Bitcoin News Today: Institutional Moves Signal Altcoin Breakout as Bitcoin's Grip Eases

- Bitcoin's market dominance declines as capital shifts to altcoins like Solana and Ethereum, signaling potential altseason patterns. - Solana's "golden cross" and "megaphone" technical patterns, plus $1B+ institutional funding plans, suggest imminent price breakouts. - Ethereum surges 40% against Bitcoin, while Litecoin and Chainlink show breakout potential amid easing regulatory uncertainty. - Historical data and macroeconomic factors indicate 2025 could see renewed altcoin momentum post-Bitcoin halving

The potential emergence of a new "altseason" in the cryptocurrency market is gaining traction as Bitcoin's dominance appears to wane, with capital flows shifting toward alternative coins. This development follows a pattern seen in past market cycles, where Bitcoin's relative strength softens and high-beta assets like Solana , Ethereum , and others rally. Analysts are monitoring technical indicators and institutional activity to gauge whether this trend will accelerate.

A key signal comes from the Solana (SOL) vs. Bitcoin (BTC) chart, where a "golden cross" — a technical indicator where the 50-day simple moving average crosses above the 200-day — has historically preceded significant rallies in both the SOL/USD and broader altcoin markets. In 2021 and 2023, such a crossover was followed by over 1,000% gains in the SOL/USD pair. As of now, SOL/BTC is nearing a similar golden cross, suggesting a potential breakout in the coming weeks. Analyst Ran Neuner notes that these setups "have historically fueled parabolic rallies" and are "screaming for a major move" in Solana’s price [1].

In addition to the golden cross, Solana is also forming a "megaphone" pattern, a technical formation often associated with large price breakouts. The upper boundary of this pattern is currently near the $295–$300 level, a critical resistance area expected to be tested by October. Solana’s price remains above both its 50-week and 200-week exponential moving averages, and the weekly RSI remains in bullish territory. Institutional demand is also growing, with plans from Galaxy Digital , Jump Crypto, and Multicoin Capital to raise over $1 billion for a Solana treasury fund, potentially fueling further upside [1].

Ethereum (ETH) is also showing strength against Bitcoin, having surged nearly 40% since June and eyeing $7,000–$7,500 targets. This outperformance is often considered an early sign of an altseason, as capital rotates from Bitcoin into higher-growth assets. Chainlink (LINK) and Litecoin (LTC) are also gaining traction, with the former breaking a multi-year falling wedge pattern and the latter testing a breakout above $135. Analysts suggest that LTC could reach $220, with a 40% relative upside against Bitcoin [3].

The broader crypto market appears to be priming for a shift in momentum, with Bitcoin's dominance slipping into the high-50s. While Bitcoin remains near $115k, this easing dominance is a classic precursor to altcoin rotations. Analysts note that a steady Bitcoin price with declining dominance typically precedes broader altcoin rallies, particularly for leaders like Solana, Cardano , and Polkadot . This dynamic is often reinforced by macroeconomic conditions and the easing of regulatory uncertainty, which encourage investors to take on higher-risk assets [2].

With historical patterns aligning and institutional support growing, the stage seems set for a potential altseason in 2025. If Bitcoin maintains its stability while altcoin flows increase, Solana and other high-beta tokens could see renewed momentum. This could be further supported by the expected liquidity expansion in the year following a Bitcoin halving event, a pattern that historically favors altcoin performance. As the market continues to evolve, investors are keeping a close eye on technical levels, institutional moves, and macroeconomic signals to determine whether a new altseason is indeed on the horizon.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

