truly reflect the economic ownership distribution of the company's value.

The Problem with Current Token Supply Metrics

Crypto investors currently mainly refer to "circulating supply," i.e., the number of tokens available for trading on the open market. But this metric has serious flaws:

- Some statistics include locked tokens, others exclude them;

- Some count treasury wallet holdings, others exclude them;

- Whether burned tokens are deducted varies by standard;

- Projects may quietly release tokens without clear disclosure.

Meanwhile, the commonly used FDV (Fully Diluted Valuation) also has issues: FDV = token price × total supply. This is like valuing Uber based on authorized shares—assuming all shares are immediately tradable, resulting in a bloated $469 billion market cap, which is clearly not economically realistic.

Thus, investors face a dilemma: either choose a distorted FDV (which includes all potential supply), or use a confusing and inconsistent "circulating supply" (whose key flaw is often excluding issued but not yet unlocked tokens).

Why is "Outstanding Supply" the best compromise?

"Outstanding Supply" counts all tokens that have been generated, while excluding balances held by the protocol (such as foundations, treasuries, or labs—i.e., non-circulating assets), making it the crypto equivalent of "shares outstanding."

- Compared to FDV: more accurately reflects economic reality;

- Compared to traditional circulating supply: clearer definition, more unified standard;

- This metric is rooted in economic substance and provides investors with a reliable intermediate benchmark.

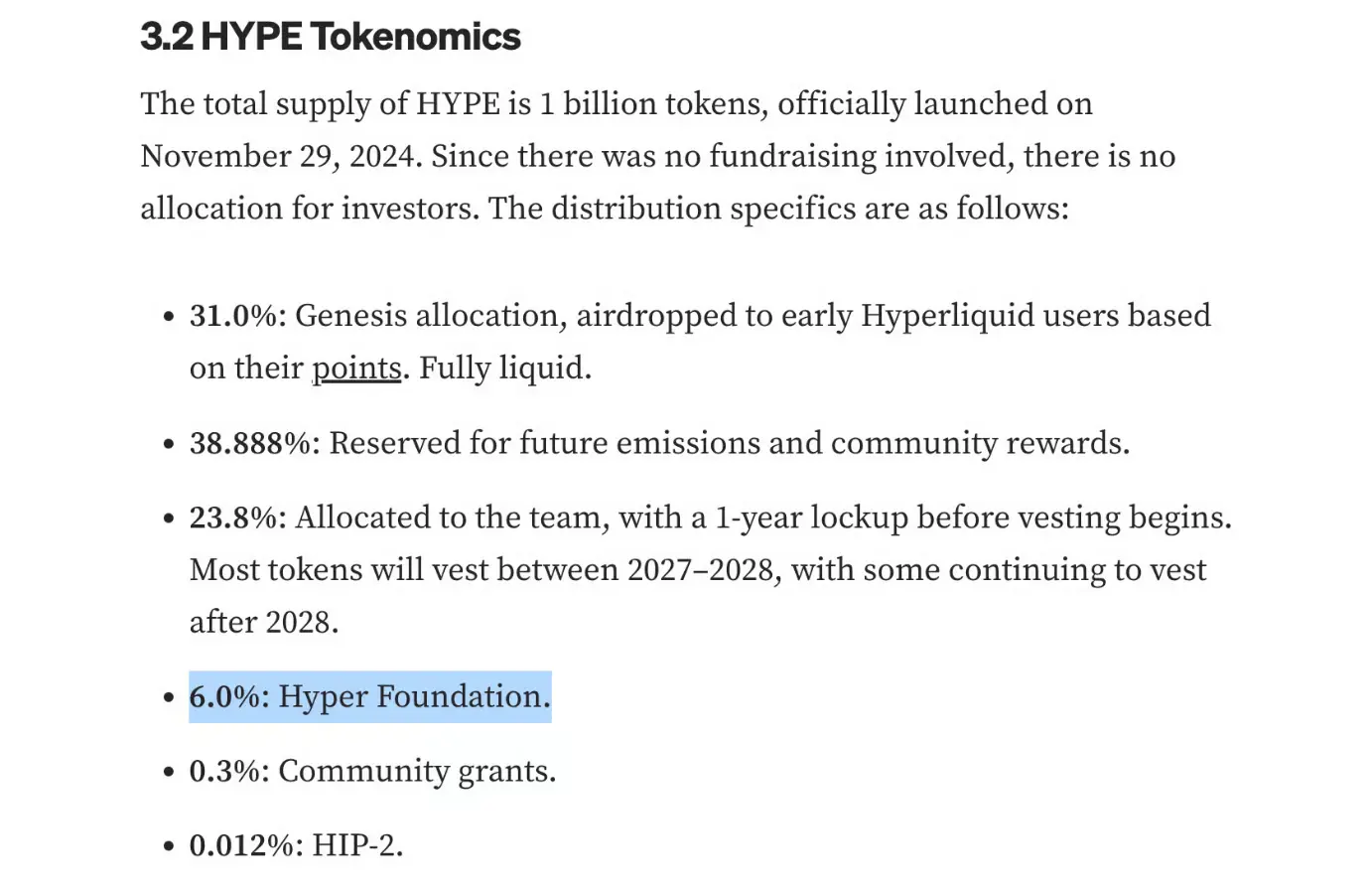

Real Token Example - Hyperliquid

Why is the Outstanding Supply metric crucial?

