LPT -858.22% 24Hr Drop Amid Sharp Volatility

- LPT plummeted 858.22% in 24 hours, reversing a 624.53% weekly surge, highlighting extreme speculative volatility. - Technical indicators showed conflicting signals: oversold RSI suggested rebounds, while bearish MACD signaled continued decline. - A backtesting strategy evaluated 5-day trades with 12% profit targets and 8% stop-losses to assess short-term volatility exploitation. - The 1263.06% monthly gain contrasted with a 5334.8% annual drop, underscoring LPT's unpredictable long-term trajectory.

On AUG 29 2025, LPT dropped by 858.22% within 24 hours to reach $6.603, LPT rose by 624.53% within 7 days, rose by 1263.06% within 1 month, and dropped by 5334.8% within 1 year.

The dramatic 24-hour decline in LPT marked a sharp reversal from a 624.53% rally over the preceding week, reflecting the extreme volatility typically observed in speculative assets. This rapid drop suggests a sudden shift in sentiment, potentially triggered by algorithmic trading activity or an exodus of large position holders. The 624.53% weekly gain, however, underscores a robust recovery from a longer-term bearish trend, indicating potential short-term momentum reversal or speculative positioning.

Technical indicators have shown mixed signals in recent sessions. The RSI crossed into oversold territory following the sharp drop, suggesting a possible short-term rebound. However, the MACD remains bearish, with the signal line continuing to trend downward. This divergence between momentum and trend indicators complicates the immediate outlook, as traders weigh the potential for a bounce against the prevailing downward trajectory.

Backtest Hypothesis

A backtesting strategy was applied to evaluate potential exit points and risk-reward ratios based on LPT’s recent volatility. The strategy assumes a maximum holding period of 5 days, with a 12% take-profit threshold and an 8% stop-loss level. These parameters are designed to capture short-term swings while limiting downside exposure. The model aims to validate whether entering positions during oversold RSI conditions could have yielded favorable outcomes, particularly in the context of LPT’s sharp price corrections. The results of the backtest, including trade-by-trade performance and key metrics, are available for review in an interactive panel.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

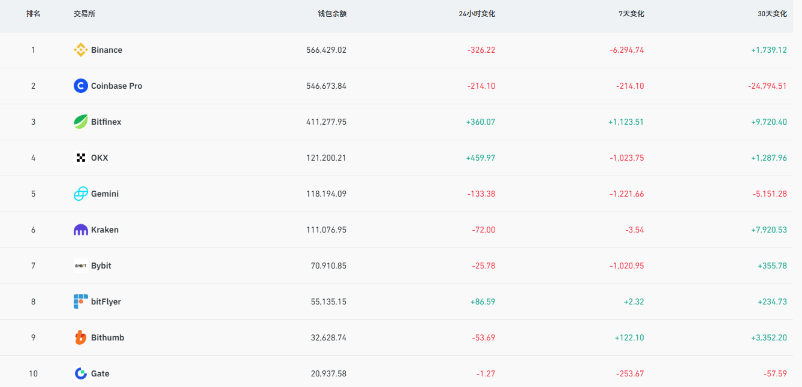

Nearly 10,000 bitcoins withdrawn from exchanges, is the market about to change direction?

Bitcoin ’rallies are for selling‘: Top 3 arguments from BTC market bears

XRP bulls grow louder: What will spark the breakout toward $2.65?