Delphi Digital: What Can History Teach Us About How Interest Rate Cuts Affect Bitcoin's Short-Term Price Movements?

The article analyzes bitcoin's historical performance during Federal Reserve rate cut cycles, noting that it typically rises before rate cuts but falls back after the cuts are implemented. However, in 2024, this pattern was disrupted due to structural buying and political factors. The trend in September 2025 will depend on bitcoin's price performance before the rate cuts. Summary generated by Mars AI. The accuracy and completeness of this summary are still undergoing iterative updates.

The market generally expects the Federal Reserve to implement the first rate cut of this cycle in September. Historically, Bitcoin tends to rise ahead of the introduction of easing policies but retreats after the rate cut is implemented. However, this pattern does not always hold. This article will review the situations in 2019, 2020, and 2024 to anticipate the possible trend in September 2025.

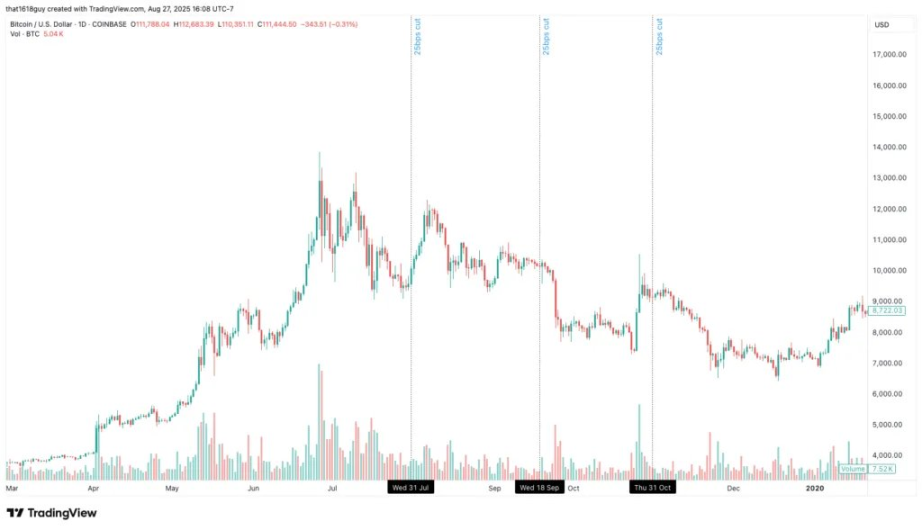

2019: Rise as Expected, Drop After Realization

In 2019, Bitcoin rebounded from $3,000 at the end of 2018 to $13,000 in June. The Federal Reserve announced rate cuts on July 31, September 18, and October 30.

Each rate cut decision marked the exhaustion of Bitcoin's upward momentum. BTC surged sharply before the FOMC meetings but was sold off afterward as the reality of sluggish economic growth re-emerged. This indicates that the benefits of rate cuts were priced in ahead of time, while the reality of slowing economic growth dominated subsequent trends.

2020: An Exception Under Emergency Rate Cuts

The situation in March 2020 was not a typical cycle. At that time, to address the panic caused by the COVID-19 pandemic, the Federal Reserve slashed interest rates to zero.

During this liquidity crisis, BTC plunged along with stocks, but then rebounded strongly with massive fiscal and monetary policy support. Therefore, this was a crisis-driven exception and cannot serve as a template for predicting the 2025 trend.

2024: Narrative Overwhelms Liquidity

The trend changed in 2024. BTC did not retreat after the rate cut; instead, it continued its upward momentum.

The reasons are:

- Trump's campaign turned cryptocurrency into an election issue.

- Spot ETFs are attracting record-breaking capital inflows.

- MicroStrategy's demand for purchases at the balance sheet level remains strong.

Against this backdrop, the importance of liquidity has diminished. Structural buying and political tailwinds have outweighed the traditional economic cycle influences.

September 2025: Conditional Market Activation

The current market environment is different from the runaway rallies seen in previous cycles. Since late August, Bitcoin has been consolidating, ETF inflows have slowed significantly, and the once persistent bullish factor of corporate balance sheet buying has also started to weaken.

This makes the September rate cut a conditional trigger for the market, rather than a direct catalyst.

If Bitcoin surges sharply before the FOMC meeting, the risk of history repeating itself increases—traders may "sell the fact" after the easing policy is implemented, resulting in a "rise then fall" scenario.

However, if prices remain stable or decline slightly before this decision, most of the excess positions may have already been cleared, allowing the rate cut to play a more stabilizing role in the market, rather than marking the end of upward momentum.

Key Takeaways

The current Bitcoin trend may be influenced by the Federal Reserve's September FOMC meeting and related liquidity changes. Overall, Bitcoin may see a rally before the FOMC meeting, but the magnitude of the rise may struggle to break new highs.

- If prices surge sharply before the meeting, a "sell the news" style pullback is likely;

- But if prices consolidate or decline from early September to the meeting, an unexpected rally could occur due to the rate adjustment.

However, even if a rebound occurs, the market should remain cautious. The next rally may form a lower high (around the $118,000 to $120,000 range).

If this lower high occurs, it could set the stage for the second half of Q4, when liquidity conditions are expected to stabilize, demand may pick up again, and Bitcoin could be pushed to new highs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

With capital outflows from crypto ETFs, can issuers like BlackRock still make good profits?

BlackRock's crypto ETF fee revenue has dropped by 38%, and its ETF business is struggling to escape the cyclical curse of the market.

Incubator MEETLabs today launched the large-scale 3D fishing blockchain game "DeFishing". As the first blockchain game on the GamingFi platform, it implements a dual-token P2E system with the IDOL token and the platform token GFT.

MEETLabs is an innovative lab focused on blockchain technology and the cryptocurrency sector, and also serves as the incubator for MEET48.

Electricity theft exceeds $1 billion, Malaysian bitcoin miners face severe crackdown

In Malaysia, the crackdown on illegal bitcoin mining gangs has turned into a game of cat and mouse.

2025 Crypto Prediction Review: 10 Institutions, Who Got It Wrong and Who Became Legends?

We can consider these predictions as indicators of industry sentiment. If you use them as an investment guide, the results could be disastrous.

Trending news

MoreWith capital outflows from crypto ETFs, can issuers like BlackRock still make good profits?

Incubator MEETLabs today launched the large-scale 3D fishing blockchain game "DeFishing". As the first blockchain game on the GamingFi platform, it implements a dual-token P2E system with the IDOL token and the platform token GFT.