For a long time, the crypto space defaulted to using FDV (Fully Diluted Valuation) = max supply × price as the valuation method. This is like valuing Uber at $469 billion using its 5 billion authorized shares, rather than the roughly $196 billion market cap typically shown on Google Finance.

The industry then shifted to using total supply for valuation, but this still overestimates actual value—because total supply includes all tokens held by the protocol. Take Hyperliquid as an example: of its 1 billion HYPE tokens, 6% (60 million) are held by the Hyper Foundation. These are assets controlled by the protocol, which can be used for operational expenses, ecosystem grants, or team incentives, and their economic attributes are fundamentally different from tokens held by investors.

Source: Mint Ventures

Therefore, Hyperliquid's outstanding supply valuation (about $20.8 billion) is closest to its real market cap. This is similar to the concept of shares outstanding in the stock market—excluding treasury shares, it's the total amount of tokens actually held by all investors.

In contrast, its circulating supply valuation (about $10.5 billion) is closer to the actual tradable token volume, similar to the float in stocks.

These supply metrics are crucial because valuation multiples such as P/E or P/S ratios calculated based on FDV are artificially inflated—this in effect penalizes projects like Hyperliquid that hold large amounts of unreleased tokens, putting them at a disadvantage in peer comparisons.

Note: Our definition of total supply differs from CoinGecko. CoinGecko counts all tokens (regardless of ownership), while we deduct permanently burned and unminted tokens to ensure total supply truly reflects the number of existing tokens affecting valuation.

