Peaks and Pitfalls: Top 10 Crypto Assets Split Between Fresh Highs and Old Lows

Several digital assets have hit all-time highs this year, and just last week ethereum ( ETH) climbed to a price peak not seen since 2021. Below is a look at the leading digital asset market caps, their latest peaks, and how close each coin is to reclaiming those heights.

A Look Down From the Peaks

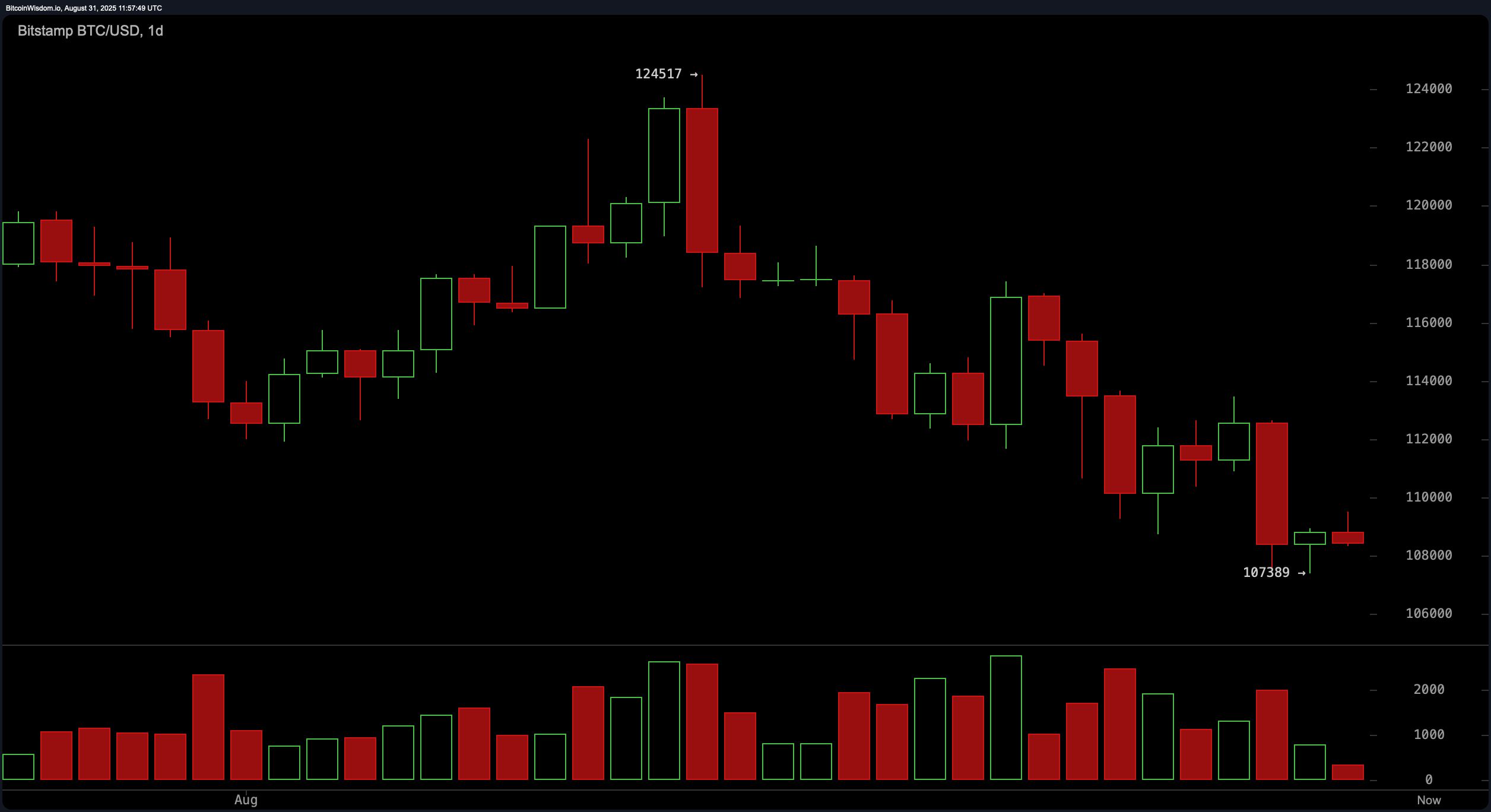

It’s been two weeks since bitcoin (BTC) marked its all-time high, with coingecko.com recording the peak on Aug. 14, 2025, at $124,128 per coin. Other exchanges and coin market cap data aggregation sites report slightly different ATH figures, though all remain fairly close range. At the present value of $108,693 per coin, BTC trades 12.5% below its all-time high.