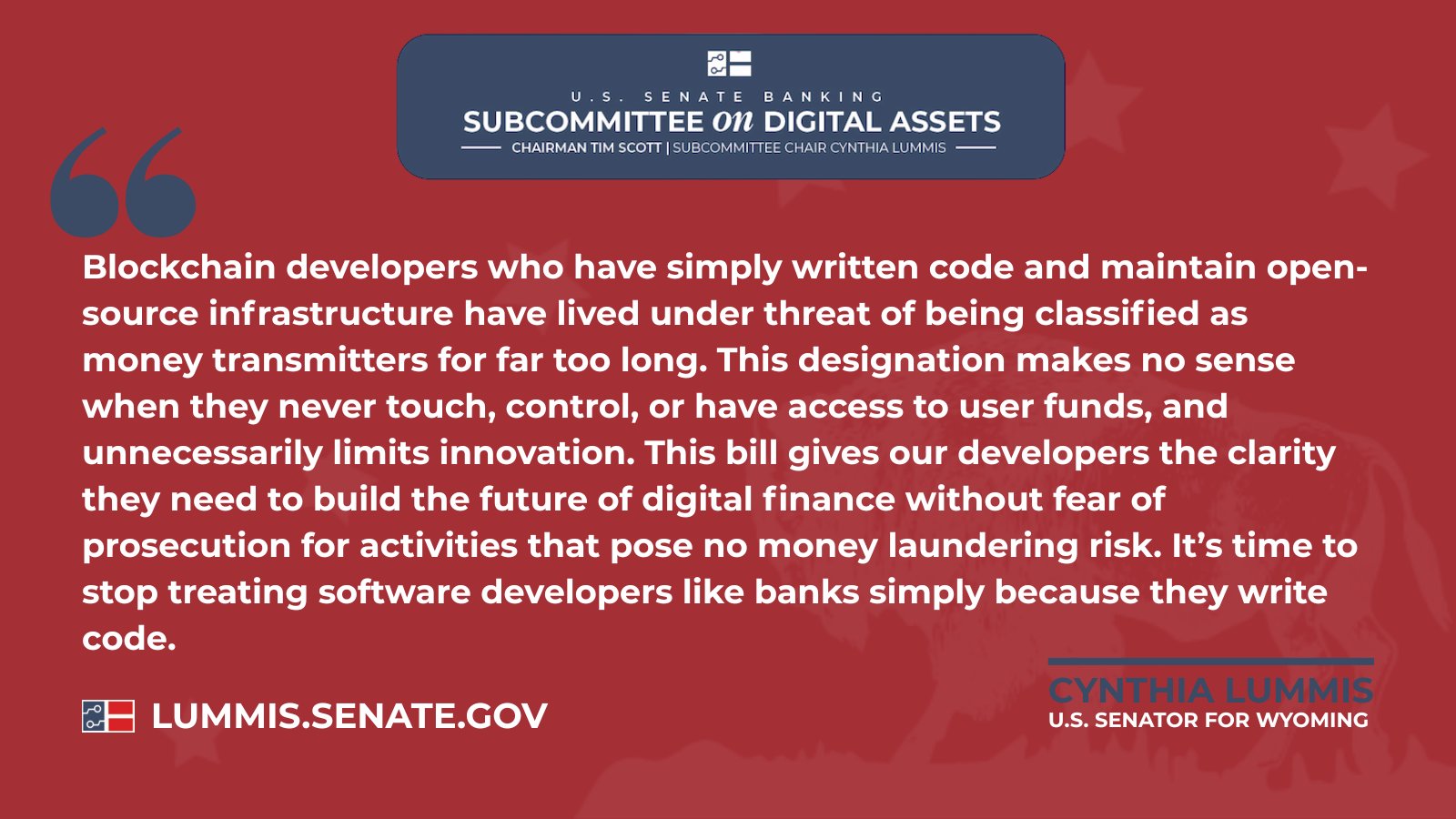

Senate Judiciary flags DeFi oversight ‘gaps’ in U.S. crypto bill

Morph Integrates RedStone Oracle for Real-Time, Secure Pricing for On-Chain Payments

SwissBorg Hooks Base for Killer Crypto Swaps – Kriptoworld.com

TRON Holds Long-Term Ascending Channel as Weekly Trend Stays Firm