Competition intensifies in China as Tesla (TSLA.US) August sales decline year-on-year

According to data from the China Passenger Car Association, Tesla (TSLA.US) reported wholesale sales of 83,192 vehicles in China in August, a month-on-month increase of 22.6%. However, this figure represents a 4% year-on-year decline, as competitors have launched lower-priced models, intensifying market competition. Meanwhile, wholesale sales of new energy passenger vehicles by manufacturers across China reached 1.3 million units in August, up 24% year-on-year and 10% month-on-month.

At the same time, Tesla's performance in the entire European market has been weak so far this year. Data from the European Automobile Manufacturers Association (ACEA) shows that although overall electric vehicle sales in Europe are on the rise, Tesla's sales in Europe in July still fell by 40% year-on-year to just 8,837 vehicles, marking the seventh consecutive month of declining sales. Currently, Tesla's sales in some European markets also remained weak in August, extending the downward trend to the eighth month.

Data released in France on Monday showed that the number of newly registered Tesla vehicles in August dropped by 47.3% compared to the same period in 2024, while the overall French car market grew by nearly 2.2% during the same period.

In Sweden, Tesla vehicle registrations fell by more than 84% (while electric vehicle sales in Sweden remained flat and the overall car market grew by 6%); in Denmark, the figure dropped by 42%.

Tesla's largest markets in Europe are Germany and the United Kingdom. Both countries have also seen a decline in sales this year, but August sales data have not yet been released.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Borderlands Mexico: Flexport cautions importers that tariff concerns will remain prominent in 2026

XRP Hits $2.17 But Digitap ($TAP) Is Technically The Best Crypto To Buy 2026

Pump.fun Revolutionizes Fee System: Catalyst for New Dynamics in the Memecoin Arena

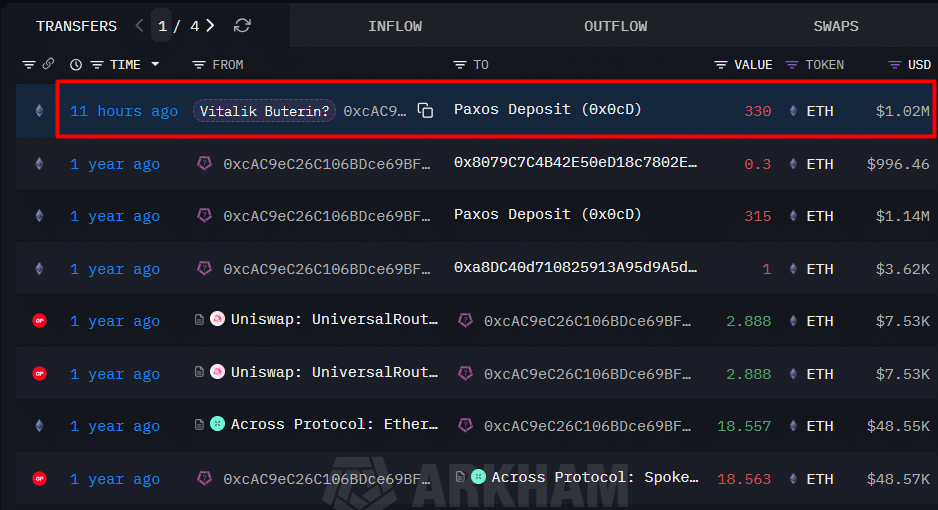

Ethereum locks 1mln as Vitalik Buterin warns of ‘corposlop’ – Identity crisis ahead?