How Many Cryptocurrencies Actually Died Between 2021 And 2025?

Contents

Toggle- What is a “Dead” Coin?

- Year-by-Year Breakdown: 2021 to 2025

- Two Case Studies: Squid Game Token & TerraUSD (UST)

- Major Reasons for Coin Deaths

- Rug Pulls and Ponzi Schemes

- Teams Abandoning Projects After Fundraising

- Tokenomics That Caused Unsustainable Inflation or Zero Demand

- External Factors: Hacks, Regulatory Crackdowns, Market Collapse

- Poor Community Engagement and Communication

- What This Means for the Future of Crypto Innovation

From 2021, the crypto industry witnessed an unprecedented surge in new projects and token launches. Fueled by investor FOMO, low interest rates, and the rise of NFTs and DeFi, thousands of new coins entered the market with unique use cases. Market valuations soared, with some tokens achieving billion-dollar market caps within months of launch.

However, the hype cycle eventually gave way to a harsh correction. As market sentiment cooled and liquidity dried up, many projects failed to deliver on their promises. Weak fundamentals, poor management, and outright scams led to the collapse or abandonment of countless tokens, turning them into so-called dead crypto coins.

Tracking these failed crypto projects is critical for both investors and the industry, as it helps identify red flags, improve due diligence practices, and guide future capital allocation toward sustainable innovations rather than short-lived hype.

What is a “Dead” Coin?

A dead crypto coin is a cryptocurrency that has effectively ceased to function as an active project or market asset. Some common criteria for labelling a coin as dead include;

- Being delisted from major exchanges, which removes most avenues for trading.

- Prolonged inactivity on official social media channels, indicating a lack of community engagement or developer updates.

- Abandoned GitHub repositories or other code bases, suggesting the development team is no longer maintaining or improving the project.

- Near-zero trading volume over an extended period, meaning there’s little to no demand or liquidity for the coin.

While a coin doesn’t have to meet all these criteria to be considered dead, the combination of these factors signals that it has lost both technical support and market confidence.

Year-by-Year Breakdown: 2021 to 2025

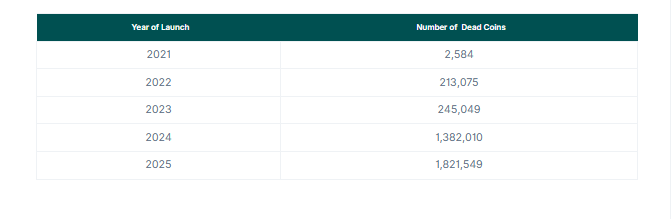

Here’s our dead crypto coins list by year, between 2021 and 2025:

The number of cryptocurrency failures by year, between 2021 and 2025. Source: Coingecko

The number of cryptocurrency failures by year, between 2021 and 2025. Source: Coingecko

Two Case Studies: Squid Game Token & TerraUSD (UST)

In late 2021, Squid Game Token (SQUID) got attention because of its tie to the popular Netflix show Squid Game. The creators promoted it as a play-to-earn project, promising big returns to investors.

But soon after launching, the developers pulled a “rug pull,” selling off their tokens and making the value crash from over $2,800 to almost nothing. The project was abandoned, and investors lost their money.

Similarly, Terra (LUNA) was a well-known cryptocurrency that collapsed in May 2022. Its algorithmic stablecoin, TerraUSD (UST), was designed to stay pegged to the US dollar using a mint-and-burn system with LUNA.

The collapse unfolded in three stages: first, large withdrawals and trades broke UST’s peg, making it unstable. Second, attempts to restore the peg, including swapping billions in USDT and selling Bitcoin reserves, temporarily slowed the decline but ultimately failed.

With the peg broken, UST holders began burning UST to mint LUNA, triggering massive hyperinflation. This caused both UST and LUNA to crash to near zero, wiping out billions and resulting in huge losses for investors.

These are just two case studies among many other coins that have died over the past 5 years. Having considered them, now let’s take a look at the common causes of coin death.

Major Reasons for Coin Deaths

Dead crypto coins rarely vanish without a story. Most fall due to a combination of poor planning, unethical behaviour, or external pressures that wipe out any remaining trust or value.

Rug Pulls and Ponzi Schemes

A rug pull occurs when a project’s developers abruptly withdraw all liquidity or funds, leaving investors with worthless tokens. These scams often start with aggressive marketing, fake partnerships, and unrealistic promises to lure buyers in quickly.

Ponzi-style crypto projects, meanwhile, rely on new investors’ funds to pay earlier participants, creating the illusion of steady returns until the system inevitably collapses.

RELATED: Can DeFi Insurance Products Solve the Problem of Rug Pulls?

Teams Abandoning Projects After Fundraising

Some projects raise millions through token sales, only to have the founding team disappear once they’ve secured the capital. Without continued development, updates, or community support, the token loses all purpose.

In many cases, even well-intentioned teams abandon ship after running out of funds or realizing that the product is not viable.

Tokenomics That Caused Unsustainable Inflation or Zero Demand

Poorly designed tokenomics can sink a project faster than bad press. For example, if too many tokens are released too quickly, inflation can erode value before adoption takes off.

Conversely, tokens with no clear utility or demand drivers quickly lose relevance in the market. Sustainable tokenomics require balanced supply schedules, clear use cases, and incentives for holding rather than dumping.

READ ALSO: Why Tokenomics Are Important in Crypto Projects

External Factors: Hacks, Regulatory Crackdowns, Market Collapse

Even legitimate projects can die due to events outside their control. A major hack can drain liquidity or compromise investor trust, while sudden regulatory bans can force exchanges to delist the token.

Market-wide crashes, like those in 2018 or 2022, can wipe out dead coins with weak reserves or limited adoption, leaving them unable to recover.

RELATED: The Biggest Hacks and Exploits in DeFi History & What We Can Learn From Them

Poor Community Engagement and Communication

A crypto project’s survival often depends on its ability to keep its community informed and engaged. When developers fail to communicate updates, respond to concerns, or deliver promised milestones, investor confidence erodes.

Over time, low community morale and participation lead to lower liquidity, reduced network activity, and eventual delisting from exchanges.

What This Means for the Future of Crypto Innovation

As regulation improves and investor awareness grows, crypto survival rates could rise. Clearer rules can filter out scams, while informed investors avoid hype-driven projects. This shift may create a safer market where credible, well-managed ventures thrive.

Project longevity will hinge on due diligence, real utility, and strong communities. Those offering real solutions and active development are more likely to endure, pushing the industry toward fewer but more resilient cryptocurrencies built on sustainability and trust.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

BEAT heats up, rallies 30%! A key level stands before Audiera’s ATH

Trending news

MoreDTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

Bitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low