[English Thread] DeFAI Application Scenarios Explained: Stablecoin Yields, Automated Trading, Data Privacy...

Chainfeeds Guide:

Just as DeFi created a wave of millionaires in 2020 and 2021, DeFAI will give rise to the next generation of top projects and investment returns.

Source:

Author:

diego

Opinion:

diego: In my mission, the most important thing is to bring new users into the crypto world. I firmly believe that the Web3 economy offers more opportunities than traditional finance (TradFi). TradFi is closed, opaque, and offers laughably low returns to ordinary investors. In contrast, DeFi is transparent, open-source, and driven by code, meaning everyone can access opportunities under the same rules. However, onboarding newcomers to DeFi is not easy. Teaching them how to manage seed phrases, understand blockchain fees, identify and execute different transactions, and avoid scams—the learning curve is extremely steep. Admittedly, DeFi is still not for everyone; it remains a track dominated by early adopters and tech enthusiasts. In the past, I used to attract newcomers by showing them how dollar stablecoins could earn over 10% APY, but they would always reply: "Sounds good, but I don't know how to get dollars on-chain, I don't know how to use a wallet, and I'm not sure which protocol won't scam me." My only answer used to be "you need to learn more," which often discouraged them. But now, DeFAI has given me the answer: let AI agents handle the complexity, so newcomers can enter and earn returns more easily. For example, Almanak's autonomous liquidity vault allows users to top up with a credit card and deposit USDC/USDT, and the rest is handled by AI agents—finding the best yield protocols, automatically reallocating funds, and dynamically optimizing returns. Previously, users had to research, compare, and operate on their own, but now everything is executed by smart agents, and users actually get higher yields with a completely passive experience. The emergence of AI agents is not only revolutionizing stablecoin management but is also transforming trading, research, and yield optimization. First, stablecoin yields are the first strong product-market fit (PMF) found by DeFAI, because "dollar interest" itself is one of the most popular financial products worldwide. In addition to Almanak, FungiAgents allows users to deposit USDC, and AI agents automatically rebalance daily to seek yield; even without extra incentives, the average annualized yield exceeds 10%. They plan to expand to more chains and dApps in V2, unlocking even higher returns. Giza's Arma strategy offers a 15% fixed annualized yield, with 8% generated by agents and 7% from $GIZA incentives. ZyfAI manages over 4 million USDC, with an annualized yield of 11%, plus governance token rewards. Beyond that, AI agents are infiltrating the trading sector. Cod3x is building an ambient trading framework where users can generate personalized AI trading agents via prompts, such as setting up an ETH maximizer: when ETH drops 5%, the agent automatically buys in. Mode Network integrates AI quantitative trading with Layer 2, providing automated analysis and trading functions. HeyAnonai is building a HUD interface that gives traders real-time on-chain flow, key resistance levels, and capital movements on frontends like Hyperliquid and GMX. The addition of AI is gradually reshaping the landscape of on-chain trading. Beyond stablecoins and trading, DeFAI is expanding into more sectors. For example, Bankrbot and BrahmaFi are building abstraction layers and chat assistants, allowing users to complete complex on-chain tasks with just a prompt. Although the popularity of these early products has declined, they still play a role in lowering the barrier to entry. Perspective AI is also worth mentioning; it offers a unified subscription portal where users can access multiple mainstream AI models (ChatGPT, Gemini, Claude, etc.) for just $20, and earn token rewards during use. Looking ahead, DeFAI's opportunities are similar to the DeFi boom of 2020-2021, and will give birth to the next wave of game-changing projects and wealth effects. Whether it's AI-driven stablecoin yields, automated trading agents, or privacy-preserving data monetization models, any of these could become huge tracks. Just as DeFi created countless millionaires, DeFAI is becoming the core of a new wave of wealth and applications. It enables ordinary people who can't learn complex DeFi knowledge on their own to participate through AI automation tools and share in the dividends of decentralized finance. In short, DeFAI not only lowers the threshold, but also redefines who can enjoy financial opportunities, making what was once exclusive to geeks and early investors accessible to a broader group. [Original text in English]

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Faces Challenges: Market Trends and Investor Insights

