Will Bitcoin Price Crash to $75,000?

Bitcoin price slide below $108,000 has reignited a pressing question for traders and long-term holders alike: could the price collapse all the way to $75,000? With fresh inflation data stalling hopes of aggressive rate cuts and whale-driven sell-offs shaking market confidence, the world’s largest cryptocurrency is once again at a crossroads. The answer depends not just on technical levels, but also on the upcoming jobs report and the Federal Reserve’s September policy decision.

Bitcoin Price Prediction: Inflation and Fed Uncertainty

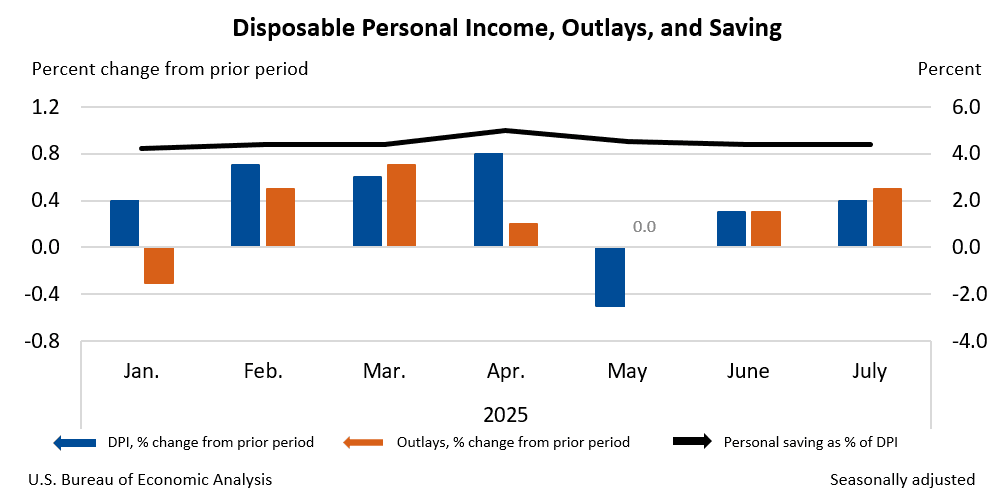

Bitcoin price slid to $107,383 as traders digested the latest US Personal Consumption Expenditures (PCE) data . Core inflation climbed 2.9% year-over-year in July, its highest since February, keeping rate-cut expectations in check. While the market still assigns an 87.6% probability of a 25bps cut at the September FOMC meeting, the tone remains cautious. Risk appetite is fragile, and crypto is reacting more sensitively to macro data than it did earlier this year.

The weekend sell-off wasn’t just macro-driven. Analysts pointed to whale distributions and liquidations of leveraged positions as accelerators of the decline. This combination of weak sentiment, fragile liquidity, and macro headwinds sets the stage for Bitcoin’s next move.

