Michael Saylor's Strategy buys $449M in Bitcoin after dodging an investor lawsuit

Key Takeaways

- Strategy acquired 4,048 Bitcoin, increasing its total holdings to 636,505 BTC.

- The purchase came after Strategy successfully defended against an investor lawsuit regarding accounting disclosures.

Strategy, the world’s top Bitcoin treasury firm, reported Tuesday that it snapped up 4,048 Bitcoin for $449 million between August 26 and September 1, its seventh consecutive week of buying.

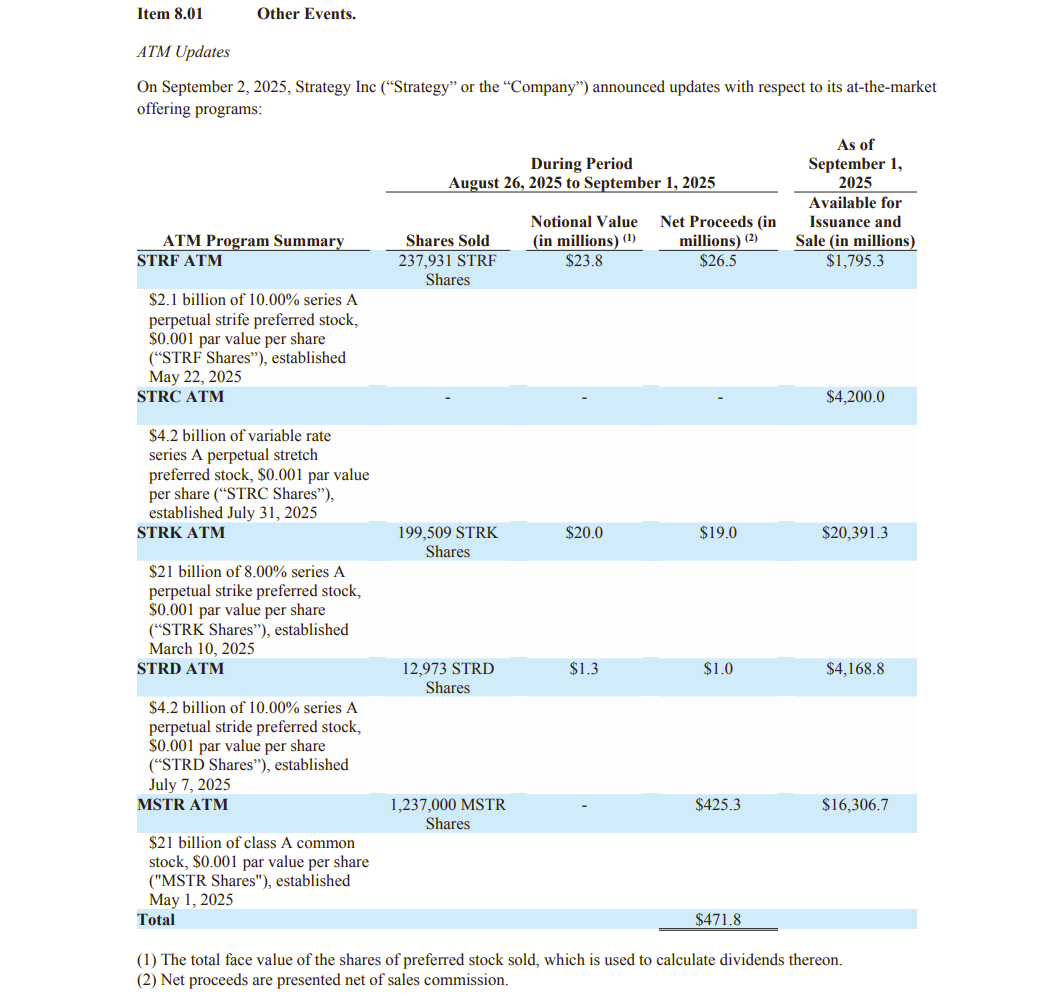

Strategy funded its latest acquisition primarily through proceeds from its at-the-market offerings. Between August 26 and September 1, the company raised a total of $471.8 million, led by sales of its class A common stock (MSTR). Other contributions included sales of STRF shares, STRK shares, and STRD shares.

The company has accumulated over 39,000 BTC this quarter, with the largest purchase of over 21,000 BTC completed at the end of July.

The latest acquisition lifts Strategy’s total Bitcoin holdings to 636,505 BTC, valued at nearly $70 billion at current market prices. The stash represents more than 3% of the total Bitcoin supply.

Bitcoin was trading at around $109,800 at press time, according to CoinGecko. The asset dropped as low as $107,295 last week amid market-wide volatility and closed August down approximately 7%.

The dip did little to rattle Strategy. On Sunday, Executive Chairman Michael Saylor hinted at an imminent purchase announcement, posting on X that “Bitcoin is on sale.”

Strategy now sits on more than $23 billion in unrealized gains, according to StrategyTracker.

The Nasdaq-listed firm recently dodged a lawsuit brought by investors over alleged misleading statements related to accounting standards. The plaintiffs argued that Strategy failed to timely disclose potential unrealized losses under the new rules.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cobie: Long-term trading

Crypto Twitter doesn't want to hear "get rich in ten years" stories. But that might actually be the only truly viable way.

The central bank sets a major tone on stablecoins for the first time—where will the market go from here?

This statement will not directly affect the Hong Kong stablecoin market, but it will have an indirect impact, as mainland institutions will enter the Hong Kong stablecoin market more cautiously and low-key.

Charlie Munger's Final Years: Bold Investments at 99, Supporting Young Neighbors to Build a Real Estate Empire

A few days before his death, Munger asked his family to leave the hospital room so he could make one last call to Buffett. The two legendary partners then bid their final farewell.

Stacks Nakamoto Upgrade

STX has never missed out on market speculation surrounding the BTC ecosystem, but previous hype was more like "castles in the air" without a solid foundation. After the Nakamoto upgrade, Stacks will provide the market with higher expectations through improved performance and sBTC.