Tesla (TSLA.US) sales in some European markets decline for eight consecutive months! Registrations in Sweden plummet 84% in August

According to Jinse Finance APP, Tesla (TSLA.US) is struggling to cope with CEO Elon Musk's aggressive political stance in Europe, regulatory challenges regarding autonomous driving, and increasingly fierce competition in the electric vehicle market. The automaker's sales data in the European market continues to be weak, with eight consecutive months of decline in some European markets. Data released on Monday by Swedish automotive industry data agency Mobility Sweden showed that Tesla's car registrations in Sweden in August plummeted 84% year-on-year, dropping from 1,348 units in the same period last year to 210 units.

Since the beginning of this year, Tesla's performance in the entire European market has been weak. Data from the European Automobile Manufacturers Association (ACEA) shows that although overall electric vehicle sales in Europe are on the rise, Tesla's sales in Europe in July still fell 40% year-on-year to only 8,837 units, marking its seventh consecutive month of declining sales. Currently, Tesla's sales in some European markets in August remain weak, extending the downward trend to the eighth month.

France, Denmark, and Sweden are the first European countries to release monthly data for August, and their car registration data shows that the revamped Model Y has done little to stop the sales decline.

Data released in France on Monday showed that the number of newly registered Tesla vehicles in August fell by 47.3% compared to the same period in 2024, while the overall French car market grew by nearly 2.2% during the same period.

In Sweden, Tesla's car registrations fell by more than 84% (while electric vehicle sales in Sweden remained flat and the overall car market grew by 6%); in Denmark, the number fell by 42%.

Norway is an exception, where Tesla has a strong foothold and almost all new car sales are electric vehicles. In August, the American electric vehicle maker's registrations in Norway jumped 21.3%. However, its Chinese competitor BYD saw its registrations in Norway soar by 218%.

Tesla's largest markets in Europe are Germany and the UK, and both countries have also seen sales declines this year, but have not yet released August sales data.

In Tesla's August sales in Sweden, the Model Y accounted for the highest proportion, with 141 registrations; followed by the Model 3, with 67 registrations. This performance is far behind other automakers: Volvo had 2,718 registrations in August, up 8% year-on-year; Volkswagen had 2,614 registrations, up 19.3% year-on-year; Toyota (TM.US) had 2,245 registrations, a year-on-year increase of 35%.

Tesla's July sales data in Europe lagged behind its Chinese electric vehicle competitor BYD, which was included in the European market's monthly sales data for the first time. Electric vehicle statistics in the European market show that in July this year (including EU+UK+EFTA), BYD's market share in Europe was 1.2%, already higher than Tesla's approximately 0.8%, so BYD led Tesla in market share that month.

Despite significant improvements to the iconic and globally popular Model Y, Tesla's new car registrations in several key European markets in July still saw a sharp decline.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

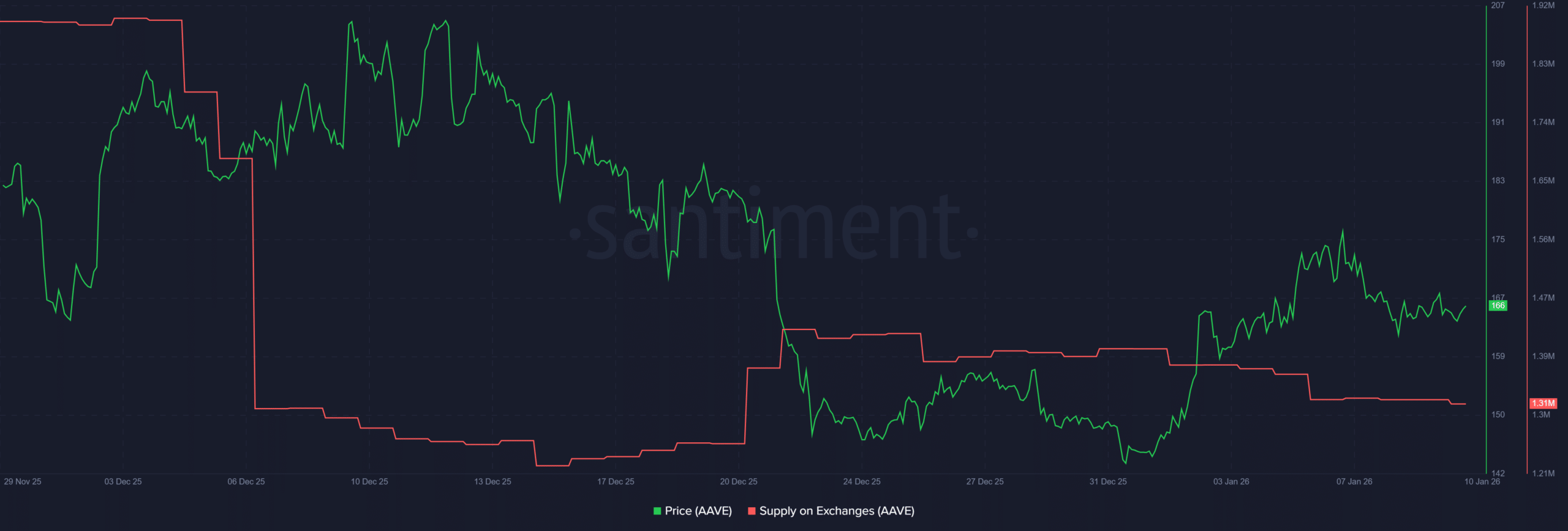

Husky Inu AI (HINU) Completes Latest Price Increase, Crypto Market Registers Marginal Bounce, ETFs See Outflows

Aave whales scoop 8% of supply amid sell-off – A move to $210 possible IF…

ZNS Connect Launches on BOB Blockchain – Human-Readable Identities Come to Bitcoin Layer-2

Iran’s IRGC Built a Billion-Dollar Crypto Pipeline Through the UK