Technical Picture: Bollinger Bands Point to Pressure

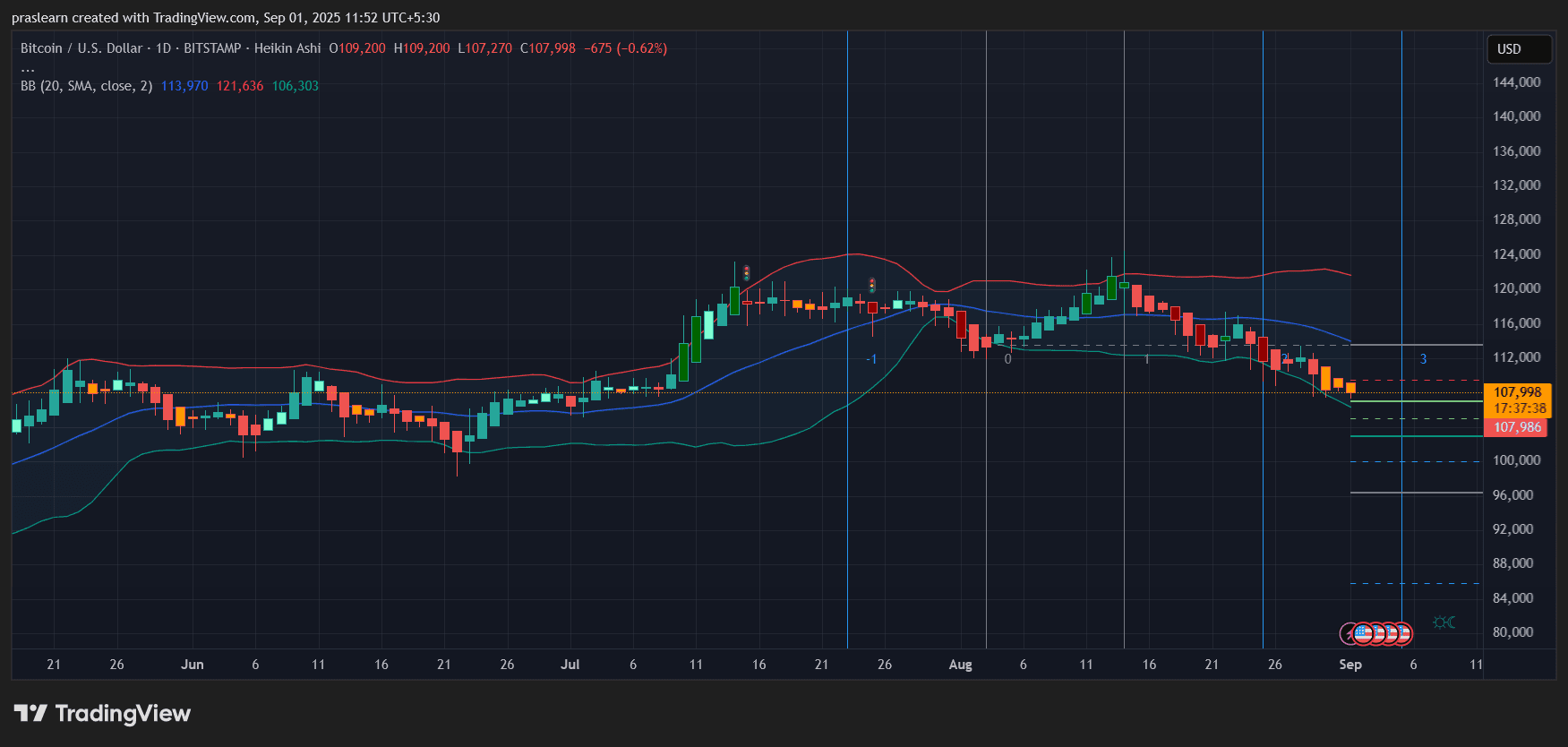

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

Looking at the daily chart, Bitcoin price is trading just under $108,000 , sitting close to the lower Bollinger Band around $106,300. This suggests the market is in oversold territory, but the fact that Bitcoin price keeps hugging the lower band indicates that sellers remain in control.

The middle band (20-day SMA) is at $113,970, now acting as resistance. For bulls to regain control, BTC needs to break back above this level. Until then, momentum favors continued downside pressure.

Key Support and Resistance Levels

- Immediate support: $106,300 (lower Bollinger Band)

- Psychological support: $100,000 (highlighted by analysts as the real line in the sand)

- Next downside target: $95,000, then $90,000 if $100,000 breaks

- Resistance: $113,970 (20-day SMA) and $121,600 (upper Bollinger Band)

The chart structure shows a descending pattern since mid-August, with consecutive red candles and lower highs. This confirms sellers are controlling the short-term trend.

Bitcoin Price Prediction: Will Bitcoin Price Fall to $75,000?

A BTC price crash to $75,000 would represent another 30% decline from current levels. For that to happen, two conditions must align:

Macro shocks such as hotter inflation or a hawkish Fed pivot that kills risk sentiment.

A decisive break below $100,000 support, triggering mass liquidations and a liquidity crunch.

While these risks are real, the probability of an immediate collapse to $75,000 looks low. The CME’s FedWatch Tool still expects a cut, and crypto investors historically buy dips near round-number psychological supports. A fall to $95,000–90,000 is more realistic in the short term, while a crash to $75,000 would require a prolonged bearish macro cycle or a systemic event in crypto markets.

Short-Term Outlook

For now, $BTC price path depends on two upcoming events:

This week’s Non-Farm Payrolls (NFP): Strong jobs data could weigh on $Bitcoin, while weak numbers might provide relief. The FOMC meeting on September 16–17: A dovish Fed cut could spark a recovery rally, while a hawkish surprise may accelerate downside.

Until then, traders should expect heightened volatility around $100,000. Bulls must defend that line at all costs, or the door to deeper corrections will open.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can the 40 billion bitcoin taken away by Qian Zhimin be returned to China?

Our core demand is very clear—to return the assets to their rightful owners, that is, to return them to the Chinese victims.

Bitcoin Surges but Stumbles: Will Crypto Market Recover?

In Brief Bitcoin fails to maintain its position above $93,000 and faces heavy selling pressure. Altcoins experience sharp declines, with some showing mixed performance trends. Shifts in U.S. spot Bitcoin ETF flows highlight cautious investor behavior.

Qubic and Solana: A Technical Breakthrough by Studio Avicenne