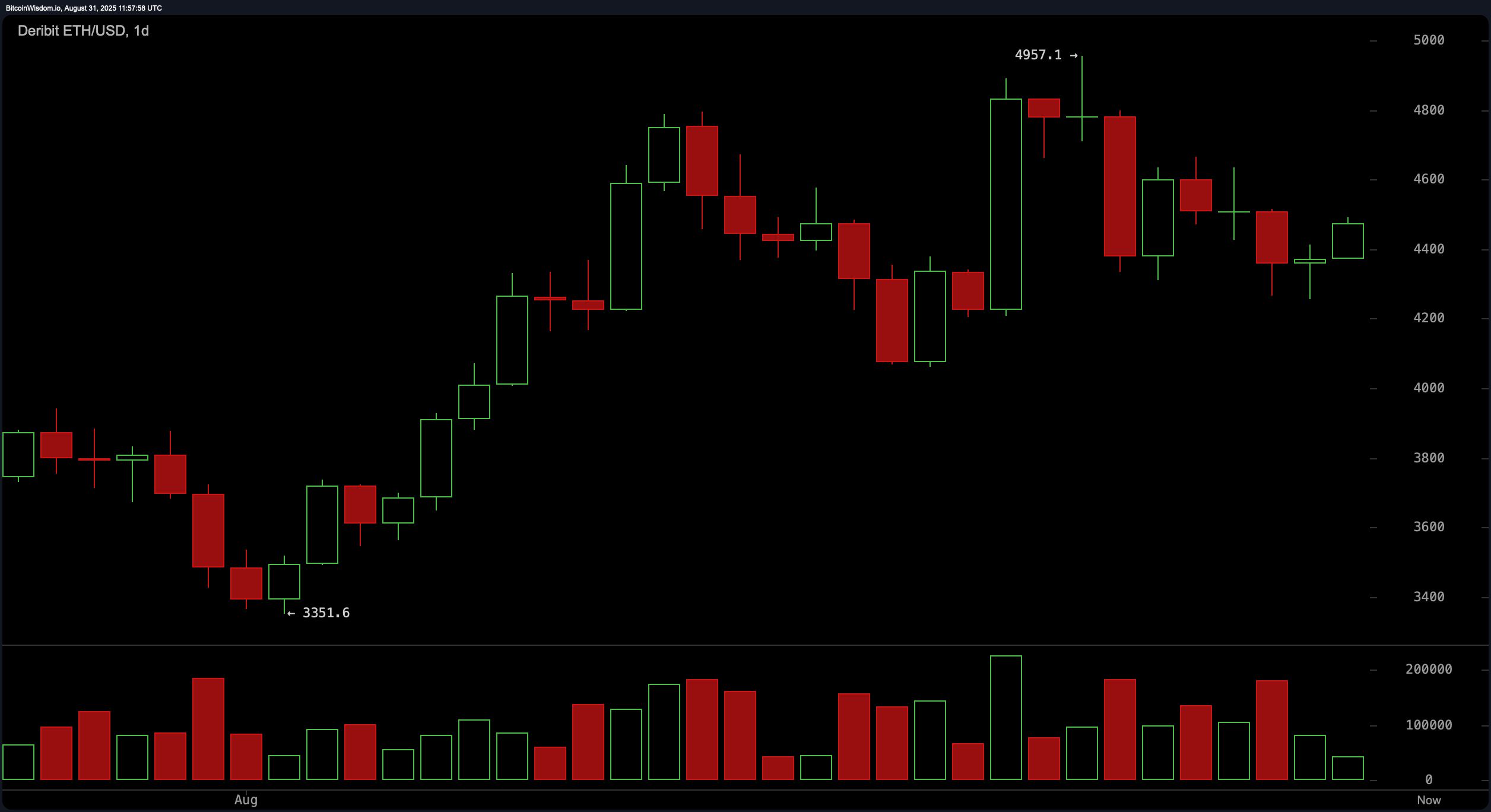

Ethereum (ETH) hit a record of $4,946.05 on Aug. 24, 2025, according to coingecko.com, and at $4,372 per ETH, it is down 11.7%. XRP, the fourth-largest crypto by market cap, trades at $2.82, reflecting a 22.9% drop from its $3.65 peak on July 18, 2025. BNB is changing hands at $863, 4.1% below its $899 all-time high set on Aug. 22.

The sixth-largest crypto, solana ( SOL), hit a peak of $293 seven months ago on Jan. 19, 2025, and now trades 31% lower at $202 per coin. In the eighth position beneath USDC, dogecoin (DOGE) trades at $0.216 per coin. DOGE has not touched an all-time high since 2021 and remains 70.5% below its $0.7316 peak.

The ninth-largest crypto, tron ( TRX), is priced at $0.339 per coin, 21.4% beneath its $0.4313 peak from Dec. 4, 2024. Rounding out the top ten, cardano ( ADA) trades at $0.8218, still 73.4% below its $3.09 high from 2021. In the eleventh spot, chainlink (LINK) trades at $23.47 per coin, standing 55.4% beneath its peak of $52.70 reached in May 2021.

In the twelfth spot—counting the top ten minus stablecoins USDT and USDC—hyperliquid (HYPE) trades at $44.08. It recently notched a record but now sits 13.5% below its Aug. 27 peak of $50.99 per coin. DOGE, ADA, LINK, and TRX are indeed the only ones in the top ten (excluding fiat-pegged tokens) that have not posted a new all-time high in 2025.

The data reveals a split between assets setting new milestones in 2025 and those still trailing historic highs. This contrast highlights how quickly momentum can shift in crypto, where some tokens regain prominence while others remain anchored to past cycles, awaiting conditions that might spark another climb. Even several of the coins that achieved new peaks in 2025 now trade lower.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?

Can the 40 billion bitcoin taken away by Qian Zhimin be returned to China?

Our core demand is very clear—to return the assets to their rightful owners, that is, to return them to the Chinese victims.