Date: Sun, Aug 31, 2025 | 06:15 AM GMT

The cryptocurrency market continues to navigate choppy waters as Ethereum (ETH) hovers around $4,450, down from its recent high of $4,954, reflecting a 6% weekly decline. Yet, ETH is back in green today, and several altcoins are also showing signs of recovery.

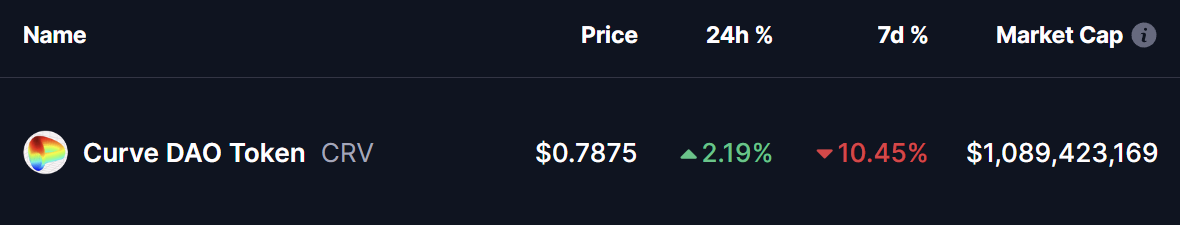

Among them, Curve DAO Token (CRV) is flashing an interesting technical signal, with its chart now forming a harmonic pattern setup that could lay the foundation for a potential upside move.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Taking Shape

On the daily chart, CRV is carving out a Bearish ABCD harmonic pattern. Despite the bearish name, this type of structure often features a strong bullish CD-leg rally before price eventually tests its Potential Reversal Zone (PRZ).

The setup began with a rally from Point A ($0.4918) to Point B, followed by a retracement down to Point C ($0.7481) — where buyers managed to defend the 100-day moving average (MA). Since then, CRV has bounced back to around $0.7838, suggesting that the CD-leg could now be unfolding.

Curve DAO Token (CRV) Daily Chart/Coinsprobe (Source: Tradingview)

Curve DAO Token (CRV) Daily Chart/Coinsprobe (Source: Tradingview)

A critical test lies ahead at the 50-day MA ($0.9062). A decisive breakout and sustained move above this resistance would strengthen the bullish outlook, signaling that the harmonic projection is in play.

What’s Next for CRV?

If bulls maintain momentum and push CRV above the 50-day MA, the token could extend higher toward the 1.62 Fibonacci PRZ near $1.411. Such a move would represent an 80%+ potential upside from current levels, giving traders plenty to watch for.

However, risks remain. A breakdown below the 100-day MA support at $0.7578 would invalidate the pattern, exposing CRV to renewed bearish pressure and possible retests of lower support levels.