Conflux (CFX) Network Upgrade and Regulatory Tailwinds: A Strategic Entry Point for Risk-Tolerant Investors

- Conflux Network (CFX) launches v3.0.0/3.0.1 hardforks in August 2025, boosting scalability to 15,000 TPS and enhancing EVM compatibility for enterprise adoption. - China's yuan-backed stablecoin initiatives and Hong Kong's regulatory clarity create cross-border payment opportunities for CFX's AxCNH stablecoin and BRI partnerships. - Despite on-chain activity concentration and price volatility, CFX's hybrid consensus model and institutional-grade features position it as a strategic long-term investment fo

The Conflux Network (CFX) is undergoing a transformative phase in 2025, marked by a series of technical upgrades and strategic regulatory alignment that position it as a compelling long-term investment for risk-tolerant investors. The v3.0.0 and v3.0.1 hardforks, launched in August 2025, have introduced groundbreaking improvements in scalability, EVM compatibility, and institutional-grade features, while China’s evolving regulatory landscape—particularly its push for yuan-backed stablecoins—creates a tailwind for CFX’s cross-border utility.

Technical Upgrades: A Foundation for Scalability and Developer Adoption

The v3.0.0 hardfork, effective 1 August 2025, introduced CIP-142, a parallel EVM execution framework that theoretically enables up to 15,000 transactions per second (TPS), a critical leap for enterprise and AI-driven decentralized applications [1]. Complementing this, CIP-148 provides AI agent smart contract templates, while CIP-150 streamlines gas fee delegation, addressing institutional pain points such as transaction cost volatility [1]. The subsequent v3.0.1 hardfork, scheduled for 31 August 2025, further optimized EVM compatibility and RPC reliability, ensuring seamless integration with existing Ethereum tooling [3]. These upgrades are not merely incremental but represent a strategic pivot toward enterprise adoption, particularly in China’s Belt and Road Initiative (BRI) corridors, where Conflux’s hybrid PoW/PoS consensus model aligns with regulatory demands for security and compliance [3].

The launch of the CFX DevKit on 19 August 2025 further lowers barriers for developers, offering streamlined node management and cross-space contract development tools [1]. This ecosystem-building effort is critical, as on-chain activity remains underwhelming compared to 2022 levels, with transaction volume concentrated among a small number of accounts [4]. However, the v3.0.1 upgrade’s temporary halt of CFX deposits and withdrawals by Binance (1 September 2025) underscores the network’s prioritization of stability, a necessary trade-off for long-term institutional trust [2].

Regulatory Tailwinds: Yuan-Backed Stablecoins and Cross-Border Payments

China’s 2025 regulatory environment is increasingly favorable for blockchain projects that align with its geopolitical and economic objectives. The State Council’s exploration of a yuan-backed stablecoin roadmap has created a niche for Conflux’s AxCNH stablecoin, which is designed to facilitate BRI cross-border transactions [1]. By partnering with fintech firm AnchorX and state-backed entities like China Telecom, Conflux is positioning itself as a bridge between China’s tightly regulated digital economy and global trade settlements [3].

Hong Kong’s Stablecoins Ordinance, effective 1 August 2025, adds another layer of regulatory clarity. The regime mandates 100% reserve backing and AML/CFT protocols, aligning with Conflux’s offshore yuan-pegged stablecoin strategy [2]. This regulatory sandbox not only legitimizes CFX’s cross-border ambitions but also attracts institutional investors wary of China’s domestic crypto ban [2]. The Belt and Road Initiative’s reliance on digital yuan alternatives further amplifies CFX’s utility, as Conflux 3.0’s 15,000 TPS throughput directly addresses the scalability needs of high-volume trade settlements [5].

Challenges and Risks: Navigating Regulatory and Market Volatility

Despite these positives, risks persist. China’s strict capital controls and limited yuan convertibility could hinder the global circulation of AxCNH, even as Hong Kong’s licensing framework provides a partial solution [2]. Additionally, Conflux’s on-chain activity remains underwhelming, with gas usage concentrated among a small number of accounts—a red flag for organic adoption [4]. The recent bearish trend in CFX’s price, despite bullish regulatory news, suggests market skepticism about the token’s fundamentals [1].

However, these challenges are not insurmountable. Conflux’s hybrid consensus model and partnerships with McDonald’s China and Eastcompeace Technology demonstrate its ability to navigate regulatory complexity while maintaining technical innovation [3]. The v3.0.1 hardfork’s focus on stability and compatibility also signals a long-term commitment to enterprise-grade infrastructure, a critical differentiator in a crowded blockchain market.

