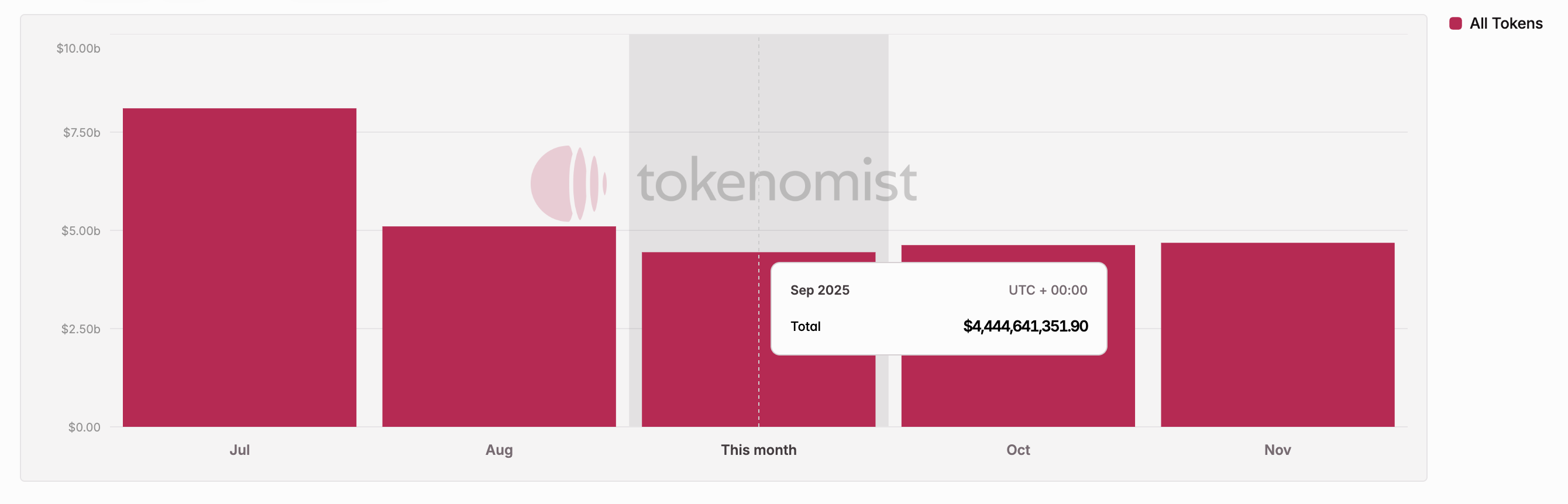

In September, the cryptocurrency market will witness the release of approximately $4.5 billion worth of coins. According to Tokenomist data, $1.17 billion of this total will be single instance releases, while $3.36 billion will be gradual openings, introducing a significant amount of crypto assets into circulation. This event is of substantial importance for investors, project teams, and other stakeholders.

Major Token Release Highlights

Tokenomist data indicates that the most notable release in September will occur within the Sui network, introducing over $153 million worth of coins. With only 35.1% of its supply currently in circulation, this release is expected to significantly boost Sui’s available pool.

Fasttoken ranks second, scheduled to release approximately $90 million. Despite this large figure, most of its total supply—over 96%—is already in circulation, causing this release to compose a minor portion of the total. Aptos follows with a $50 million release, and Arbitrum is close behind with a $48 million release.

Other significant releases include Starknet with $16.85 million, Sei with $16.49 million, Immutable with $13.4 million, and ZKsync with roughly $10.7 million worth of coins set to enter the market. These projects will contribute to a substantial influx of billions of dollars’ worth of new supply.

Potential Market Impacts of Token Releases

Single, large-scale coin releases, known as ‘cliff releases,’ can generate supply shocks, thus bearing inherent risks. In contrast, gradual releases distribute the coins over preset periods, limiting their immediate market impact. Recognizing this distinction is crucial for market participants.

The impending September coin releases will notably expand market supply. In particular, major cryptocurrency projects such as SUI, FTN, APT, and ARB deserve close monitoring due to their increasing circulating volumes. These developments hold significance for investors and market observers alike.