Improved economic growth prospects provide support as Goldman Sachs and JPMorgan both turn bullish on European stocks

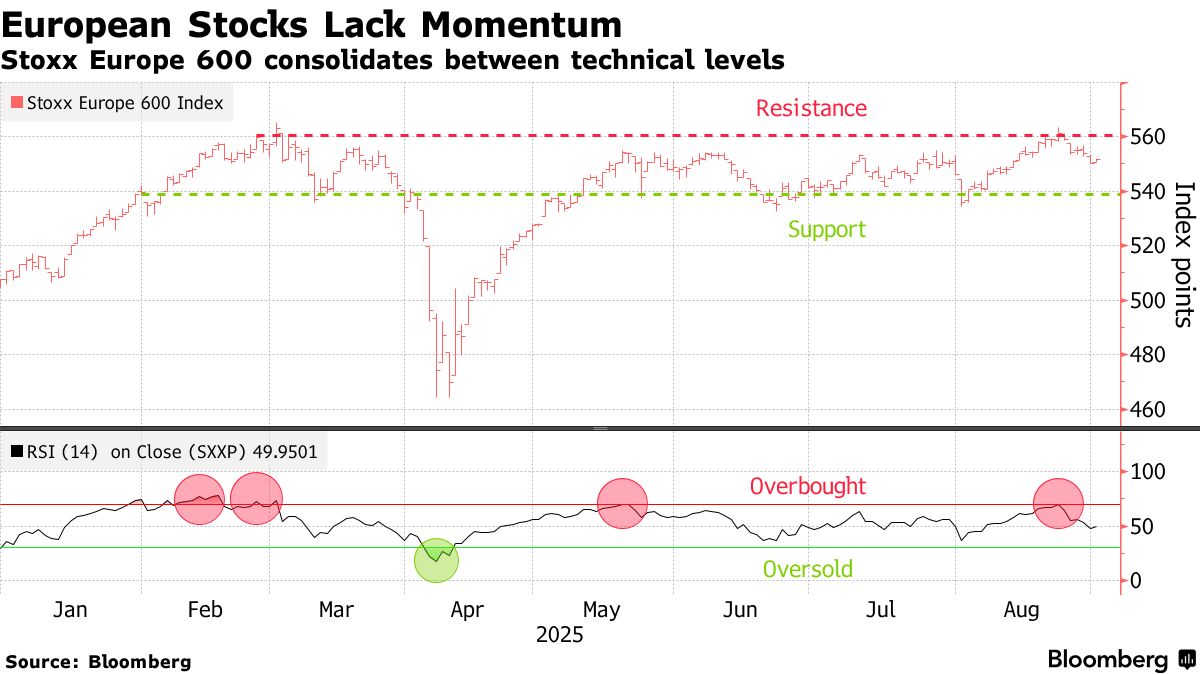

On September 1, some of Wall Street’s top strategists stated that with robust economic prospects pushing the stock market to break out of a narrow trading range, European stocks could rise in the coming months. Strategists at Goldman Sachs, led by Sharon Bell, expect the pan-European Stoxx 600 Index to rise 2% to around 560 points by the end of 2025, benefiting from improved economic growth prospects, relatively low positioning, and cheaper valuations. The strategists also noted that investors are “increasingly seeking to diversify their exposure away from the US market, both due to a weaker dollar and because of excessive concentration in the technology sector.” These strategists also expect the Stoxx 600 Index to rise 5% over the next year.

It is reported that Sharon Bell correctly predicted in May this year that it was unlikely for European stocks to repeat the strong performance of the first quarter. Due to US tariffs and sluggish corporate earnings keeping investors on the sidelines, the Stoxx 600 Index has struggled to reach new highs since hitting a record in March. Since the start of 2025, the Stoxx 600 Index has risen 8.7%, slightly below the S&P 500’s 9.8% gain over the same period.

Meanwhile, JPMorgan strategist Mislav Matejka, who correctly predicted the consolidation of European stocks in July, said in a report on Monday that the loss of momentum is “healthy” and that market sentiment at the start of the year was overly optimistic. He stated: “The time to buy (European stocks) is approaching.” He also mentioned the recent recovery in Chinese stocks. As the world’s second-largest economy, China is an important market for European mining, automakers, and luxury goods manufacturers.

The strategist also believes that in the next one to two months, European stocks may outperform US stocks, although he warned that a weakening US labor market and political turmoil in France remain potential risks. On August 25, French Prime Minister Gabriel Attal stated that the French government would proactively seek a vote of confidence in the National Assembly, with the vote scheduled for September 8. He hopes to use this move to gain the National Assembly’s support for the government’s budget plan. However, polls show that more than 70% of the public do not want the French government to win the vote of confidence in the National Assembly (the lower house of parliament). This suggests that France may once again fall into political turmoil.

It is worth noting that a Bloomberg survey of 17 strategists last month showed that, on average, strategists expect the Stoxx 600 Index to end the year at around 556 points, implying an increase of about 1% from current levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025