Investment Thesis: Strategic Entry for Risk-Tolerant Investors

For investors willing to tolerate short-term volatility, CFX presents a compelling case. The v3.0.0/3.0.1 upgrades have laid the groundwork for institutional adoption, while China’s regulatory pivot toward yuan-backed stablecoins creates a unique value proposition. Analysts project CFX could reach $4.15 by 2031, driven by cross-border payment demand and BRI-driven infrastructure projects [1].

The key question is whether Conflux can sustain developer and institutional momentum post-upgrade. The CFX DevKit and AI agent templates are strong first steps, but broader adoption will depend on real-world use cases—such as the AxCNH stablecoin’s integration into BRI trade networks. For now, the alignment of technical innovation with regulatory tailwinds makes CFX a strategic entry point for investors betting on China’s blockchain-driven economic modernization.

Source:

[1] Conflux Network’s v3.0.0 and v3.0.1 hardfork details

[2] Hong Kong’s Stablecoins Ordinance and Conflux’s AxCNH stablecoin

[3] Conflux’s hybrid consensus model and BRI partnerships

[4] On-chain activity and gas usage trends

[5] Conflux 3.0’s TPS and cross-border payment capabilities

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chevron Gives Green Light to Expand Leviathan Gas Project in the Eastern Mediterranean

Bitcoin Momentum Recovery: The Critical Juncture That Could Spark a Dramatic Rally

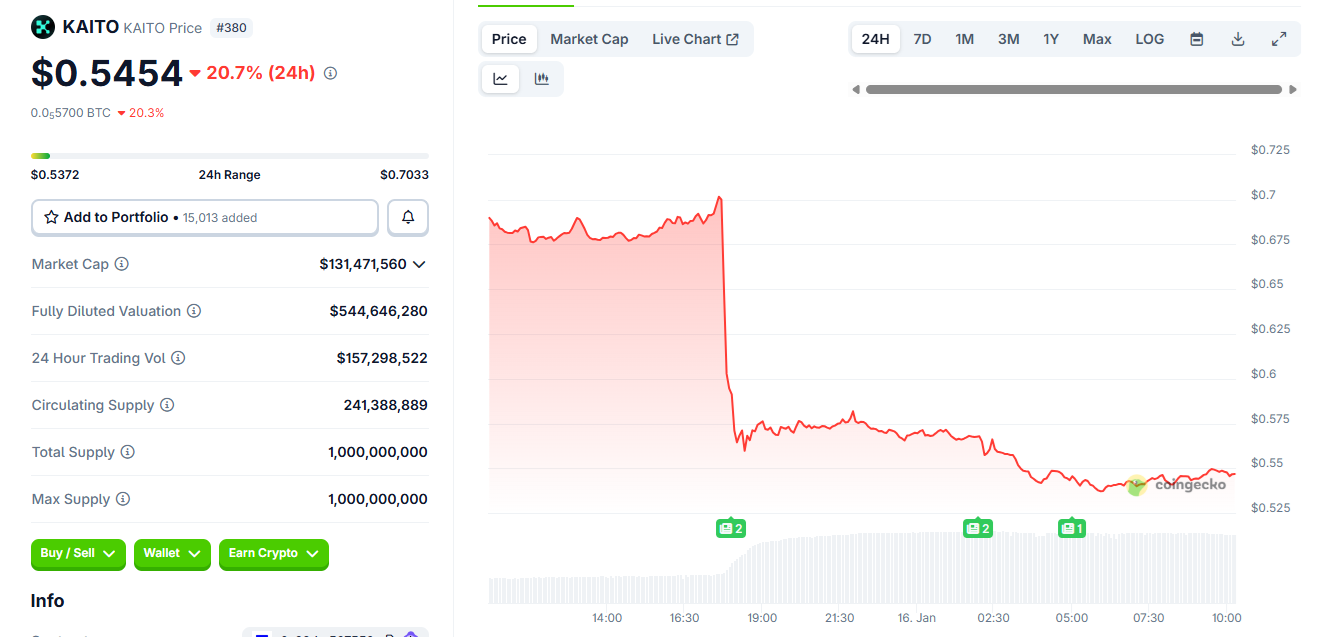

Kaito retires Yaps as token falls near all-time lows

The US Treasury market is experiencing a level of stagnation that is approaching record highs