Is inflation no longer a major concern? UBS: The Federal Reserve will start four consecutive rate cuts to protect employment

According to information from Zhihu Finance APP, UBS expects that due to inflation remaining near target levels and rising risks in the labor market, the Federal Reserve will cut interest rates at four consecutive meetings starting in September, with a total rate cut of 100 basis points. The bank pointed out that the mild Personal Consumption Expenditures (PCE) data for July, weakening employment demand, and increasingly dovish statements from Federal Reserve officials all indicate that the Federal Open Market Committee (FOMC) is ready to take action on rate cuts.

As the Federal Reserve's preferred inflation indicator, the core PCE for July rose slightly year-on-year to 2.9%, while the overall PCE remained stable at 2.6% year-on-year, both in line with market expectations. This suggests that price pressures are effectively under control and there is no sign of accelerating increases. Currently, falling energy prices and stable goods inflation are offsetting the stickiness of service costs, while slowing housing inflation is also helping to curb overall price increases.

UBS believes that the greater risk now lies in the employment market. Although the unemployment rate remains low, several recent indicators show that employment demand is softening. At the same time, the Federal Reserve meeting minutes indicate that officials expect the unemployment rate to rise above the natural rate by the end of the year and remain elevated until 2027. Federal Reserve Chair Powell has warned that if layoffs intensify, labor market conditions could deteriorate rapidly—UBS believes that the importance of this risk now outweighs concerns about residual inflation.

In addition, statements from Federal Reserve officials and shifts in positions within the FOMC further support the rationale for rate cuts. At the July meeting, there were two dissenting votes in favor of rate cuts, marking the first such division among Federal Reserve governors on interest rate decisions in more than 30 years. Meanwhile, Powell, Vice Chair Williams, and Governor Waller have all sent more dovish signals in recent speeches. Notably, Waller explicitly supported a rate cut in September last week and even stated that if employment market data weakens further, a larger rate cut could not be ruled out.

UBS stated that given current inflation is near target levels, economic growth remains resilient but is slowing, and policymakers are increasingly focused on employment risks, it is expected that the Federal Reserve will restart the easing cycle at the next meeting and implement a rate cut at each of the next four meetings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

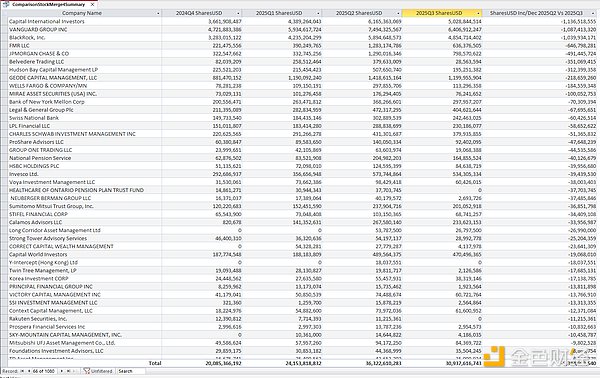

BTC mining faces short-term pressure, why does JPMorgan have a high target of $170,000?

The US CFTC officially approves cryptocurrency spot products, reshaping the regulatory landscape from the "crypto sprint" to 2025

US crypto regulation is gradually becoming clearer.

Controversial Strategy: The Dilemma of BTC Faith Stocks After a Sharp Decline

SOL price capped at $140 as altcoin ETF rivals reshape crypto demand