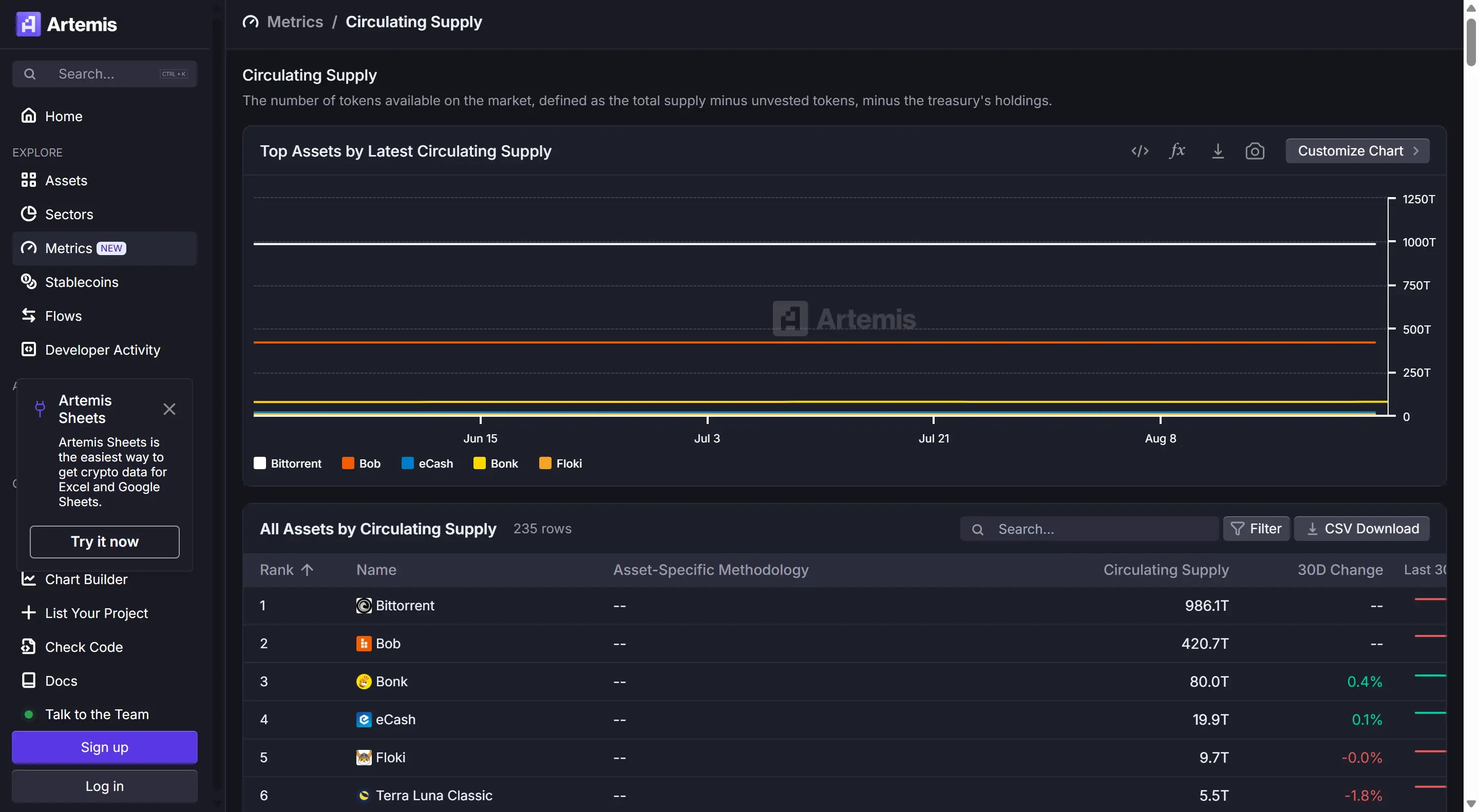

Why do current data sources conflict?

Currently, when investors look up HYPE tokens, different data platforms present completely different numbers:

DefiLlama shows a circulating FDV of $27.8 billion. Based on a token price of $43, this assumes a circulating supply of about 647 million tokens—even exceeding the current 577 million actually minted.

CoinGecko's circulating supply valuation is $14.5 billion, implying a circulating supply of about 337 million tokens.

But this number is likely overestimated, as CoinGecko does not exclude all protocol-held wallets (such as the Hyper Foundation, Community Grant Fund, and Relief Fund). In reality, a large number of these tokens have not yet entered the market, so the true circulating supply should be even lower.

The problem is, these discrepancies can lead to valuation differences of billions of dollars. Without unified standards, different investors will have vastly different perceptions of the scale of the same token.

This is precisely why we need to promote "Outstanding Supply" and "Smarter Circulating Supply." Standardizing token outstanding supply not only enhances transparency but also enables horizontal comparability with stock valuation systems.

Artemis Solution: Launching New Standards for Outstanding Supply and Smart Circulating Supply

Total Supply

Definition: The total number of tokens that have been generated (minted), minus those that have been burned. This is comparable to "issued shares" in the stock market.

Calculation formula: Total Supply = Max Supply - Unminted Tokens - Burned Tokens

Outstanding Supply (New Metric)

Definition: Of all existing tokens, excludes those held by the protocol itself (including foundations, DAOs, labs, or vesting distribution contracts). The reason for excluding protocol-held tokens is similar to excluding treasury shares in the stock market—these tokens exist but do not belong to external investors. Only externally held tokens reflect true ownership, liquidity, and market value. This is comparable to "shares outstanding" in the stock market.

Source: Artemis

Calculation formula: Outstanding Supply = Total Supply - Protocol Holdings

Protocol holdings include:

- DAO/Foundation Holdings—tokens held by entities responsible for governance or ecosystem development;

- Lab Holdings—tokens held by lab entities that perform protocol management functions in the absence of an independent foundation (such as ecosystem funds, distribution managers);

- Programmatic Distribution Contracts—smart contracts that automatically release tokens to the ecosystem according to preset rules;

- Idle Funds—tokens in on-chain funds managed by validator governance that have not yet been deployed (require decentralized voting to be released);

- Buyback Reserves (not yet burned)—tokens bought back by the protocol but not yet burned.

Smart Circulating Supply (Optimized Metric)

Definition: The number of tokens currently available for immediate trading. Excludes locked tokens, not-yet-unlocked internal/team holdings, and illiquid treasury wallets. This is comparable to "float" in the stock market.

Source: Artemis

Calculation formula: Circulating Supply = Outstanding Supply - Locked Tokens

Why are dual metrics needed?

- Transparency—clearly distinguishes between generated tokens and those actually available for trading;

- Risk Assessment—anticipates potential future supply that may enter circulation;

- Standardization—eliminates statistical ambiguities between different projects;

- True Market Cap—precise circulating supply means more accurate valuations;

- Comparability—enables standardized cross-project comparisons.

Key Takeaways:

The stock market does not require guessing the number of shares or potential supply, and this clarity builds market trust.

The crypto space should be the same. If the industry wants to gain institutional trust, it must provide institutional-level transparency. Through the standards of outstanding supply and smart circulating supply, investors will finally gain a level of transparency equivalent to that of traditional financial markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nobel laureate criticizes: "Trump trade" is collapsing

Unlock cross-chain liquidity, Avail Nexus helps you seamlessly experience Monad applications

Monad is dedicated to achieving ultimate performance, while Avail Nexus focuses on unlimited scalability and seamless access.

Even the ex-boyfriend of ChatGPT's creator was robbed of over 10 million dollars—how crazy are foreign robberies?

Crypto enthusiasts no longer dare to flaunt their wealth.