Nobel Economist Warns: Stablecoins Could Spark Costly Bailouts

Nobel Prize-winning economist Jean Tirole raised red flags over stablecoins, saying he is “very, very worried” about how the assets are supervised. In an interview with the Financial Times, the Toulouse School of Economics professor warned that shaken confidence in reserves could spark mass redemptions, forcing governments into expensive bailouts. Stablecoin Can Result in “Runs” … <a href="https://beincrypto.com/nobel-laureate-tirole-stablecoin-bailout-warning/">Continued</a>

Nobel Prize-winning economist Jean Tirole raised red flags over stablecoins, saying he is “very, very worried” about how the assets are supervised.

In an interview with the Financial Times, the Toulouse School of Economics professor warned that shaken confidence in reserves could spark mass redemptions, forcing governments into expensive bailouts.

Stablecoin Can Result in “Runs” and Banking Crisis

Tirole, who won the Nobel Prize in Economics in 2014, warned that the prevalent optimistic scenarios of stablecoin’s growth amplify systemic risks. He said, “Retail investors often view stablecoins as a perfectly safe deposit.”

He cautioned that this perception could prove dangerous if reserves falter. Retail and institutional investors might suffer losses in that case, and governments would face sharp political pressure to intervene.

A primary concern lies in the composition of reserves. US Treasuries remain popular, but yields often turn negative once adjusted for inflation. That pushes issuers toward riskier assets in pursuit of higher returns.

According to Tirole, such a shift heightens the likelihood of losses within reserve portfolios. If stablecoins break their peg to the US dollar or other sovereign currencies, confidence could evaporate quickly. A destabilizing run might then force governments into costly rescues, mirroring past banking crises in which only a small number of uninsured depositors bore losses.

“Stablecoins could quickly become a source of losses and trigger government rescues if reserves falter,” Tirole warned.

US Driving Officials Are Tied to Crypto

Tirole emphasized that effective supervision could mitigate these risks—if regulators have enough resources and incentives. But he doubts that current standards are adequate, citing political and financial conflicts of interest among US officials with ties to crypto.

His warning echoes concerns voiced by global institutions. The European Central Bank has warned that stablecoins could undermine monetary policy, while the Bank for International Settlements has questioned whether they satisfy basic criteria for money. BeInCrypto has reported that some stablecoins struggle to maintain their peg, fueling concerns over transparency and long-term viability.

Tirole’s intervention highlights a growing policy dilemma: balancing innovation against financial stability. With projections pointing to trillions in circulation, regulators must close oversight gaps before the next crisis forces taxpayers to bail out the digital economy.

Source:

Goldman Sachs

Source:

Goldman Sachs

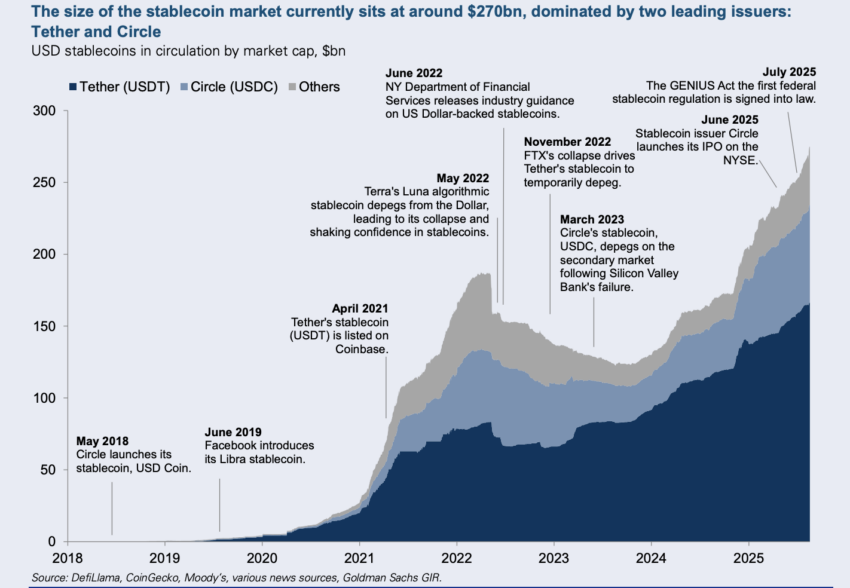

Stablecoins, such as those issued by Tether and Circle, peg their value to sovereign currencies and rely on cash reserves, Treasury bonds, or other securities. Recent US legislation has even paved the way for banks to issue digitized dollar tokens backed by government debt. However, some US banks have pushed back against provisions of the Genius Act, citing risks around stablecoin issuance, BeInCrypto reported.

The market for stablecoins has grown to about $284 billion. Analysts at Citi project expansion to $1.6 trillion by 2030, with a bullish scenario reaching $3.7 trillion. A conservative view suggests growth could stall near $500 billion. Separately, the U.S. Treasury expects the sector to hit $2 trillion by 2028. Goldman Sachs has also projected that the stablecoin market could reach trillions as institutional adoption rises.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who decides the fate of 210 billions euros in frozen Russian assets? German Chancellor urgently flies to Brussels to lobby Belgium

In order to push forward the plan of using frozen Russian assets to aid Ukraine, the German Chancellor even postponed his visit to Norway and rushed to Brussels to have a working meal with the Belgian Prime Minister, all in an effort to remove the biggest "obstacle."

The "Five Tigers Competition" concludes successfully | JST, SUN, and NFT emerge as champions! SUN.io takes over as the new driving force in the ecosystem

JST, SUN, and NFT are leading the way, sparking increased trading and community activity, which is driving significant capital inflows into the ecosystem. Ultimately, the one-stop platform SUN.io is capturing and converting these flows into long-term growth momentum.

The End of Ethereum's Isolation: How EIL Reconstructs Fragmented L2s into a "Supercomputer"?

EIL is the latest answer provided by the Ethereum account abstraction team and is also the core of the "acceleration" phase in the interoperability roadmap.