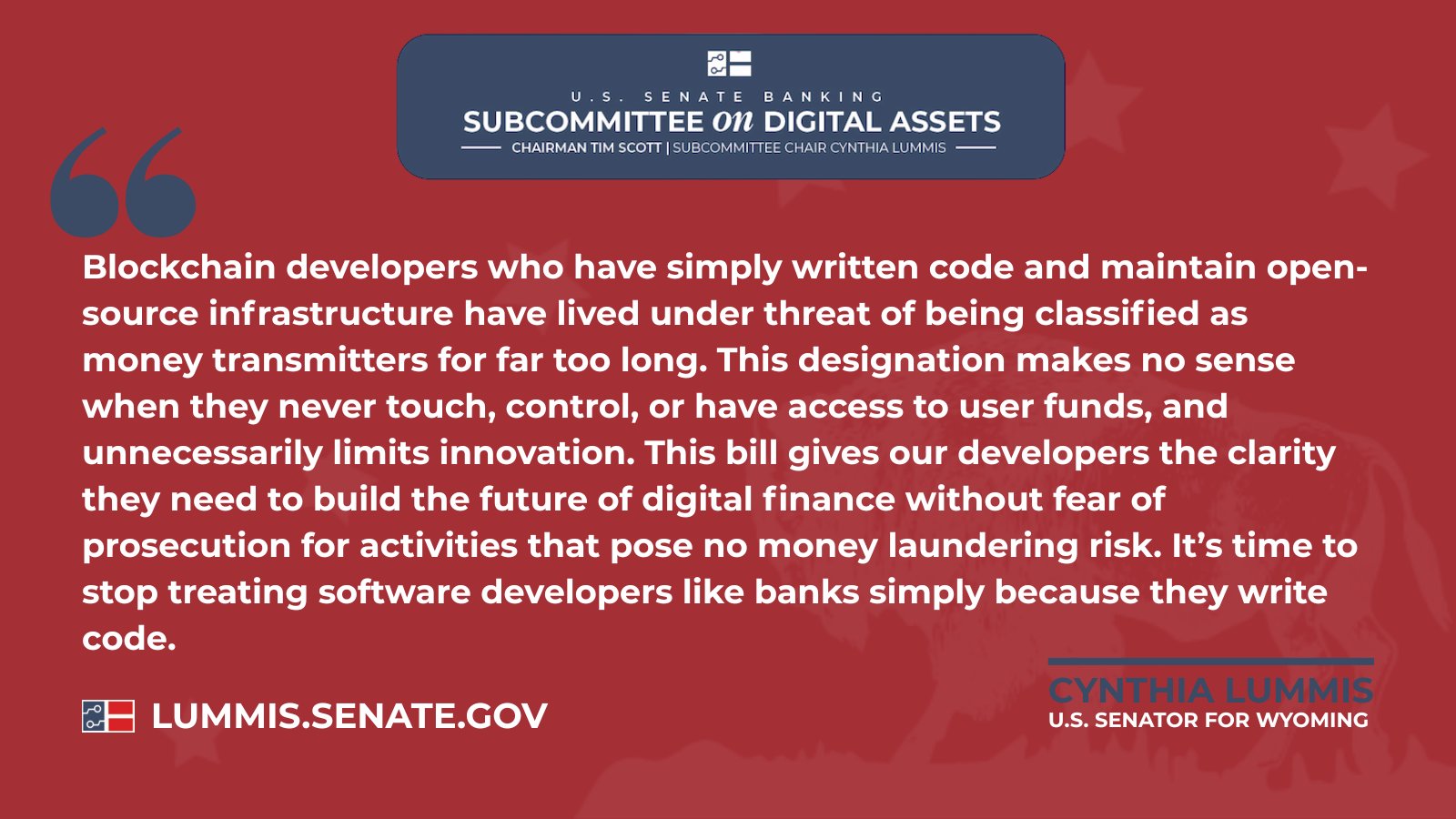

Senate Judiciary flags DeFi oversight ‘gaps’ in U.S. crypto bill

Morph Integrates RedStone Oracle for Real-Time, Secure Pricing for On-Chain Payments

SwissBorg Hooks Base for Killer Crypto Swaps – Kriptoworld.com